France Biopesticides Market

France Biopesticides Market Size, Share, and COVID-19 Impact Analysis, By Type (Bioherbicides, Organic residues, Bioinsecticides, Biofungicides, and Others), By Application (Crop-based, Non-crop-based), and France Biopesticides Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

France Biopesticides Market Insights Forecasts to 2035

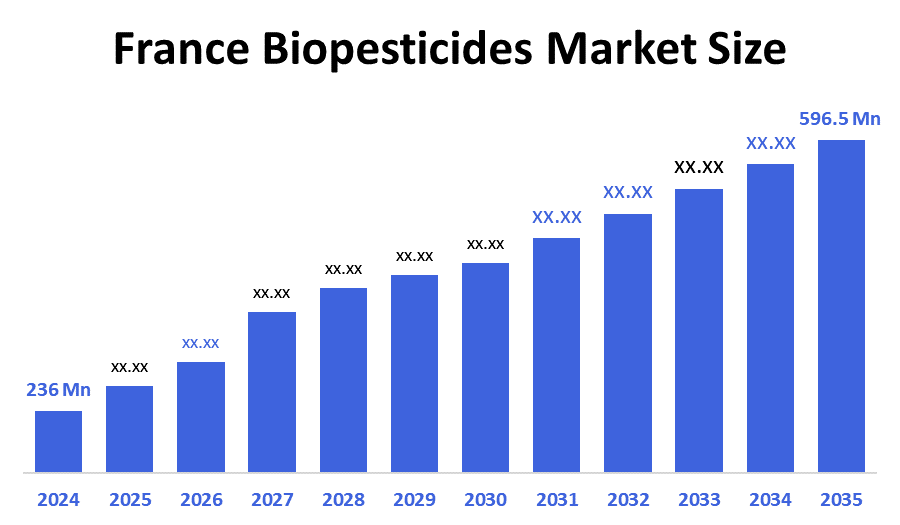

- The France Biopesticides Market Size Was Estimated at USD 236 Million in 2024.

- The France Biopesticides Market Size is Expected to Grow at a CAGR of Around 8.8% from 2025 to 2035.

- The France Biopesticides Market Size is Expected to Reach USD 596.5 Million by 2035.

According to a research report published by Decision Advisior & Consulting, the France Biopesticides Market size is anticipated to reach USD 596.5 million by 2035, growing at a CAGR of 8.8% from 2025 to 2035. The France biopesticides market is driven by the growing demand for organic and sustainable farming practices, as farmers and consumers increasingly prefer food produced without synthetic chemicals. Rising awareness of environmental protection and soil health also supports their use, as biopesticides are eco-friendly and target-specific. Additionally, the expansion of high-value crops such as fruits, vegetables, and vineyards in France increases the need for effective and safe pest management solutions.

Market Overview

The France biopesticides market refers to the sector of the France agricultural industry that involves the production, distribution, and use of biological pest control products to protect crops from insects, weeds, fungi, and other pests. Biopesticides are derived from natural materials such as plants, bacteria, fungi, or certain minerals, and include microbial pesticides, biochemical pesticides, and plant-incorporated protectants. Unlike chemical pesticides, biopesticides are eco-friendly, target-specific, and safer for humans, animals, and the environment, making them a key component of sustainable and organic farming practices in France.

The adoption of biopesticides in France is driven by a combination of health, environmental, and regulatory factors. Chemical pesticide use has led to significant food contamination and environmental damage, with studies showing pesticide residues in 37% of sampled food items and in 98% of France soils, highlighting risks to public health and ecosystems. Rising consumer demand for safe, residue-free, and organic food is pushing farmers toward natural, target-specific biopesticides. Organic farming, which now covers around 10.4% of France's agricultural land, heavily relies on biopesticides due to restrictions on chemical pesticides. Government initiatives, such as the Ecophyto 2030 plan, aim to significantly reduce synthetic pesticide use, further encouraging adoption. Advances in microbial and biochemical biopesticides, along with integrated pest management (IPM) practices, have improved their efficacy, making them more practical for farmers, reflecting increasing acceptance among farmers and agribusinesses. Innovation in microbial, biochemical, and biofungicide/bioinsecticide formulations, integration with IPM, and alignment with environmental and public-health objectives, positioning biopesticides as a critical component of sustainable agriculture in France.

Report Coverage

This research report categorizes the market for the France biopesticides market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France biopesticides market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France biopesticides market.

Driving Factors

The France biopesticides market is driven by several key factors. Strong government regulations and initiatives, such as the Ecophyto plan, which aims to reduce chemical pesticide use by 50%, encourage farmers to adopt biopesticides and other sustainable solutions. Rising consumer demand for organic and pesticide-residue-free food further motivates the use of natural pest-control methods. Environmental concerns related to soil health, biodiversity, and water quality make eco-friendly biopesticides increasingly attractive. Moreover, advancements in microbial and biochemical pesticide technologies, along with integrated pest management (IPM) practices, have enhanced their efficacy and reliability. High adoption in key crop sectors, including vineyards, fruits, vegetables, and cereals, further supports market growth, underscoring the growing importance of biopesticides in sustainable agriculture in France.

Restraining Factors

The France biopesticides market faces some challenges. High costs of production and development compared to chemical pesticides can limit adoption. Some biopesticides show slower action or lower immediate effectiveness, which may discourage use in urgent pest situations. Strict regulatory approvals for new products can delay market entry. Additionally, many farmers have limited awareness or technical knowledge about how to use biopesticides effectively, which can slow adoption, especially in traditional farming areas.

Market Segmentation

The France biopesticides market share is categorized by type and application.

- The biofungicides segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France biopesticides market is segmented by type into bioherbicides, organic residues, bioinsecticides, biofungicides, and others. Among these, the biofungicides segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The biofungicides segmental growth is due to the high prevalence of fungal diseases in key crops such as fruits, vegetables, cereals, and vineyards in France, which require effective and safe control measures. Biofungicides are eco-friendly, target-specific, and compatible with organic farming, making them a preferred choice over chemical fungicides.

- The crop-based segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France biopesticides market is segmented by application into crop-based and non-crop-based. Among these, the crop-based segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The crop-based segmental growth is due to the high demand for biopesticides in major crops such as fruits, vegetables, cereals, and vineyards in France, where pest and disease management is critical. Farmers increasingly adopt biopesticides to meet organic farming standards, reduce chemical residues, and ensure sustainable crop production. Additionally, supportive government policies and regulations, along with rising consumer demand for safe, pesticide-residue-free food, drive the extensive use of biopesticides in crop cultivation, fueling the growth of this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France biopesticides market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bayer CropScience

- BASF SE

- Syngenta AG

- Corteva Agriscience

- Novozymes

- Marrone Bio Innovations

- UPL Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, BASF announced plans to build a new fermentation plant in Ludwigshafen to produce biological and biotech?based crop protection products, including biofungicides and seed?treatment solutions, a move highlighting the growing demand for sustainable, biopesticide solutions in France and beyond.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the France Biopesticides Market based on the below-mentioned segments:

France Biopesticides Market, By Type

- Bioherbicides

- Organic residues

- Bioinsecticides

- Biofungicides

- Others

France Biopesticides Market, By Application

- Crop-based

- Non-crop-based

Frequently Asked Questions (FAQ)

- What is the CAGR of the France biopesticides market?

The France biopesticides market size is expected to grow at a CAGR of around 8.8% from 2024 to 2035.

- What is the France biopesticides market size in 2024?

The France biopesticides market size was estimated at USD 236 million in 2024.

- What is the projected market size of the France biopesticides market by 2035?

The France biopesticides market size is expected to reach USD 596.5 million by 2035.

- What are the key growth drivers of the France biopesticides market?

Growing demand for organic and sustainable farming practices. Rising awareness of environmental protection and soil health also supports their use, as biopesticides are eco-friendly and target-specific.

- Which application segment dominated the market in 2024?

The crop-based segment held the largest market share in 2024.

- Which type segment accounted for the largest market share in 2024?

The biofungicides segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 189 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |