France Anti-Hypertensive Drugs Market

France Anti-Hypertensive Drugs Market Size, Share, and COVID-19 Impact Analysis, By Product (ACE Inhibitors, Angiotensin II Receptor Blockers, Direct Renin Inhibitors, Calcium Channel Blockers, Beta-Blockers, Alpha-1 Blockers, Central Alpha-2 Agonists, Direct Vasodilators, and Others), By Route of Administration (Oral, Transdermal, Intravenous, and Others), By Distribution Channel (Retail Pharmacy and Hospital Pharmacy), and France Anti-Hypertensive Drugs Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Anti-Hypertensive Drugs Market Insights Forecasts to 2035

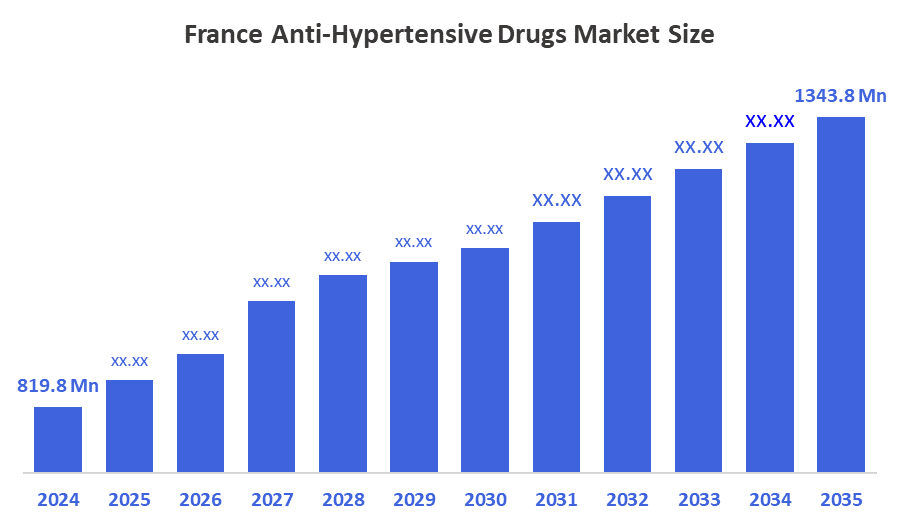

- The France Anti-Hypertensive Drugs Market Size Was Estimated at USD 819.8 Million in 2024.

- The France Anti-Hypertensive Drugs Market Size is Expected to Grow at a CAGR of Around 4.6% from 2024 to 2035.

- The France Anti-Hypertensive Drugs Market Size is Expected to Reach USD 1343.8 Million by 2035.

According to a research report published by Decision Advisors, the France Anti-Hypertensive Drugs Market Size is Projected to Reach USD 1343.8 Million by 2035, growing at a CAGR of 4.6% from 2025 to 2035. The France anti-hypertensive drugs market is driven by a high prevalence of hypertension, a strong and well-covered healthcare system, and government initiatives that promote diagnosis and access to treatment. Additionally, advancements in drug development, such as combination therapies and new formulations, improve patient adherence and outcomes, while economic growth and investment in pharmaceutical R&D further fuel market expansion.

Market Overview

The France anti-hypertensive drugs market refers to the market for pharmaceutical products used to prevent, manage, and treat high blood pressure (hypertension) in France. It includes a range of drug classes such as ACE inhibitors, angiotensin II receptor blockers (ARBs), beta-blockers, calcium channel blockers, diuretics, and combination therapies. The market encompasses all sales of these medications through various distribution channels, including retail pharmacies and hospital pharmacies in France.

The France anti-hypertensive drugs market is expected to grow in the coming years, driven by increasing prevalence of hypertension, rising awareness of blood pressure management, and demand for more convenient and effective treatments such as fixed-dose combination therapies. There is a particular focus on addressing resistant hypertension and improving patient adherence through novel delivery methods, long-acting formulations, and digital health solutions like home monitoring and telemedicine.

According to Sante Publique France, hypertension affects approximately 17 million adults in France, about one in three of the adult population. Nearly 6 million of these individuals are unaware of their condition. About 55% of hypertensive patients know their diagnosis, and of those, roughly 72.6% receive pharmacological treatment. However, blood pressure control remains poor, with fewer than 25% of patients achieving adequate management. These numbers highlight the substantial prevalence, underdiagnosis, and ongoing management challenges of hypertension in France.

Government support plays a key role, with initiatives from Sante Publique France, the National Nutrition and Health Program (PNNS), and regional health agencies promoting prevention, early diagnosis, and chronic disease management. Programs such as May Measurement Month and targeted screening campaigns for vulnerable populations further enhance detection and treatment. Additionally, funding under national strategies like the Segur de la Sante and the 2023–2027 digital health roadmap supports the development of digital tools, telemedicine, and real-world data collection to optimize hypertension care.

Report Coverage

This research report categorizes the market for the France anti-hypertensive drugs market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France anti-hypertensive drugs market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France anti-hypertensive drugs market.

Driving Factors

The France anti-hypertensive drugs market is driven by a high prevalence of hypertension and cardiovascular diseases, supported by a robust healthcare system with government initiatives for early diagnosis and reimbursement. Other key factors include the adoption of combination and extended-release therapies, advancements in drug delivery systems, increasing awareness of preventative care, a growing geriatric population, and ongoing research and development.

Restraining Factors

The France anti-hypertensive drugs market faces several restraining factors that limit its growth. One major challenge is the strong presence of generic drugs and government-imposed price controls, which create pricing pressure on branded medications. Patient non-adherence to treatment, often due to the side effects, reduces overall drug consumption. Additionally, the high cost of research and development for innovative therapies

Market Segmentation

The France anti-hypertensive drugs market share is categorized by product, route of administration, and distribution channel.

- The angiotensin II receptor blockers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France anti-hypertensive drugs market is segmented by product into ACE inhibitors, angiotensin II receptor blockers, direct renin inhibitors, calcium channel blockers, beta-blockers, alpha-1 blockers, central alpha-2 agonists, direct vasodilators, and others. Among these, the angiotensin II receptor blockers segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The angiotensin II receptor blockers’ segmental growth is due to their proven efficacy, favorable safety profile, and widespread use for long-term management of hypertension and related cardiovascular diseases. Their ability to reduce the risk of stroke, heart failure, and kidney disease further strengthened their position. ARBs are also preferred in patients who cannot tolerate ACE inhibitors due to side effects like cough or angioedema.

- The oral segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France anti-hypertension drugs market is segmented by route of administration into oral, transdermal, intravenous, and others. Among these, the oral segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The oral segmental growth is due to its convenience, high patient compliance, lower cost, and wide availability of oral formulations across all major antihypertensive drug classes. Oral medications are easy to administer, suitable for long-term therapy, and the standard first-line treatment for most hypertension patients, which significantly boosts their adoption. Additionally, the large presence of generics, stable dosing regimens, and broad prescribing preference among physicians further supported the dominance of the oral segment in France in 2024.

- The retail pharmacy segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France anti-hypertension drugs market is segmented by distribution channel into retail pharmacy and hospital pharmacy. Among these, the retail pharmacy accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The retail pharmacy segmental growth is due to its wider accessibility and convenience for patients. Hypertension is a chronic condition requiring long-term medication. Patients prefer obtaining their prescriptions from retail pharmacies, which are more numerous and geographically dispersed than hospital pharmacies. Many antihypertensive drugs are prescribed in outpatient settings and dispensed through retail pharmacies. The convenience of services such as medication counseling, refill reminders, and home delivery further drives patient preference, reinforcing the dominance of the retail pharmacy channel in the market

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France anti-hypertension drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Boehringer Ingelheim Pharma

- Daiichi Sankyo Co Ltd

- AstraZeneca PLC

- Sun Pharmaceutical Industries

- Lupin

- Merck & Co Inc

- Sanofi SA

- Pfizer Inc

- Novartis AG ADR

- Johnson & Johnson

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, France sees major hypertension treatment developments, including new drugs like baxdrostat and aprocitentan, a fixed-dose tritherapy pill, and innovative digital tools predicting drug effects, alongside experimental therapies like apelin-17 analogs, aiming to improve blood pressure control and patient outcomes.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the France Anti-Hypertensive Drugs Market based on the below-mentioned segments:

France Anti-Hypertensive Drugs Market, By Product

- ACE Inhibitors

- Angiotensin II Receptor Blockers

- Direct Renin Inhibitors

- Calcium Channel Blockers

- Beta-Blockers

- Alpha-1 Blockers

- Central Alpha-2 Agonists

- Direct Vasodilators

- Others

France Anti-Hypertensive Drugs Market, By Route of Administration

- Oral

- Transdermal

- Intravenous

- Others

France Anti-Hypertensive Drugs Market, By Distribution Channel

- Retail Pharmacy

- Hospital Pharmacy

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |