France ATM Market

France ATM Market Size, Share, and COVID-19 Impact Analysis, By ATM Type (Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, and Cash Dispensers), By Application (Withdrawals, Transfers, and Deposits), and France ATM Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France ATM Market Insights Forecasts to 2035

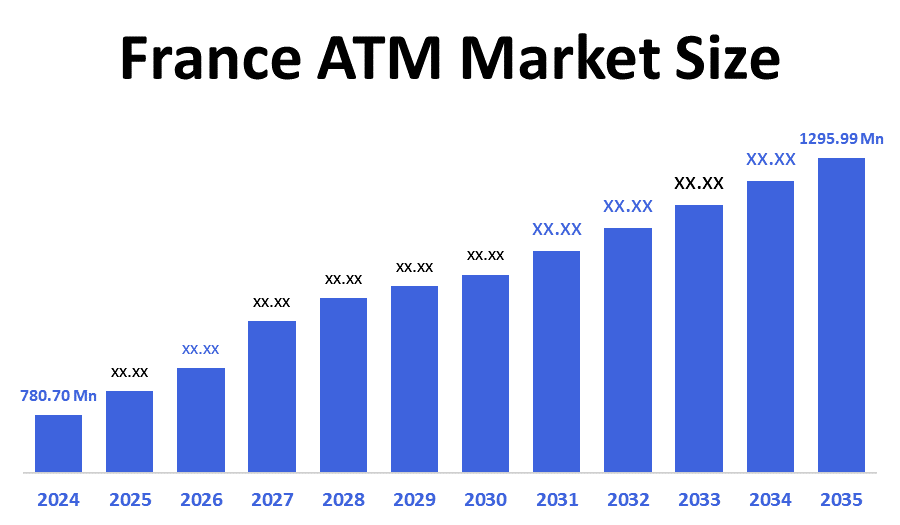

- The France ATM Market Size was estimated at USD 780.70 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.71% from 2025 to 2035

- The France ATM Market Size is Expected to Reach USD 1295.55 Million by 2035

According to a research report published by Decision Advisior & Consulting, the France ATM Market is anticipated to reach USD 1295.55 million by 2035, growing at a CAGR of 4.71% from 2025 to 2035. Increased need for cash in the countryside, shutting down of bank branches, cash withdrawals due to tourism, and regulations are among the factors influencing France's ATM market share. Also, there is a rising trend in installation due to the focus on security enhancements, and multi-functional and contactless technologies. Besides, independent ATM suppliers and banks' alliances are contributing to the market growth in a big way.

Market Overview

The France ATM market is the term used for the whole sector that deals with cash machines placed all over the country and that people can use to withdraw money, make deposits, transfers, and other bank services. Additionally, In France, independent ATM deployers (IADs) are growing rapidly, particularly in areas where no banks are present, during the period of traditional banks offering fewer cash services. Due to the closure of bank branches or restriction of cash withdrawal hours, private players are occupying the areas with high foot traffic, such as supermarkets, train stations, convenience stores, and the nightlife zone, in order to meet the demand for cash access, which is, however, a niche demand. The marketing strategy is thus creating an entirely new market segment for ATMs that is less focused on banking and more on consumer comfort. IADs usually impose withdrawal fees, but the customers consider the fee as the cost of getting what they want in terms of location and access. These machines are also getting integrated with mobile money platforms and QR code-based interfaces in order to reach the younger customers. The profitability model is slimmer: lower installation costs, minimum real estate, and selective targeting of cash-heavy areas. It is apparent in tourist-heavy zones where foreign cardholders are looking for quick access to currency. Though regulations are getting stricter, IAD will not be stopped from expanding further, and thus it is expected that this sector will be a growth area while the overall ATM network is shrinking.

Report Coverage

This research report categorizes the market for the France ATM market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France ATM market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France ATM market.

Driving Factors

The France ATM market is propelled by financial inclusion programs, biometric authentication, the replacement of old ATM systems, and the adoption of AI monitoring systems. The sharing of ATM networks among banks, the continuous opening of ATMs to customers, and the governments' encouragement of digital change are some factors that not only delight the growth but also take care of the accessibility and sturdiness of the evolving financial ecosystem in France.

Restraining Factors

The France ATM market has several restraining factors which include, profitability of banks declining, scarce support of rural infrastructure, increased energy costs, difficulties in the replacement of old machines, consumers moving to mobile wallets, and finally, the slow acceptance of new technologies in the country compared to the global standards.

Market Segmentation

The France ATM market share is classified into ATM type and application.

- The conventional/bank ATMs segment dominated the market in 2024, approximately 34.1% and is projected to grow at a substantial CAGR during the forecast period.

The France ATM market is segmented by ATM type into conventional/bank ATMs, brown label ATMs, white label ATMs, smart ATMs, and cash dispensers. Among these, the conventional/bank ATMs segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth in the ATM market is mainly attributed to the large and well-established banking networks all over France, very high consumer confidence in the use of machines operated by banks, and the government including the safe and branded ATMs as the most preferable ones. Moreover, cash access demand in rural and semi-urban areas, installation of better security features, and planned investments of banks in a reliable ATM infrastructure for customer convenience are the driving forces behind the growth of ATM market even when the digital payment adoption is on the rise.

- The withdrawals segment dominated the market in 2024, approximately 69% and is projected to grow at a substantial CAGR during the forecast period.

The France ATM market is segmented by application into withdrawals, transfers, and deposits. Among these, the withdrawals segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The main factor behind this trend is the massive use of cash transactions all over France. This is especially true for rural and semirural areas where the use of digital payments is not high yet. Tourism-related demand, daily retail purchases, and cooperative measures like the Cash Services program that was started by the leading banks in France in 2025 to provide financial inclusion through shared ATMs help the sector to grow more. Moreover, the introduction of new security features and the growth of multi-purpose ATMs that are still convenient for cash withdrawal contribute to the continuous dominance of the segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France ATM market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AVEM (Groupe)

- ATM Broker Place

- NCR Corporation

- Diebold Nixdorf

- Ingenico (Worldline Group)

- Others

Recent Developments:

- In February 2025, Four major French banks, i.e., BNP Paribas, Société Générale, CIC, and Crédit Mutuel, announced the launch of shared, brand-free ATMs in rural areas under the ‘Cash Services’ initiative. Aimed at improving cash access in underserved communities, the rollout followed two years of testing. These neutral ATMs featured a unified logo and began operating in 2025, offering a collaborative solution that ensured continued financial inclusion across France’s smaller towns and villages.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the France ATM Market based on the below-mentioned segments:

France ATM Market, By ATM Type

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

France ATM Market, By Application

- Withdrawals

- Transfers

- Deposits

FAQ’s

Q: What is the France ATM market size?

A: France ATM Market is expected to grow from USD 780.70 million in 2024 to USD 1295.55 million by 2035, growing at a CAGR of 4.71% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: The demand for cash access in rural areas, along with bank branch closures and more withdrawals related to tourism, are some of the factors that are pushing the France ATM market. Also, regulatory mandates, security improvements, multifunctional features, and contactless technologies are supporting this adoption.

Q: What factors restrain the France ATM market?

A: The French ATM market suffers from a range of factors that curb its growth: the ever-increasing popularity of digital payments, maintenance costs that are not only high but also difficult to bear, security issues, lack of innovation in the area of ATMs as against fintech solutions, and so on, which can be attributed to regulatory compliance burdens and reduced cash usage.

Q: Who are the key players in the France ATM market?

A: AVEM (Groupe), ATM Broker Place, NCR Corporation, Diebold Nixdorf, Ingenico (Worldline Group), Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 205 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |