France Blood Collection Market

France Blood Collection Market Size, Share, and COVID-19 Impact Analysis, By Collection Site (Venous and Capillary), By Application (Diagnostics and Treatment), By Method (Manual Blood Collection and Automated Blood Collection), By End User (Hospitals, Diagnostics Centers, Blood Banks, Emergency Departments, and Others), and France Blood Collection Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

France Blood Collection Market Insights Forecasts to 2035

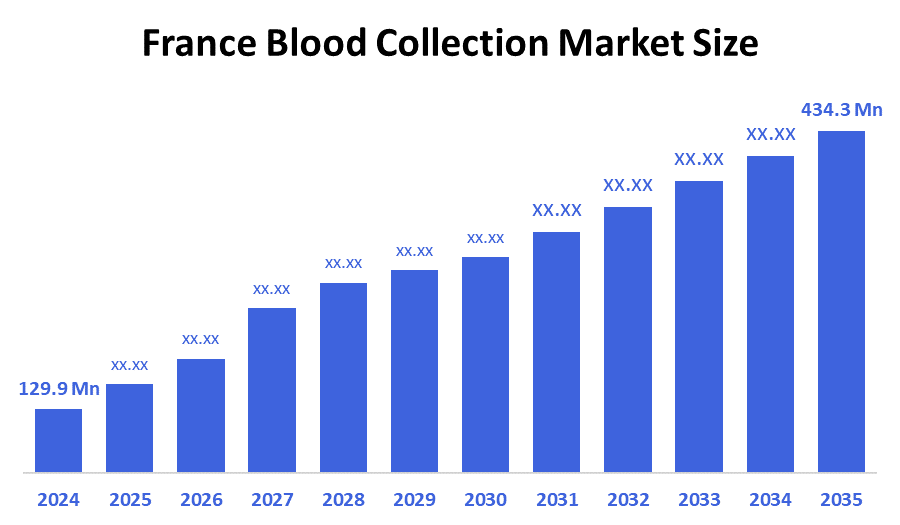

- The France Blood Collection Market Size Was Estimated at USD 129.9 Million in 2024.

- The France Blood Collection Market Size is Expected to Grow at a CAGR of Around 11.6% from 2025 to 2035.

- The France Blood Collection Market Size is Expected to Reach USD 434.3 million by 2035.

According to a research report published by Decision Advisior & Consulting, the France Blood Collection Market size is anticipated to reach USD 434.3 million by 2035, growing at a CAGR of 11.6% from 2025 to 2035. The France blood collection market is driven by a strong, well-funded public healthcare system, the growing prevalence of chronic and infectious diseases, and government initiatives that improve disease monitoring. The widespread availability of health insurance ensures continuous investment in diagnostic tools, while factors like increased demand for health check-ups and technological advancements in collection devices also contribute to market growth.

Market Overview

The France blood collection market includes all products and services used to safely collect, process, store, and transport human blood and its components for transfusion, diagnostic testing, or scientific research. The market also includes blood collection devices (needles, tubes, and bags), blood processing equipment, and blood banks, hospitals, and donation centers that provide a safe and efficient national blood supply.

The aging population and increasing number of patients needing surgery, cancer treatment, and emergency treatment, as well as the widespread prevalence of chronic diseases across the population, are pushing France to create a viable blood collection marketplace. Together with these demographic-related conditions, there is an ongoing requirement for blood, plasma, and platelets to treat individuals who experience trauma, suffer from hemophilia, are immunosuppressed, and have long-term chronic diseases. Due to the short shelf life of these blood products, they must be continually replenished. As such, France will require continuous donations and operationally sound blood collection systems in order to support thousands of patients on an annual basis. Collectively, these pressures on the healthcare system and the healthcare industry make the development of a robust and productive blood collection marketplace an important component in supporting the healthcare programs of France.

France’s blood collection market's recent conditions show recurring shortages, especially during holidays, despite more than 2.6 million annual donations, highlighting the need for stronger and more resilient collection systems. Demand is rising for transfusions, cancer treatments, surgeries, emergency care, and plasma-based therapies, which France partly imports, creating both a health-sovereignty issue and a market opportunity. In response, the government, through the France National Blood Service, or France Blood Establishment, is expanding donation centers, increasing mobile blood drives, promoting plasma donation, and adopting technologies like remote medical assistance to improve access and efficiency. With the market projected to grow rapidly in the coming years, France’s strategic focus on boosting donor recruitment, expanding plasma collection, and modernizing infrastructure underscores the essential role and future opportunity of the blood-collection market in ensuring national medical preparedness.

Report Coverage

This research report categorizes the market for the France blood collection market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France blood collection market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France blood collection market.

Driving Factors

The France blood collection market is driven by several key factors, including an aging population that increases the need for transfusions and plasma-based therapies, and the rising prevalence of chronic and critical illnesses such as cancer, cardiovascular disease, and blood disorders that require frequent use of blood components. Growing demand for plasma-derived medicines, particularly immunoglobulins, is another major driver pushing France to strengthen its domestic collection capacity. The expansion of surgical procedures, trauma care, and advanced medical treatments also fuels continuous demand for safe and reliable blood supplies. At the same time, strong government support through the centralized France National Blood Service, or France Blood Establishment, along with national donor-recruitment campaigns, new donation centers, and mobile blood drives, reinforces market growth.

Restraining Factors

The France blood collection market faces several restraining factors that limit its growth and efficiency. The declining pool of regular donors, due to demographic shifts, busy lifestyles, and donation hesitancy, reduces the number of consistent contributors. The short shelf life of blood components, especially platelets, creates constant pressure on supply chains and often leads to shortages despite ongoing collection efforts. Additionally, seasonal fluctuations in donations during holidays or crises disrupt the stability of blood reserves. The market also faces logistical and staffing constraints in managing mobile blood drives and maintaining sufficient clinical personnel.

Market Segmentation

The France blood collection market share is categorized by collection site, application, method, and end user.

- The venous segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France blood collection market is segmented by collection site into venous and capillary. Among these, the venous segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The venous segmental growth is due to venous blood draws, which are the standard method for collecting larger, high-quality blood volumes required for transfusions, diagnostic testing, and plasma collection. This method supports a wide range of clinical applications, making it the preferred choice across hospitals, diagnostic laboratories, and blood donation centers. Its growth is further driven by the increasing demand for whole blood and plasma-derived therapies, the rise in chronic and infectious disease testing, and the expanding number of surgical and therapeutic procedures requiring substantial blood components.

- The diagnostics segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France blood collection market is segmented by application into diagnostics and treatment. Among these, the diagnostics segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period. The diagnostics segmental growth is due to the increasing demand for blood-based diagnostic tests to detect and monitor various diseases, including infectious diseases, cancers, hematological disorders, and chronic conditions. Blood samples are essential for routine health check-ups, disease screening, and personalized medicine, driving consistent demand for diagnostic collections.

- The manual blood collection segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France blood collection market is segmented by method into manual blood collection and automated blood collection. Among these, the manual blood collection segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The manual blood collection segmental growth is due to its widespread adoption across hospitals, clinics, and blood donation centers, particularly for routine blood draws and small-scale collection needs. Manual collection methods are cost-effective, simple to implement, and require minimal specialized equipment, making them suitable for a variety of healthcare settings. Additionally, the high reliability and familiarity of manual techniques among healthcare professionals, combined with their continued use in diagnostic testing, transfusions, and plasma collection, support sustained growth.

- The diagnostic centers segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France blood collection market is segmented by end user into hospitals, diagnostic centers, blood banks, emergency departments, and others. Among these, the diagnostic centers segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The diagnostic centers' segmental growth is due to the increasing demand for blood-based diagnostic testing for a wide range of diseases, including infectious diseases, cancers, and chronic conditions. Diagnostic centers play a critical role in routine health check-ups, early disease detection, and preventive healthcare, driving consistent blood collection requirements. Additionally, the expansion of private and specialized diagnostic centers, rising awareness about health monitoring, and government initiatives promoting early detection programs contribute to the sustained growth of this segment in France.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France blood collection market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Laboratories

- Nipro Corp

- BD

- Terumo Corp

- Medtronic PLC

- Qiagen NV

- Haemonetics Corp

- FL Medical

- Greiner Bio-One

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2024, Fresenius Kabi submitted a 510(k) to the U.S. FDA for Aurora Xi Plasmapheresis System Software Version 2.0, introducing an adaptive (linear) donor-specific nomogram to target plasma collection volume and improve source-plasma collection efficiency.

- In January 2025, Becton, Dickinson, and Company (BD) introduced a new line of blood collection tubes intended to enhance sample quality and decrease redraws. The new tube provides a 15% gain in sample stability over earlier models.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the France Blood Collection Market based on the below-mentioned segments:

France Blood Collection Market, By Collection Site

- Venous

- Capillary

France Blood Collection Market, By Application

- Diagnostics

- Treatment

France Blood Collection Market, By Method

- Manual Blood Collection

- Automated Blood Collection

France Blood Collection Market, By End User

- Hospitals

- Diagnostics Centers

- Blood Banks

- Emergency Departments

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France blood collection market?

The France blood collection market size is expected to grow at a CAGR of around 11.6% from 2024 to 2035.

- What is the France blood collection market size in 2024?

The France blood collection market size was estimated at USD 129.9 million in 2024.

- What is the projected market size of the France blood collection market by 2035?

The France blood collection market size is expected to reach USD 434.3 million by 2035.

- What are the key growth drivers of the France blood collection market?

Growing prevalence of chronic and infectious diseases and government initiatives that improve disease monitoring. The widespread availability of health insurance ensures continuous investment in diagnostic tools, while factors like increased demand for health check-ups.

- Which application segment dominated the market in 2024?

The diagnostics segment held the largest market share in 2024.

- Which collection site segment accounted for the largest market share in 2024?

The venous segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 177 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |