France Blood Transfusion Diagnostics Market

France Blood Transfusion Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Product (Reagents/Kits and Instruments), By Application (Blood Grouping and Disease Screening), By End User (Hospitals, Blood Banks, Diagnostic Laboratories, and Others), and France Blood Transfusion Diagnostics Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Blood Transfusion Diagnostics Market Insights Forecasts to 2035

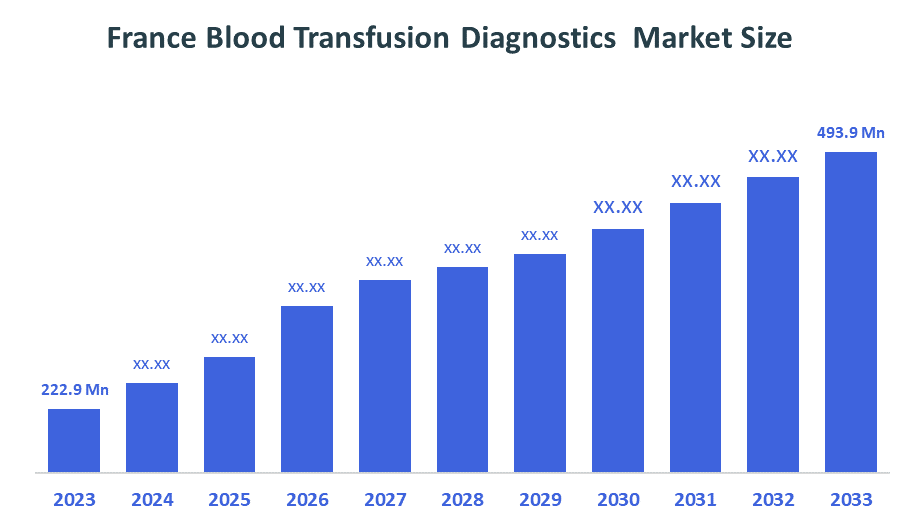

- The France Blood Transfusion Diagnostics Market Size Was Estimated at USD 222.9 Million in 2024.

- The France Blood Transfusion Diagnostics Market Size is Expected to Grow at a CAGR of Around 7.5% from 2025 to 2035.

- The France Blood Transfusion Diagnostics Market Size is Expected to Reach USD 493.9 million by 2035.

According to a Research Report Published by Decision Advisiors & Consulting, the France Blood Transfusion Diagnostics Market size is anticipated to reach USD 493.9 million by 2035, growing at a CAGR of 7.5% from 2025 to 2035. The France blood transfusion diagnostics market is driven by the rising prevalence of blood-related and chronic diseases, an increasing demand for transfusions due to surgeries and trauma, and advancements in diagnostic technologies like molecular testing and automation. The market is also supported by government initiatives and a strong focus on the safety and quality of blood transfusions, as highlighted by initiatives emphasizing donor screening.

Market Overview

The France blood transfusion diagnostics market encompasses everything from the devices to conduct tests on the blood to the consumables that support the testing. The blood transfusion diagnostics contain solutions used to ensure safe, compatible, and high-quality blood before it is transfused into another person. In addition to diagnostic testing, blood transfusion diagnostics will have reagents, analyzers, consumables, and software used within blood banks, hospitals, transfusion centers, and diagnostic laboratories.

The France blood transfusion diagnostics market is expected to see growth due to a growing need for safe blood products and transfusions. Annually, 2.6?million donations are made, which can provide blood products to approximately 500,000 patients. Advanced diagnostic methods are necessary to address evolving risks that may be caused by infectious agents, transfusion-transmitted infections, and repeated transfusions for surgeries, chronic disease, and emergencies. Regulatory structures and the centralized public-health model established by the France National Blood Service (also known as the French Blood Establishment, or EFS) allow for strict quality control with the creation of blood screening technologies via nucleic acid testing (NAT) and immunohematology assays, which are being widely adopted across the country. Market growth will be further enhanced by an increase in plasma collection and transfusion volume, as well as the opportunities created by relational hemovigilance and the surveillance of infectious diseases. Any growth opportunities identified within the blood transfusion diagnostics sector will be influenced by government support, ethical volunteer donation programs, and the establishment of automated, high-throughput diagnostic platforms. Consequently, any growth opportunities associated with blood transfusion diagnostics will be attributed to the critical role that such diagnostics play in the continuous assurance of safe, efficient, and adequate public health preparedness in France. Likewise, they offer substantial growth potential for technological innovation in the blood transfusion diagnostic industry.

Report Coverage

This research report categorizes the market for the France blood transfusion diagnostics market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France blood transfusion diagnostics market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France blood transfusion diagnostics market.

Driving Factors

The France blood transfusion diagnostic market is influenced by various factors, including an increase in the number of surgeries, trauma victims, and complications from childbirth (i.e., birth injuries), and the need for better diagnostic testing options. As more consumers are diagnosed with infectious diseases, governments have begun to enforce stricter regulations on screening blood donors. This has resulted in greater demand for accurate testing technologies such as negative nucleic acid testing (NAT), serological testing, and immunohematology assays. An aging population, coupled with an increase in the number of patients diagnosed with conditions that require frequent transfusions (e.g., anemia or hematologic disorders), continues to contribute to the growth of the France Blood Transfusion Diagnostic Market.

Restraining Factors

The France blood transfusion diagnostics market faces a number of constraints. The high costs associated with advanced testing technologies limit accessibility for smaller healthcare centers. The complexity of regulation and quality assurance requirements increases operational complexity and slows the introduction of new diagnostic tools into the marketplace. The ongoing shortage of skilled laboratory personnel negatively impacts their ability to utilize advanced testing systems efficiently. Also, the variability of blood donation rates combined with an unreliable supply can result in lower testing volumes.

Market Segmentation

The France blood transfusion diagnostics share is categorized by product, application, and end user.

- The reagents/kits segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France blood transfusion diagnostics market is segmented by product into reagents/kits and instruments. Among these, the reagents/kits segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The reagents/kits segmental growth is due to the high recurring demand for blood typing, infectious disease screening, and compatibility testing. Its growth is driven by increasing transfusions, rising pathogen screening needs, and the frequent replenishment of consumables in hospitals and blood banks.

- The disease screening segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France blood transfusion diagnostics market is segmented by application into blood grouping and disease screening. Among these, the disease screening segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period. The disease screening segmental growth is due to the increasing need to ensure blood safety and prevent transfusion-transmitted infections. The rising prevalence of infectious diseases such as HIV, hepatitis B, and C, and emerging pathogens has heightened the demand for comprehensive and accurate screening tests. Advancements in sensitive and rapid diagnostic technologies, such as nucleic acid testing (NAT) and automated immunoassays, support the expansion of the disease screening segment.

- The hospitals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France blood transfusion diagnostics market is segmented by end user into hospitals, blood banks, diagnostic laboratories, and others. Among these, the hospitals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The hospital's segmental growth is due to the high volume of transfusions, the need for donor-recipient compatibility testing, and the presence of advanced lab infrastructure. Increasing adoption of automated systems and strict safety regulations further drive growth in hospital settings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France blood transfusion diagnostics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Grifols SA Ordinary Shares - Class A

- Bio-Rad Laboratories Inc

- Roche Holding AG ADR

- Quotient Sciences

- Abbott Laboratories

- BioMerieux SA

- Siemens Healthineers AG ADR

- MedGenome

- Beckman Coulter

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, Grifols France SARL launched the Grifols sCD38 solution to facilitate pre-transfusion compatibility testing in multiple myeloma patients.

- In November 2020, Ortho Clinical Diagnostics announced the CE mark availability of the semi-automated ORTHO Optix reader. This instrument allows small-sized transfusion labs to elevate their standard of patient care by providing quality results with the use of an automated platform.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the France Blood Transfusion Diagnostics Market based on the below-mentioned segments:

France Blood Transfusion Diagnostics Market, By Product

- Reagents/Kits

- Instruments

France Blood Transfusion Diagnostics Market, By Application

- Blood Grouping

- Disease Screening

France Blood Transfusion Diagnostics Market, By End User

- Hospitals

- Blood Banks

- Diagnostic Laboratories

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France blood transfusion diagnostics market?

The France blood transfusion diagnostics market size is expected to grow at a CAGR of around 7.5% from 2024 to 2035.

- What is the France blood transfusion diagnostics market size in 2024?

The France blood transfusion diagnostics market size was estimated at USD 222.9 million in 2024.

- What is the projected market size of the France blood transfusion diagnostics market by 2035?

The France blood transfusion diagnostics market size is expected to reach USD 493.9 million by 2035.

- What are the key growth drivers of the France blood transfusion diagnostics market?

Rising prevalence of blood-related and chronic diseases, an increasing demand for transfusions due to surgeries and trauma, and advancements in diagnostic techniques.

- Which application segment dominated the market in 2024?

The disease screening segment held the largest market share in 2024.

- Which product segment accounted for the largest market share in 2024?

The reagents/kits segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 154 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |