France Air Purifier Market

France Air Purifier Market Size, Share, and COVID-19 Impact Analysis, By Technology (Ionic Filters, High Efficiency Particulate Air, Electrostatic Precipitator, Activated Carbon, and Others), By Application (Commercial, Industrial, Residential, and Others), By Coverage Range (401-700 Sq Ft, Above 700 Sq Ft, 250-400 Sq Ft, Below 250 Sq Ft, and Others), By Sales Channel (Online and Offline), and France Air Purifier Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Air Purifier Market Insights Forecasts to 2035

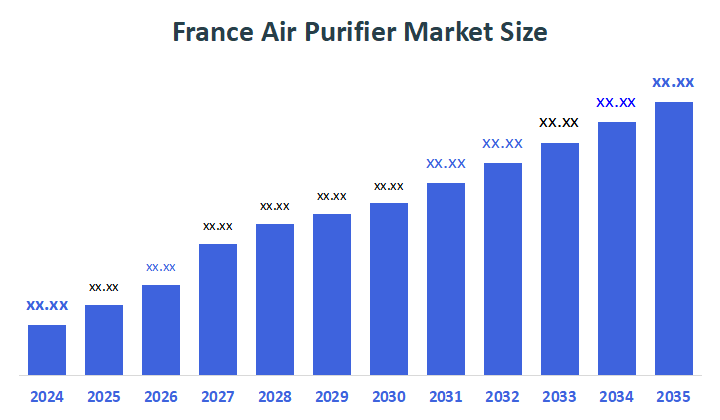

- The France Air Purifier Market Size Was Estimated at USD 380.1 Million in 2024.

- The France Air Purifier Market Size is Expected to Grow at a CAGR of Around 9.01% from 2025 to 2035.

- The France Air Purifier Market Size is Expected to Reach USD 981.9 Million by 2035.

According to a research report published by Decisions Advisors, the France air purifier market size is anticipated to reach USD 981.9 million by 2035, growing at a CAGR of 9.01% from 2025 to 2035. The France air purifier market is driven by growing awareness of indoor air quality and health concerns, including allergies, asthma, and respiratory diseases. Increasing urban pollution and indoor pollutants from cooking, smoking, and household chemicals are key factors. The demand is further boosted by government initiatives and regulations promoting healthier indoor environments, technological advancements in air purification systems, and the growing adoption of smart and energy-efficient devices in residential and commercial spaces.

Market Overview

The France air purifier market refers to the segment of the consumer and commercial electronics industry that involves the manufacture, distribution, and sale of devices designed to clean and improve indoor air quality. These devices remove pollutants such as dust, pollen, smoke, volatile organic compounds (VOCs), bacteria, viruses, and other airborne particles. The market serves residential, commercial, and industrial applications, driven by increasing awareness of health impacts from poor air quality, rising urban pollution, and growing demand for smart, energy-efficient, and technologically advanced air purification solutions in homes, offices, schools, and healthcare facilities.

In France, both outdoor and indoor air pollution pose significant public health challenges, highlighting the critical need for air purifiers. Exposure to fine particulate matter (PM2.5) contributes to approximately 40,000 premature deaths annually among adults, accounting for around 7% of total mortality. Poor indoor air quality further exacerbates health risks, leading to over 28,000 new disease cases and about 20,000 deaths each year, primarily from respiratory and cardiovascular illnesses, diabetes, strokes, and cancers. Since people spend a large portion of their time indoors, pollutants from cooking, heating, household products, and building materials significantly affect health, quality of life, and economic productivity. These statistics underscore the importance of effective indoor air purification solutions, positioning the air purifier market as both a health necessity and a growing commercial opportunity in France.

Report Coverage

This research report categorizes the market for the France air purifier market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France air purifier market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France air purifier market.

Driving Factors

The France air purifier market is driven by rising awareness of health and indoor air quality, as concerns about respiratory diseases, allergies, and asthma prompt both consumers and businesses to adopt air purification solutions. Increasing urban air pollution, including high levels of PM2.5 and smog, further fuels demand for devices that reduce indoor exposure to harmful particles. Government regulations and initiatives promoting healthier indoor environments, along with technological advancements in smart, energy-efficient purifiers featuring HEPA filters, UV sterilization, and IoT connectivity, support market growth. Additionally, growing adoption in residential, commercial, and healthcare settings reinforces the expansion of the market.

Restraining Factors

The France air purifier market is restrained by several factors. High initial costs of advanced air purifiers can limit adoption among price-sensitive consumers. Maintenance requirements, including regular filter replacements, add ongoing expenses and reduce convenience. Limited awareness in certain regions and skepticism about the effectiveness of some devices may also hinder market growth. Additionally, competition from alternative solutions like natural ventilation or low-cost air cleaning methods can restrict demand for premium air purifiers.

Market Segmentation

The France air purifier market share is categorized by technology, application, coverage range, and sales channel.

- The high efficiency particulate air segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France air purifier market is segmented by technology into ionic filters, high efficiency particulate air, electrostatic precipitators, activated carbon, and others. Among these, the high efficiency particulate air segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The high efficiency particulate air’s segmental growth is driven by its proven effectiveness in capturing fine particles, allergens, dust, and airborne pathogens, making it highly reliable for improving indoor air quality. Increasing health awareness, rising cases of respiratory issues, and concerns about pollution and indoor allergens encourage both residential and commercial users to adopt HEPA-based purifiers.

- The commercial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France air purifier market is segmented by application into commercial, industrial, residential, and others. Among these, the commercial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The commercial segmental growth is driven by increasing adoption of air purifiers in offices, schools, hospitals, hotels, and other public spaces to ensure healthier indoor environments for employees, students, and visitors. Rising awareness of indoor air quality regulations, the need to reduce airborne diseases, and the focus on workplace productivity and safety further support demand. Additionally, advancements in commercial-grade, energy-efficient, and smart air purification systems make these solutions more practical and effective for large spaces, fueling continued market expansion.

- The 250-400 sq ft segment held the largest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France air purifier market is segmented by coverage range into 401-700 sq ft, above 700 sq ft, 250-400 sq ft, below 250 sq ft, and others. Among these, the 250-400 sq ft segment held the largest market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The 250-400 sq ft segmental growth is driven by its suitability for the most common room sizes in residential and small commercial spaces, such as bedrooms, living rooms, and small offices. Consumers prefer air purifiers that efficiently cover these areas without excessive energy consumption or oversizing. Rising awareness of indoor air quality, increasing cases of allergies and respiratory issues, and the availability of affordable, compact, and energy-efficient models further boost demand for purifiers in this coverage range.

- The offline segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France air purifier market is segmented by sales channel into online and offline. Among these, the offline augment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period. The offline segmental growth is driven by consumer preference for in-store purchases, which allows buyers to see, test, and compare products physically before buying. Established retail networks, electronics stores, and specialty appliance outlets make air purifiers easily accessible.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France air purifier market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Honeywell International Inc

- Koninklijke Philips NV

- Unilever PLC

- Sharp Corp

- Samsung Electronics Co Ltd

- LG Electronics Inc ADR

- Panasonic Holdings Corp

- Whirlpool Corp

- Dyson

- Carrier Global Corp Ordinary Shares

- IQAir

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, Aerophile, in collaboration with SOLIDEO, installed large-scale outdoor air purifiers throughout the Olympic Village for the Paris 2024 Summer Olympics. The systems branded as Aerophiltres use the company’s “ParaPM” technology, which draws in polluted air, ionizes airborne particulates, collects them via electrostatic filtration, and then releases cleaned air.

- In April 2024, French biotech firm Neoplants introduced Neo Px, a bioengineered houseplant that removes VOCs from indoor air. It can eliminate 30 times more pollutants than regular plants, offering a natural and innovative solution that is expected to boost the air purifier market in France.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Air Purifier Market based on the below-mentioned segments:

France Air Purifier Market, By Technology

- Ionic Filters

- High Efficiency Particulate Air

- Electrostatic Precipitator

- Activated Carbon

- Others

France Air Purifier Market, By Application

- Commercial

- Industrial

- Residential

- Others

France Air Purifier Market, By Coverage Range

- 401-700 Sq Ft

- Above 700 Sq Ft

- 250-400 Sq Ft

- Below 250 Sq Ft

- Others

France Air Purifier Market, By Sales Channel

- Online

- Offline

Frequently Asked Questions (FAQ)

- What is the CAGR of the France air purifier market?

The France air purifier market size is expected to grow at a CAGR of around 9.01% from 2024 to 2035.

- What is the France air purifier market size in 2024?

The France air purifier market size was estimated at USD 380.1 million in 2024.

- What is the projected market size of the France air purifier market by 2035?

The France air purifier market size is expected to reach USD 981.9 million by 2035.

- What are the key growth drivers of the France air purifier market?

Increasing urban pollution and indoor pollutants from cooking, smoking, and household chemicals are key factors, as are technological advancements in air purification systems and the growing adoption of smart and energy-efficient devices in residential and commercial spaces.

- Which application segment dominated the market in 2024?

The commercial segment held the largest market share in 2024.

- Which technology segment accounted for the largest market share in 2024?

The high efficiency particulate air segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 160 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |