France Blood Filtration and Purification Market

France Blood Filtration and Purification Market Size, Share, and COVID-19 Impact Analysis, By Product (Filtration Kits and Reagents, Membranes/Filters/Consumables, Sample Preparation Systems, Specialty Assays/Columns, and Others), By Application (Infectious Disease Diagnostics, Toxicology and Immunodiagnostics, Cancer Diagnostics, Genetic/Molecular Diagnostics, and Others), By End User (Clinical Diagnostic Labs, Hospitals, Research and Academic Institutes, and Others), and France Blood Filtration and Purification Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Blood Filtration and Purification Market Insights Forecasts to 2035

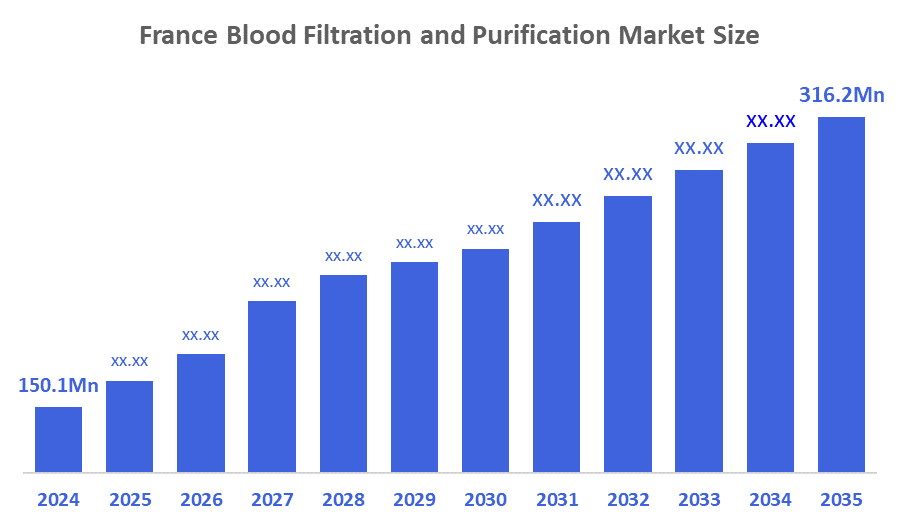

- The France Blood Filtration and Purification Market Size Was Estimated at USD 150.1 Million in 2024.

- The France Blood Filtration and Purification Market Size is Expected to Grow at a CAGR of Around 7.01% from 2025 to 2035.

- The France Blood Filtration and Purification Market Size is Expected to Reach USD 316.2 Million by 2035.

According To a Research Report Published By Decisions Advisors and Consulting, The France Blood Filtration And Purification Market Size Is Anticipated To Reach USD 316.2 Million By 2035, Growing At a CAGR of 7.01% From 2025 to 2035. The France blood filtration and purification equipment market is driven by the rising prevalence of chronic kidney disease and growing demand for dialysis and renal therapies. Its use in critical care for conditions like sepsis and acute kidney injury further boosts adoption. Technological advancements, including portable and home-use systems, are expanding the market. Strong healthcare coverage and expanding applications in diagnostics, oncology, and autoimmune diseases continue to support steady growth.

Market Overview

The France blood filtration and purification market is a division of the healthcare sector in France that concerns the production, sale, and deployment of products intended to clean, filter, or purify blood. This includes devices employed in hemodialysis, plasmapheresis, and apheresis, as well as hemofiltration and other types of blood purification methods that utilize extracorporeal circulation. The sector encompasses devices sold directly to hospitals for clinical use and devices sold directly to patients for personal home use; as a consequence, the sector features not just products and devices but also consumable items (like filters, membranes, and cartridges) used in conjunction with those products in both hospital and home settings, and this sector is spurred by the requirements of patients who are undergoing chronic kidney disease (CKD) treatment or critical care applications and other types of diagnostic or therapeutic usage.

The France health challenges posed by an aging population and a significant degree of chronic disease among adults drive demand for devices utilized to filter and purify blood. Chronic kidney disease (CKD) is a chronic condition affecting approximately 1.6 million adult citizens in France. Of these individuals, approximately 93,000 are on dialysis or undergo a transplantation to treat their disease. As a result, there are approximately 11,000 new patients who receive renal replacement therapy annually, contributing to a continual increase in the demand for blood purification solutions in this country. In tandem with the growing number of diabetic and hypertensive citizens within the Fr population, these statistics highlight the critical role that blood filtration and purification technology play in the overall healthcare system in France.

The France blood filtration and purification market is increasing due to an increase in the number of people suffering from chronic kidney disease or end-stage renal disease. Chronic kidney disease affects approximately 1.6 million people. There are more than 93,000 consumers who are currently receiving dialysis or have received transplants. Additionally, an aging population is causing an increase in the demand for blood purification therapies. Blood filtration technologies are widely used in the critical care setting, where they are employed to treat patients experiencing septic, multi-organ failure, and autoimmune or oncological diseases. The introduction of new technology in filter design, membrane technology, and portable/home-use devices will enhance the overall adoption of these therapies. In addition, the France healthcare system's robust infrastructure, extensive reimbursement coverage for these therapies, and their expanding application in the diagnosis and management of acute and chronic diseases will continue to drive robust growth in the France blood filtration and purification markets.

Report Coverage

This research report categorizes the market for the France blood filtration and purification market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France blood filtration and purification market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France blood filtration and purification market.

Driving Factors

The France blood filtration and purification market is driven by the rising prevalence of chronic kidney disease and end-stage renal disease, affecting around 1.6 million adults, with over 93,000 on dialysis or with transplants. An aging population further increases demand for blood purification therapies. These technologies are widely used in critical care for sepsis, multi-organ failure, and autoimmune or oncology treatments. Technological advancements in filters, membranes, and portable or home-use devices enhance adoption. Strong healthcare infrastructure, reimbursement coverage, and expanding applications in diagnostics and disease management continue to support market growth.

Restraining Factors

The France blood filtration and purification market is restrained by the high cost of equipment and consumables, which can limit adoption. Stringent regulatory requirements may delay product approvals and market entry. Limited availability of trained healthcare professionals and maintenance challenges restrict usage, especially in smaller or remote facilities. Additionally, patient compliance and low awareness of long-term or home-based therapies can hinder broader adoption.

Market Segmentation

The France blood filtration and purification market share is categorized by product, application, and end user.

- The membranes/filters/consumables segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France blood filtration and purification market is segmented by product into filtration kits and reagents, membranes/filters/consumables, sample preparation systems, specialty assays/columns, and others. Among these, the membranes/filters/consumables segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the increasing prevalence of chronic kidney disease and end-stage renal disease, which raises demand for dialysis and blood purification therapies. Technological advancements in membranes and filters, offering higher efficiency, better biocompatibility, and longer lifespans, are boosting adoption.

- The infectious disease diagnostics segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France blood filtration and purification market is segmented by application into infectious disease diagnostics, toxicology and immunodiagnostics, cancer diagnostics, genetic/molecular diagnostics, and others. Among these, the infectious disease diagnostics segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to the increasing prevalence of infectious diseases, including bacterial, viral, and emerging pathogens, which create a high demand for accurate and rapid diagnostic solutions. Advances in blood filtration and purification technologies enhance the reliability and sensitivity of diagnostic tests. Additionally, rising public health awareness and expanding use of these diagnostics in hospitals, laboratories, and point-of-care settings further support segment growth.

- The clinical diagnostic labs segment held the largest market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France blood filtration and purification market is segmented by end user into clinical diagnostic labs, hospitals, research and academic institutes, and others. Among these, the clinical diagnostic labs segment held the largest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period. The clinical diagnostic labs’ segmental growth is due to the increasing demand for accurate and rapid diagnostic testing across a wide range of diseases, including infectious, genetic, and cancer-related conditions. These labs rely heavily on blood filtration and purification technologies to ensure high-quality samples for precise analysis. The trend toward centralized and high-throughput testing in clinical laboratories further drives the adoption of advanced blood purification equipment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France blood filtration and purification market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers and acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- MilliporeSigma

- Sigma-Aldrich

- Biotage

- HiMedia Laboratories

- MP Biomedicals

- Avantor Inc

- Takara Bio Inc

- Qiagen NV

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2025, Thermo Fisher Scientific’s recent acquisition of Solventum’s purification and filtration business is set to boost the France blood filtration and purification market. The move strengthens supply chains, accelerates the adoption of advanced technologies, and supports growing demand.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Blood Filtration and Purification Market based on the below-mentioned segments:

France Blood Filtration and Purification Market, By Product

- Filtration Kits and Reagents

- Membranes/Filters/Consumables

- Sample Preparation Systems

- Specialty Assays/Columns

- Others

France Blood Filtration and Purification Market, By Application

- Infectious Disease Diagnostics

- Toxicology and Immunodiagnostics

- Cancer Diagnostics

- Genetic/Molecular Diagnostics

- Others

France Blood Filtration and Purification Market, By End User

- Clinical Diagnostic Labs

- Hospitals

- Research and Academic Institutes

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France blood filtration and purification market?

The France blood filtration and purification market size is expected to grow at a CAGR of around 7.01% from 2024 to 2035.

- What is the France blood filtration and purification market size in 2024?

The France blood filtration and purification market size was estimated at USD 150.1 million in 2024.

- What is the projected market size of the France blood filtration and purification market by 2035?

The France blood filtration and purification market size is expected to reach USD 316.2 million by 2035.

- What are the key growth drivers of the France blood filtration and purification market?

Rising prevalence of chronic kidney disease and growing demand for dialysis and renal therapies. Technological advancements, strong healthcare coverage, and expanding applications in diagnostics, oncology, and autoimmune diseases continue to support steady growth.

- Which formulation segment dominated the market in 2024?

The infectious disease diagnostics segment held the largest market share in 2024.

- Which product segment accounted for the largest market share in 2024?

The membranes/filters/consumables accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Regional |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |