France Cement Market

France Cement Market Size, Share, and COVID-19 Impact Analysis, By Type (Blended, Portland, and Others), By End-Use (Residential, Commercial, and Infrastructure), and France Cement Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

France Cement Market Insights Forecasts to 2035

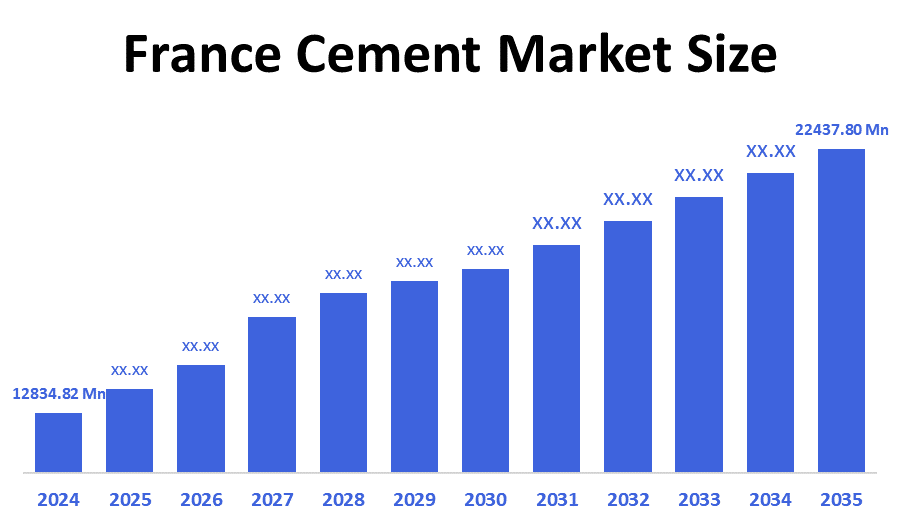

The France Cement Market Size was estimated at USD 12834.82 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.21% from 2025 to 2035

- The France Cement Market Size is Expected to Reach USD 22437.80 Million by 2035

According to a research report published by Spherical Insights & Consulting, the France Cement Market is anticipated to reach USD 22437.80 million by 2035, growing at a CAGR of 5.21% from 2025 to 2035. The government's spending on infrastructure modernization, rising residential building demand, and a move toward low-carbon cement technologies are the main factors propelling the market.

Market Overview

The domestic industry that produces, distributes, and uses cement for a range of construction applications is referred to as the French cement market. Additionally, the market is experiencing strong shifts toward decarbonization due to increased regulatory changes and the nation's revised climate targets. According to the reports in the industry, the Ministry of Ecological Transition has updated its targets in the nation climate and energy strategy. The revised target is to reduce gross GHG emissions to half of 1990 levels, by 2030. As part of that program, the government has also targeted 58% of total energy use to come from carbon-free sources by that time, including 34% from electricity and 23% from non-electric, renewable sources. Those targets place heavy expectations on energy intensive industry, with the buildings industry singled out as a focus area to limit emissions, and cement specifically called out in that industry. Cement manufacturers are stepping forward in addressing this management target by looking for low-carbon alternatives to clinker, using basalt, slag, fly ash, and calcined clays. These substitutes can limit the emissions that stem from using traditional clinker, which is the most carbon-intensive component of cement. Furthermore, using carbon capture and storage (CCS) technology is being piloted, especially in large-scale plants.

Report Coverage

This research report categorizes the market for the France cement market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France cement market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France cement market.

Driving Factors

The demand for cement related to infrastructure is rising sharply as France becomes a more attractive location for industrial investment. As a result, the cement market in France is expanding at a substantial rate. Furthermore, the nation is now a competitive location in Europe for manufacturing, logistics, and data center operations thanks to strategic changes made to taxation, labor laws, and foreign investment policies. For example, with 415 new projects in 2024, France cemented its position as Europe's top industrial investment destination, according to industry reports. It made up more than a quarter of all initiatives for foreign manufacturing on the continent. France's standing as a major center of European industry is strengthened by this performance.

Restraining Factors

The high cost of energy and raw materials is one of the many factors holding back the French cement market, which has a big effect on production margins. Tight environmental rules, especially those that target CO? emissions under EU climate policies and RE2020, raise the cost of compliance and require expensive technology upgrades. Due to high interest rates and low housing demand, the market also faces stagnating residential construction. Domestic producers are further put under pressure by competition from low-cost cement and alternative low-carbon materials that are imported.

Market Segmentation

The France cement market share is classified into type and end-use.

- The ended segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France cement market is segmented by type into blended, portland, and others. Among these, the blended segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This growth is driven by its reduced carbon footprint, compliance with environmental regulations of RE2020, and rising demand for environmentally friendly building materials. Blended cement adoption has accelerated due to public and private sector initiatives supporting green infrastructure and growing awareness of the impact on the climate.

- The infrastructure segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France cement market is segmented by end-use into residential, commercial, and infrastructure. Among these, the infrastructure segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This growth due to significant public investments in energy-efficient retrofits, transportation networks, and urban renewal initiatives that comply with RE2020 guidelines. The use of cement in infrastructure has increased due to government-sponsored projects to update public buildings, roads, and bridges as well as growing demand for low-carbon building materials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France cement market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IMERYS

- Ciments Français

- Consolis Group

- Bonna Sabla

- KP1 Group

- Vicat

- Others

Recent Developments:

- In May 2025, Ecocem announced an additional investment of €170 million to construct four new production lines in France and accelerate the delivery of its ACT scalable low-carbon cement technology. The French Government, specifically the Ministries of Economy & Finance and Industry, committed to working closely with Ecocem to identify operational and financial solutions to expedite and implement the expansion plan.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Cement Market based on the below-mentioned segments:

France Cement Market, By Type

- Blended

- Portland

- Others

France Cement Market, By End-Use

- Residential

- Commercial

- Infrastructure

FAQ’s

Q: What is the France cement market size?

A: France Cement Market is expected to grow from USD 12834.82 million in 2024 to USD 22437.80 million by 2035, growing at a CAGR of 5.21% during the forecast period 2025-2035

Q: What are the key growth drivers of the market?

A: Cement market growth in France is primarily driven by investments in public infrastructure, sustainable retrofitting, compliance with RE2020 regulations, adoption of low-carbon cement, digitalization, and energy-efficient production techniques in response to changing construction demands.

Q: What factors restrain the France cement market?

A: Stalling residential construction, high energy costs, strict carbon regulations, limited availability of raw materials, and growing competition from low-carbon alternatives and imported cement products are some of the factors limiting the cement market in France.

Q: Who are the key players in the France cement market?

A: IMERYS, Ciments Français, Consolis Group, Bonna Sabla, KP1 Group, Vicat, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 170 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |