France Beauty and Personal Care Products Market

France Beauty and Personal Care Products Market Size, Share, and COVID-19 Impact Analysis, By Product (Skin care, Hair care, Color Cosmetics, Fragrances, and Others), By Product Type (Conventional and Organic), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, E-Commerce, and Others), and France Beauty and Personal Care Products Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Beauty and Personal Care Products Market Size Insights Forecasts to 2035

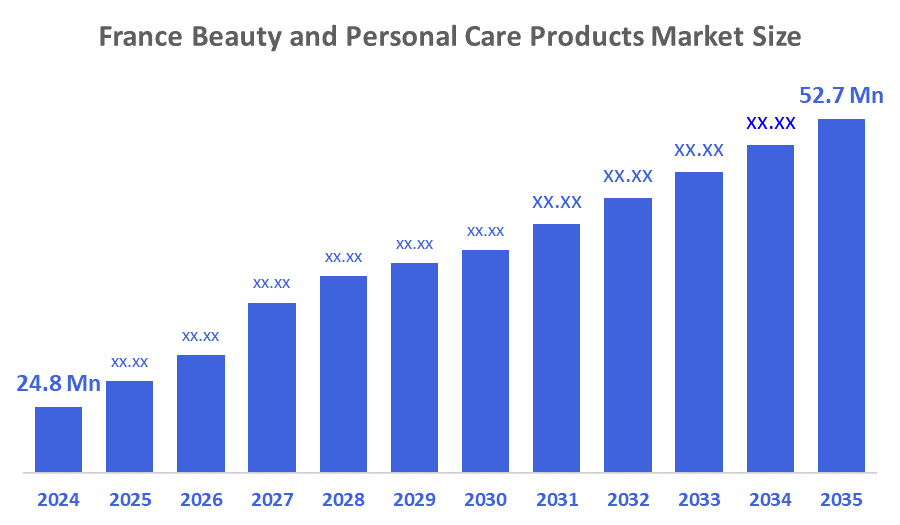

- The France Beauty and Personal Care Products Market Size Was Estimated at USD 24.8 Million in 2024.

- The France Beauty and Personal Care Products Market Size is Expected to Grow at a CAGR of Around 7.1% from 2025 to 2035.

- The France Beauty and Personal Care Products Market Size is Expected to Reach USD 52.7 million by 2035.

According to a Research Report Published by Decisions Advisors & Consulting, The France Beauty and Personal Care Products Market Size is anticipated to Reach USD 52.7 Million by 2035, Growing at a CAGR of 7.1% from 2025 to 2035. The France beauty and personal care products market is driven by rising consumer preference for premium and natural formulations, strong demand for skincare innovations, growing influence of social media and beauty influencers, increased focus on sustainability, and expanding online retail channels that enhance product accessibility.

Market Overview

The France beauty and personal care products market includes the manufacturing, distribution, and sale of all the products in the beauty and personal care categories: personal care, skincare, haircare, cosmetic, fragrance, wellness, and well-being products. Many France consumers have strong preferences for innovative (high-end) product lines, natural products, eco-friendly ingredients, etc. The retail types for these products are also wide-ranging and include pharmacies, supermarkets, beauty salons, and online retailing. The is driven by rising consumer demand for premium and natural products, growing focus on skincare and anti-aging, increasing health and skin sensitivity awareness, widespread online shopping and influencer influence, and a growing male grooming segment.

In France a significant share of the population faces skin and allergy-related problems. A survey found that around 43.2% of people (23.5 million) reported some form of skin problem over 24 months. Meanwhile, around 20.2% of adults report allergies, with nearly half of those (48.8%) involving skin-allergy reactions, and over half of those allergy-sufferers also report skin reactions when using skincare or beauty products. These conditions acne, eczema, dryness, sensitivity, and allergic reactions, are common and often chronic, leading many individuals to seek gentle, dermatologically tested, and specialized beauty and personal-care products. Additionally, many people admit to being self-conscious or socially affected because of visible skin conditions, for instance, 45% report being complexed about their skin. Together, these health burdens and skin sensitivities create a substantial and persistent demand for beauty and personal-care products tailored to treat, protect, and improve skin health, underlining the importance and growth potential of the market in France.

Report Coverage

This research report categorizes the market for the France beauty and personal care products market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France beauty and personal care products market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France beauty and personal care products market.

Driving Factors

In France, the beauty and personal care market is predominantly influenced by the evolving consumption of products; the growing propensity to consume premium natural & dermatologically tested products due to France's rich Heritage in Beauty & high-quality product offerings has acted as a major factor driving this sector. growth continuation of product offering. adoption has been fueled by increased E-commerce solutions usage, digital tools used in conjunction with E-commerce solutions (such as social media, etc.), as well as marketing via Influencer Marketing (Influencers). Furthermore, the increase in the population aged 65+ has caused increased interest in anti-aging product offerings, while the expanding male grooming segment continues to provide a significant portion of sustained growth potential for the beauty and personal care product market across France.

Restraining Factors

The France beauty and personal care products market is restrained by strict regulatory standards, which results in compliance costs being significantly high and product launch delays. Additionally, due to the saturation of the market and intense competition, brands will have difficulty making their products more noticeable than their competitors'. Economic and inflation-related pressures contribute to the increasing price sensitivity of consumers. Ingredients used in cosmetics (such as chemicals and preservatives) create a lack of trust among consumers regarding the safety of the products, while the increasing need for sustainable practices creates an increase in operating costs for companies, all of which are hindering the growth of this category.

Market Segmentation

The France beauty and personal care products market share is categorized by product, product type, and distribution channel.

- The skin care segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France beauty and personal care products market is segmented by product into skin care, hair care, color cosmetics, fragrances, and others. Among these, the skin care segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The skin care segmental growth is due to increasing consumer awareness about skin health, rising prevalence of skin sensitivities and dermatological conditions, growing demand for anti-aging and moisturizing products, and the popularity of premium, natural, and organic formulations. Additionally, the influence of social media, beauty influencers, and online tutorials has encouraged consumers to adopt comprehensive skincare routines, further driving the segment’s expansion in France.

- The conventional segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France beauty and personal care products market is segmented by product type into conventional and organic. Among these, the conventional segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period. The conventional segmental growth is due to its widespread availability, well-established brand presence, and affordability compared to organic alternatives. Additionally, conventional products offer a wide range of formulations targeting diverse consumer needs, such as anti-aging, moisturizing, and hair care, making them highly popular among a broad demographic in France. Strong marketing campaigns, extensive retail distribution, and consumer familiarity with trusted conventional brands further support the segment’s dominance and sustained growth.

- The hypermarkets & supermarkets segment held the largest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France beauty and personal care products market is segmented by distribution channel into hypermarkets & supermarkets, specialty stores, e-commerce, and others. Among these, the hypermarkets & supermarkets segment held the largest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period. The hypermarkets & supermarkets segmental growth is due to the convenience of one-stop shopping, wide product variety, competitive pricing, and easy accessibility for a large consumer base. These channels allow consumers to compare multiple brands and purchase both everyday and premium beauty and personal care products under one roof. Additionally, frequent promotional offers, discounts, and loyalty programs in hypermarkets and supermarkets encourage higher sales, contributing to the segment’s continued dominance and substantial growth in France.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France beauty and personal care products market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Unilever PLC

- The Estee Lauder Companies Inc Class A

- Shiseido Co Ltd

- Revlon

- Procter & Gamble Co

- L'Oreal SA,

- Coty Inc Class A

- Kao Corp

- Avon Protection PLC

- Oriflame Cosmetics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2025, Clarins partnered with Albea Cosmetics & Fragrance to launch its first refillable skincare jar in France, featuring a recycled PET cap and tinted PP inner cup, produced at Albea Simandre, the company’s skincare packaging center of excellence.

- In March 2025, Innovative Beauty Group expanded its Curls Matter product line into 150 Monoprix stores across France, demonstrating the growing presence of premium textured haircare products in mass retail channels. This expansion reflects a broader market trend where premium beauty brands are increasingly entering mass retail spaces to reach a wider consumer base.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Beauty and Personal Care Products Market based on the below-mentioned segments:

France Beauty and Personal Care Products Market, By Product

- Skin care

- Hair care

- Color Cosmetics

- Fragrances

- Others

France Beauty and Personal Care Products Market, By Product Type

- Conventional

- Organic

France Beauty and Personal Care Products Market, By Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Stores

- E-Commerce

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France beauty and personal care products market?

The France beauty and personal care products market size is expected to grow at a CAGR of around 7.1% from 2024 to 2035.

- What is the France beauty and personal care products market size in 2024?

The France beauty and personal care products market size was estimated at USD 24.8 million in 2024.

- What is the projected market size of the France beauty and personal care products market by 2035?

The France beauty and personal care products market size is expected to reach USD 52.7 million by 2035.

- What are the key growth drivers of the France beauty and personal care products market?

Rising consumer preference for premium and natural formulations, strong demand for skincare innovations, growing influence of social media and beauty influencers, increased focus on sustainability, and expanding online retail channels that enhance product accessibility.

- Which distribution channel segment held the largest market share in 2024?

The hypermarkets & supermarkets segment held the largest market share in 2024.

- Which product segment accounted for the largest market share in 2024?

The skin care segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 194 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |