France Bariatric Surgery Market

France Bariatric Surgery Market Size, Share, and COVID-19 Impact Analysis, By Device (Assisting Devices and Implantable Devices), By End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Others), and France Bariatric Surgery Market Size Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Bariatric Surgery Market Size Insights Forecasts to 2035

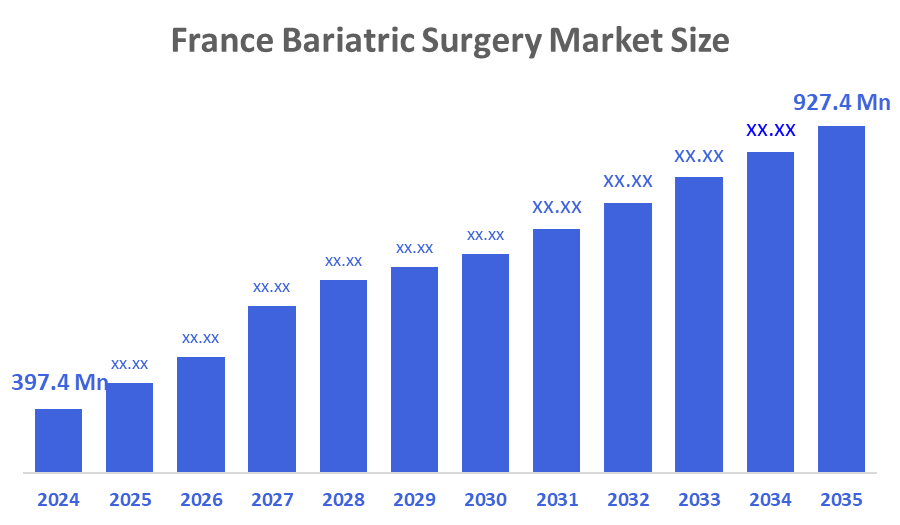

- The France Bariatric Surgery Market Size Was Estimated at USD 397.4 Million in 2024.

- The France Bariatric Surgery Market Size is Expected to Grow at a CAGR of Around 8.01% from 2025 to 2035.

- The France Bariatric Surgery Market Size is Expected to Reach USD 927.4 Million by 2035.

According to a Research Report Published by Decisions Advisors & Consulting, The France Bariatric Surgery Market size is Anticipated to Reach USD 927.4 Million by 2035, Growing at a CAGR of 8.01% from 2025 to 2035. The France bariatric surgery market Size is driven by the rising prevalence of obesity, increasing awareness of obesity-related health risks, and growing demand for effective long-term weight management solutions, along with advancements in minimally invasive surgical techniques, which also boost adoption. Additionally, increasing patient preference for improved quality of life and reduced comorbidities further fuels market growth.

Market Overview

The France bariatric surgery market refers to the segment of the healthcare industry in France that involves surgical procedures designed to help individuals with obesity lose weight and manage obesity-related health conditions. This market includes various types of surgeries such as gastric bypass, sleeve gastrectomy, adjustable gastric banding, and biliopancreatic diversion, along with associated pre- and post-operative care. The market reflects the demand for effective, long-term weight management solutions to address rising obesity rates and related comorbidities like diabetes, hypertension, and cardiovascular diseases.

The France bariatric surgery market is shaped by recent conditions. In France, obesity and overweight have become major public health concerns, highlighting the need for bariatric surgery as an effective treatment option. Around 17–18% of France adults, equivalent to more than 8–9 million consumers, are classified as obese, with almost half of adults being overweight or obese combined, increasing the risk of related diseases such as hospitals, cardiovascular conditions and respiratory problems. Due to this high burden of obesity and its comorbidities, many patients opt for bariatric surgery to achieve sustained weight loss and reduce health risks. In 2022, nearly 39,000 bariatric surgery hospital stays were recorded in France, reflecting significant surgical activity. These figures demonstrate the importance and growing need for bariatric surgery services in France, driven by widespread obesity, substantial associated health complications, and the limitations of non-surgical weight?loss methods.

In terms of recent conditions and adoption, the French healthcare system supports bariatric procedures within national care pathways, and government policies have expanded insurance coverage and reimbursement to make these surgeries more accessible. This reduces financial barriers for many patients and helps more qualify for treatment under assurance maladie. On the government support and research front, France continues to invest in healthcare initiatives aimed at combating obesity, including funding and policy frameworks that support bariatric surgery as part of comprehensive obesity management. Although specific bariatric surgery research programs are less prominently highlighted, broader public health and innovation initiatives, such as those targeting chronic diseases and digital health, indirectly support advancements in surgical practices and patient care pathways.

Report Coverage

This research report categorizes the market for the France bariatric surgery market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France bariatric surgery market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France bariatric surgery market.

Driving Factors

The France bariatric surgery market is driven by the rising prevalence of obesity and obesity-related health conditions, such as hospitals, cardiovascular diseases and sleep apnea. Growing awareness among patients and healthcare providers about the effectiveness of surgical interventions for long-term weight loss and improved quality of life further fuels demand. Supportive government policies and reimbursement programs make bariatric procedures more accessible, while advancements in minimally invasive and laparoscopic surgical techniques enhance safety and recovery, encouraging more patients to opt for surgery.

Restraining Factors

The France bariatric surgery market faces several restraining factors. High costs of surgery and related hospital care can limit access for some patients. Surgical risks and potential complications may make patients hesitant. Additionally, strict eligibility criteria and the need for lifelong lifestyle changes after surgery can restrict the number of candidates. Limited awareness or fear of surgery among certain populations also slows market growth.

Market Segmentation

The France bariatric surgery market share is categorized by device and end user.

- The assisting devices segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France bariatric surgery market is segmented by device into assisting devices and implantable devices. Among these, the assisting devices segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The assisting devices segment's growth is driven by the widespread use of surgical tools in minimally invasive procedures, the increasing number of bariatric surgeries, the preference for safer and more precise techniques, and continuous technological improvements that make devices more effective and accessible, and the availability of cost-effective assistive devices contribute to the segment’s sustained growth.

- The hospitals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France bariatric surgery market is segmented by end user into hospitals, ambulatory surgical centers, specialty clinics, and others. Among these, the hospitals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The hospitals segment's growth is driven by the availability of advanced surgical facilities and experienced medical staff, which ensure safe and effective bariatric procedures. Hospitals also offer comprehensive pre- and post-operative care, making them the preferred choice for patients. Additionally, higher patient trust, strong infrastructure, and government support for hospital-based surgeries contribute to the segment’s continued dominance and growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France bariatric surgery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medtronic

- Johnson & Johnson

- AbbVie

- Boston Scientific.

- Stryker

- Apollo Endosurgery Inc

- Peters Surgical

- Conmed Corporation

- Sterifil

- B Braun SE

- Olympus Corporation

- TransEnterix Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2023, Johnson & Johnson launched the ETHICON™ 4000 Stapler, featuring advanced 3D stapling technology to improve staple line security and reduce leaks and bleeding, which is expected to benefit bariatric surgery procedures and support better surgical outcomes.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Bariatric Surgery Market based on the below-mentioned segments:

France Bariatric Surgery Market, By Device

- Assisting Devices

- Implantable Devices

France Bariatric Surgery Market, By End User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Others

Frequently Asked Questions (FAQ)

- What is the France bariatric surgery market size in 2024?

The France bariatric surgery market size was estimated at USD 397.4 million in 2024.

- What is the projected market size of the France bariatric surgery market by 2035?

The France bariatric surgery market size is expected to reach USD 927.4 million by 2035.

- What is the CAGR of the France bariatric surgery market?

The France bariatric surgery market size is expected to grow at a CAGR of around 8.01% from 2024 to 2035.

- What are the key growth drivers of the France bariatric surgery market?

the rising prevalence of obesity, increasing awareness of obesity-related health risks, and growing demand for effective long-term weight management solutions, along with advancements in minimally invasive surgical techniques, also boost adoption.

- Which end-user segment dominated the market in 2024?

The hospitals segment dominated the market in 2024.

- Which device segment accounted for the largest market share in 2024?

The assisting devices segment accounted for the largest market share in 2024.

- What segments are covered in the France bariatric surgery market report?

The France bariatric surgery market is segmented on the basis of device and end user.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |