France Cardiovascular Treatment Market

France Cardiovascular Treatment Market Size, Share, and COVID-19 Impact Analysis, By Type (Surgical Procedures, Interventional Procedures, Non-invasive Procedures, and Others), By Indication (Ischemic Heart Disease, Heart Failure & Cardiomyopathies, Cardiac Arrhythmias & Conduction Disorders, Structural Heart & Valvular Disease, and Others), By Care Setting (Hospitals and Outpatient Facilities), and France Cardiovascular Treatment Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Cardiovascular Treatment Market Insights Forecasts to 2035

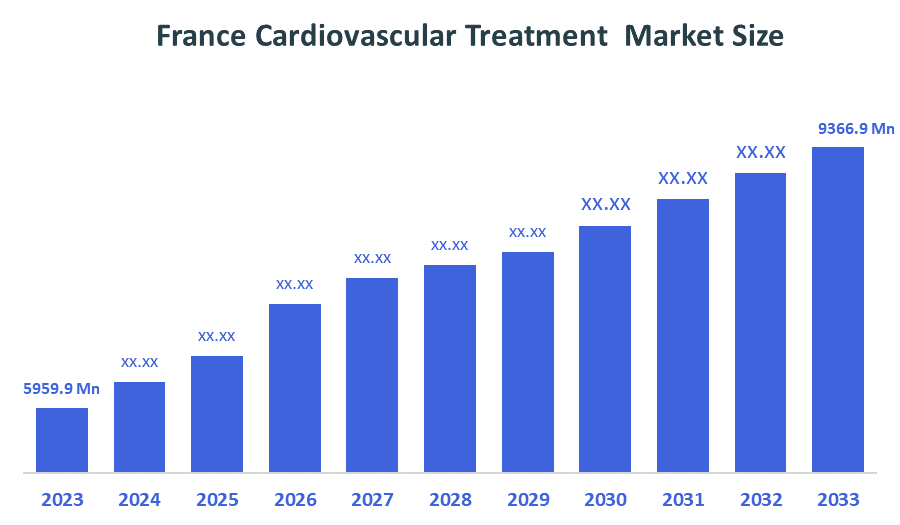

- The France Cardiovascular Treatment Market Size Was Estimated at USD 5,959.9 Million in 2024.

- The France Cardiovascular Treatment Market Size is Expected to Grow at a CAGR of Around 4.2% from 2024 to 2035.

- The France Cardiovascular Treatment Market Size is Expected to Reach USD 9,366.9 Million By 2035.

According to a research report published by Decision Advisiors & Consulting, the France Cardiovascular Treatment Market size is projected to reach USD 9,366.9 million by 2035, growing at a CAGR of 4.2% from 2025 to 2035. The France cardiovascular treatment market is driven by the aging population, rising prevalence of cardiovascular diseases, advancements in medical technology, and the growing number of professionals, cardiologists, and treatment centers.

Market Overview

The cardiovascular treatment market in France consists of drug sales, manufacturing, and distribution, as well as surgical procedures for heart and circulatory system diseases, such as heart failure, coronary artery disease, and stroke. With an aging population coupled with increasing rates of heart-related and cardiovascular disease and an ever-growing use of technology in the treatment of heart and cardiovascular conditions (including personalized medicine and advanced minimally invasive procedures), the cardiovascular treatment market in France will continue to escalate rapidly.

As the burden of cardiovascular disease continues to grow in France, this market is likely to expand dramatically over the next several years. According to data, there are 1.2 million patients who will be admitted into hospitals for various cardiac-related problems. This statistic alone, when paired with millions of other patients being diagnosed with chronic cardiovascular diseases such as ischemic heart disease (IHD) and heart failure, illustrates just how difficult managing and treating people with heart diseases can be. Around 10% of the entire population can be classified as having 'ideal' cardiovascular health. Many patients with major cardiovascular disease risk factors, e.g., hypertension, high cholesterol, etc., are not diagnosed. This creates a wide-ranging public health crisis, evident in the need for improvements in detectability, options for treatment (medications), availability of equipment, and the utilization of digital technology. All of the above-mentioned factors, coupled with some aspects of the ongoing support of government programs (PNNS) and funding for programs aimed at reducing high blood pressure/obesity and improving screening for cardiovascular disease, as well as providing digital technology/remote care, have moved the nation towards an increased emphasis on investing in digital technology.

Report Coverage

This research report categorizes the market for the France cardiovascular treatment market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France cardiovascular treatment market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France cardiovascular treatment market.

Driving Factors

The cardiovascular treatment market in France is primarily driven by older populations getting older, while they also become ill with more heart disease due to becoming sedentary, being overweight due to poor eating habits, high blood pressure caused by the same poor eating habits, and diabetes from the same poor eating habits. New technology innovation, minimally invasive devices for cardiac procedures. The following new technologies have contributed to increased patient access to and use of cardiac treatments via innovative methods. In addition to new therapeutic approaches, France also has well-developed healthcare delivery systems supported by comprehensive reimbursement policies, providing widespread access to innovative cardiac therapeutics and technologies. Therefore, demand will continue beyond drugs, devices, & diagnostics to include long-term cardiovascular disease management.

Restraining factors

Several constraints impede the potential growth of the cardiovascular treatment market in France, primarily due to the growing number of people with cardiovascular diseases. Factors affecting the acceptance of advanced cardiovascular devices include the cost of new cardiovascular devices, other interventions, and the extended use of regenerative therapies, such as stem cells, to treat cardiovascular disease. The lengthy process of regulatory approval for drugs/devices also contributes to higher costs associated with R&D for these products. France may experience periodic shortages of certified cardiologists, interventional cardiologists, and other specialized personnel, resulting in a lower number of centers capable of providing advanced cardiovascular treatment.

Market Segmentation

The France cardiovascular treatment market share is categorized by type, indication, and care setting.

- The interventional procedures segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The France cardiovascular treatment market is segmented by type into surgical procedures, interventional procedures, non-invasive procedures, and others. Among these, the interventional procedures segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The interventional procedures' segmental dominance is due to the increasing demand for less complex surgical intervention, shorter time to recover following surgical intervention, and better clinical outcomes compared with traditional surgery; the continuing development of new techniques in interventional cardiology, including the use of drug-eluting stents, transcatheter aortic valve replacement (TAVR), balloon angioplasty, and catheter-based therapies, allows for successfully treating patients with complex cardiovascular conditions and reducing risk associated with these treatments.

- The is chemic heart disease segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France cardiovascular treatment market is segmented by indication into ischemic heart disease, heart failure & cardiomyopathies, cardiac arrhythmias & conduction disorders, structural heart & valvular disease, and others. Among these, the ischemic heart disease segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The ischemic heart disease segment accounted for the largest market share due to many people being affected by these conditions, which include hypertension, diabetes, obesity, and smoking. These patients tend to have an increased demand for diagnostic testing, pharmaceuticals for treatment, and interventional treatment, such as angioplasty & stenting, etc. An increasing number of patients in France as a result of the aging population means the demand for cardiac treatment will only grow, solidifying the current leading place held by this group.

- The hospitals held the largest share in 2024 and are anticipated to grow at a significant CAGR during the forecast period.

The France cardiovascular treatment market is segmented by care setting into hospitals and outpatient facilities. Among these, the hospitals segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The hospital's segmental growth is due to hospitals being equipped with high levels of advanced cardiovascular systems, including catheterization laboratories, surgical departments, and specialized cardiology teams, and they are the main site of many of the most complex procedures in cardiology, including surgical intervention, interventional cardiology treatment, and acute care for emergencies. In addition, the higher preference of patients to receive thorough diagnoses, continued intensive monitoring, and access to multidisciplinary expertise has increased hospital dominance in this area of patient care. The continued development of hospital technology and greater capacity for providing hospital-based advanced cardiovascular interventions have also contributed to the growth of this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France cardiovascular treatment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- London Bridge Hospital

- Burjeel Hospital

- Medanta Medicity

- University Health Network

- Johns Hopkins University

- Cleveland Clinic

- University of Tokyo

- Fortis Healthcare

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2025, Merck Foundation launched a significant five-year initiative, the Collaborative for Equity in Cardiac Care, committing USD 22 million to improve access to high-quality, person-centered cardiovascular care in the U.S. Under this initiative, the Foundation is providing grants to 11 nonprofit and public health organizations in underserved communities across the country, supporting the development and implementation of evidence-informed programs to address gaps in cardiac care delivery.

- In October 2024, AstraZeneca strengthened its cardiovascular-treatment pipeline by signing an exclusive licensing agreement with CSPC Pharmaceutical Group Ltd. to develop a novel, pre-clinical small molecule that targets Lipoprotein(a) named YS2302018. The therapy is intended to be developed either alone or in combination with AstraZeneca’s existing investigational oral PCSK9 inhibitor (AZD0780) for the management of dyslipidaemia and other cardiovascular indications.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the France Cardiovascular Treatment Market based on the below-mentioned segments:

France Cardiovascular Treatment Market, By Type

- Surgical Procedures

- Interventional Procedures

- Non-invasive Procedures

- Others

France Cardiovascular Treatment Market, By Indication

- Ischemic Heart Disease

- Heart Failure & Cardiomyopathies

- Cardiac Arrhythmias & Conduction Disorders

- Structural Heart & Valvular Disease

- Others

France Cardiovascular Treatment Market, By Care Setting

- Hospitals

- Outpatient Facilities

Frequently Asked Questions (FAQ)

- What is the CAGR of the France cardiovascular treatment market?

The France cardiovascular treatment market size is expected to grow at a CAGR of around 4.2% from 2024 to 2035.

- What is the France cardiovascular treatment market size in 2024?

The France cardiovascular treatment market size was estimated at USD 5,959.9 million in 2024.

- What is the projected market size of the France cardiovascular treatment market by 2035?

The France cardiovascular treatment market size is expected to reach USD 9,366.9 million by 2035.

- What are the key growth drivers of the France cardiovascular treatment market?

Aging population, rising prevalence of cardiovascular diseases, advancements in medical technology, and the growing number of professionals, cardiologists, and treatment centers.

- Which type of segment dominated the market share in 2024?

The interventional procedures dominated the market share in 2024

- Which indication segment accounted for the largest market share in 2024?

The ischemic heart disease segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 199 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |