France Animal Health Market

France Animal Health Market Size, Share, and COVID-19 Impact Analysis, By Animal Type (Commercial and Companion), By Product Type (Pharmaceuticals, Biologicals, Medicinal Feed Additives, and Diagnostics), and France Animal Health Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Animal Health Market Size Insights Forecasts to 2035

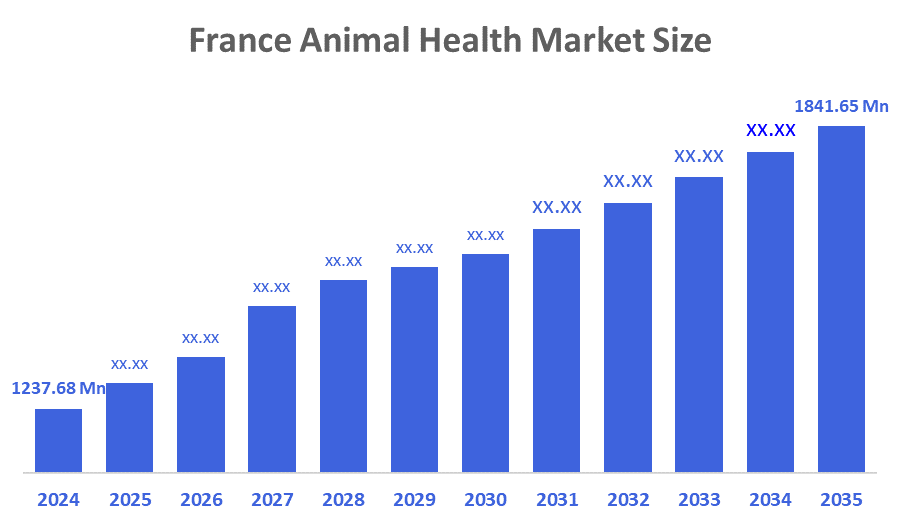

- The France Animal Health Market Size was estimated at USD 1237.68 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.68% from 2025 to 2035

- The France Animal Health Market Size is Expected to Reach USD 1841.65 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The France Animal Health Market Size is anticipated to Reach USD 1841.65 Million by 2035, Growing at a CAGR of 3.68% from 2025 to 2035. French animal health services are currently being improved by technological advancements. This is driving the country's market expansion, as is the growing demand for animal-based protein on a global scale.

Market Overview

The France animal health market involves the development, manufacture and distribution of veterinary pharmaceuticals and biologics, diagnostics and related services that maintain or improve the health of domestic and farm animals. They include preventive care, disease management and wellness solutions that are guided by regulations, veterinary infrastructure, veterinary education and training, and technological advancement. Additionally, the French animal health market offers a range of investment opportunities in areas like feed additives, pharmaceuticals, vaccines, and diagnostics. Innovative and efficient animal health products are in greater demand as livestock farming places more emphasis on disease prevention, biosecurity, and animal welfare. Businesses that provide products for improving nutrition, preventing disease, and improving the general health of animals are well-positioned to expand in this market. Investment opportunities in digital health platforms and data analytics are also presented by developments in telemedicine and digital health for animals. Partnerships with regulatory agencies and research institutions can also open doors for funding the creation and marketing of new goods that address the changing demands of the French animal health sector.

Report Coverage

This research report categorizes the market for the France animal health market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France animal health market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France animal health market.

Driving Factors

The demand for vaccines, diagnostics, and preventive treatments is rising as the French animal health market shifts toward a stronger emphasis on preventive healthcare for animals. Pet owners and livestock farmers are becoming more conscious of the value of preserving the health and welfare of their animals, which is fueling this trend. Furthermore, there is growing concern about zoonotic diseases and the necessity of using efficient animal health management techniques to control and stop their spread. The dynamics of the French market are also being impacted by technological developments in the creation of novel goods and solutions, as well as the focus on environmentally friendly and sustainable practices. As stakeholders place a higher priority on animal welfare and health outcomes, the market is generally expected to grow.

Restraining Factors

Rising regulatory requirements and scrutiny are some of the major obstacles facing the French animal health market, which can raise costs for businesses attempting to launch new products. Additionally, consumers' concerns about the use of antibiotics and veterinary medications in animal health are growing, which is causing a shift toward more sustainable and natural solutions. Smaller businesses find it challenging to compete in the market due to the intense competition and the large market share held by a few dominant players.

Market Segmentation

The France animal health market share is classified into animal type and product type.

- The commercial segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France animal health market is segmented by animal type into commercial and companion. Among these, the commercial segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to of the thriving livestock sector in the nation, especially in Brittany and Nouvelle-Aquitaine. Growing investments in preventive healthcare and biosecurity measures, strict EU regulations on animal welfare and traceability, and rising demand for premium animal-derived food products are the main drivers of growth. The use of digital monitoring tools, vaccination programs, and sophisticated veterinary diagnostics in commercial farming is also improving productivity and disease control, which will support the market's continued growth over the forecast period.

- The pharmaceuticals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France animal health market is segmented by product type into pharmaceuticals, biologicals, medicinal feed additives, and diagnostics. Among these, the pharmaceuticals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to both livestock and companion animals frequently uses anti-infectives, parasiticides, and anti-inflammatory medications. The expansion of prescription-based veterinary services, growing awareness of preventive veterinary care, and rising incidences of zoonotic diseases are additional factors driving growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France animal health market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ceva Santé Animale

- Virbac

- Vetoquinol

- bioMérieux

- Merial

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Animal Health Market based on the below-mentioned segments:

France Animal Health Market, By Animal Type

- Commercial

- Companion

France Animal Health Market, By Product Type

- Pharmaceuticals

- Biologicals

- Medicinal Feed Additives

- Diagnostics

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 257 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |