France Carbon Black Market

France Carbon Black Market Size, Share, and COVID-19 Impact Analysis, By Type (Furnace Black, Acetylene Black, Channel Black, and Others), By Application (Tire and Non-Tire Rubber, Plastics, Inks and Coatings, Textile Fiber, and Others), and France Carbon Black Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Carbon Black Market Insights Forecasts to 2035

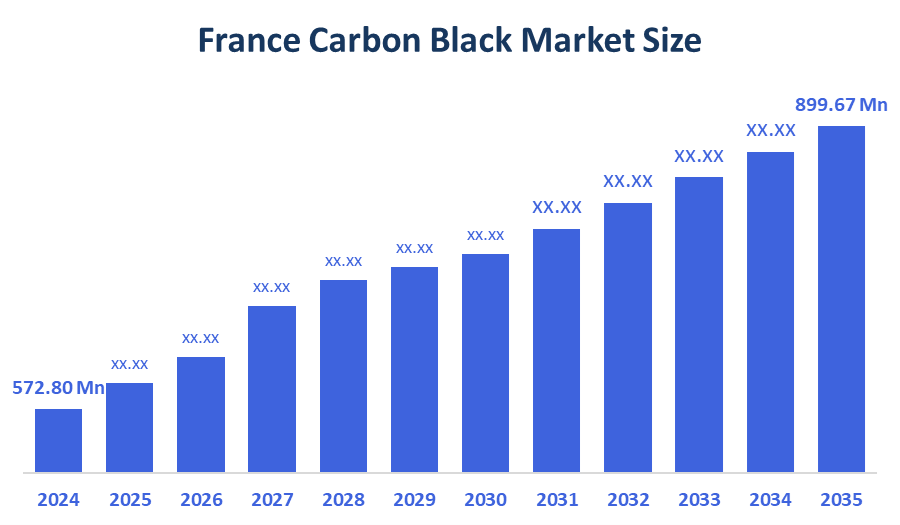

- The France Carbon Black Market Size was estimated at USD 572.80 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.19% from 2025 to 2035

- The France Carbon Black Market Size is Expected to Reach USD 899.67 Million by 2035

According to a research report published by Spherical Insights & Consulting, The France Carbon Black Market is anticipated to reach USD 899.67 Million by 2035, growing at a CAGR of 4.19% from 2025 to 2035. French automobile innovations, luxury consumer packaging, and environmentally friendly building practices are driving the market.

Market Overview

The French carbon black market pertains to the domestic industry for the production, distribution, and use of carbon black the black powder produced by the incomplete combustion of heavy petroleum products. The market is particularly important in France for the essential support it provides to industries like automotive, packaging, and construction. Additionally, to civil infrastructure projects like power distribution, rail, and tunnels, carbon-black-filled plastic conduits and composites are used to improve mechanical qualities and shorten maintenance cycles. High-performance additives like carbon black are becoming more and more popular in construction materials as climate resilience and longevity become national priorities under France's ecological transition framework. Beyond bulk materials, carbon black is also used in façade components and decorative finishes for architectural applications that require uniformity and deep tone retention. Carbon black will continue to be incorporated into France's infrastructure and green building ecosystem thanks to the convergence of aesthetic, structural, and thermal criteria.

Report Coverage

This research report categorizes the market for the France carbon black market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France carbon black market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France carbon black market.

Driving Factors

The demand for carbon black in coatings, pipes, membranes, and sealants is largely driven by the French construction industry, which is driven by energy efficiency regulations, public housing programs, and urban redevelopment. Carbon black grades that are weather-stable and UV-resistant are necessary for black HDPE and PVC components used in cabling, water management, and piping systems. Carbon-black modified foams and insulation layers that enhance thermal performance are becoming increasingly popular in France as a result of the country's push for energy-positive buildings and net-zero performance goals. Carbon black's capacity to absorb solar radiation and increase structural durability is advantageous for exterior coatings and roofing materials, especially in climate-sensitive areas.

Restraining Factors

Strict environmental laws that restrict emissions and waste, high production costs linked to energy-intensive processes, and restricted domestic supply of essential raw materials are some of the main obstacles facing the French carbon black market. Furthermore, traditional manufacturing's scalability and profitability are threatened by the growing push to use recycled carbon black and sustainable alternatives as well as competition from new green technologies.

Market Segmentation

The France carbon black market share is classified into type and application.

- The furnace black segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France carbon black market is segmented by type into furnace black, acetylene black, channel black, and others. Among these, the furnace black segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to its affordability, high conductivity, and suitability for lithium-ion battery formulations. It is perfect for improving battery performance, especially in electric cars and energy storage systems, due to its consistent particle structure and scalable production. Adoption is also being fueled by rising demand for energy-efficient solutions and growing battery production facilities in Asia and Europe, which positions furnace black as a preferred conductive additive in cutting-edge battery technologies.

- The tire and non-tire rubber segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France carbon black market is segmented by application into tire and non-tire rubber, plastics, inks and coatings, textile fiber, and others. Among these, the tire and non-tire rubber segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the growth in the manufacturing of automobiles, the need for conductive and long-lasting rubber parts, and the incorporation of cutting-edge materials to improve performance and safety. In rubber formulations, conductive carbon black is essential for increasing mechanical strength, electrical conductivity, and abrasion resistance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France carbon black market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cabot Corporation

- Orion Engineered Carbons

- Birla Carbon

- Imerys

- Philblack SAS

- Others

Recent Developments:

- In May 2024, Orion S.A. announced an investment in Alpha Carbone, a French tire recycling company, to scale up the production of tire pyrolysis oil and recovered carbon black at Alpha Carbone’s Dole, France, facility. This initiative supported France’s recycled tire and carbon black market by enabling the large-scale production of sustainable materials and addressed the annual disposal of approximately 500,000 metric tons of tires in the country.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Carbon Black Market based on the below-mentioned segments:

France Carbon Black Market, By Type

- Furnace Black

- Acetylene Black

- Channel Black

- Others

France Carbon Black Market, By Application

- Tire and Non-Tire Rubber

- Plastics

- Inks and Coatings

- Textile Fiber

- Others

FAQ’s

Q: What is the France carbon black market size?

A: France Carbon Black Market is expected to grow from USD 572.80 million in 2024 to USD 899.67 million by 2035, growing at a CAGR of 4.19% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: The expansion of tire production, improvements in conductive applications, sustainability programs, growing automotive demand, and greater investment in recycling and specialty carbon technologies are some of the major factors propelling the growth of the French carbon black market.

Q: What factors restrain the France carbon black market?

A: The French carbon black market is hampered by strict environmental laws, high production costs, a shortage of domestic raw materials, and mounting pressure to switch to recycled and sustainable carbon black substitutes.

Q: Who are the key players in the France carbon black market?

A: Cabot Corporation, Orion Engineered Carbons, Philblack SAS, IMERYS, Birla Carbon, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 234 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |