France Cold Plasma Market

France Cold Plasma Market Size, Share, and COVID-19 Impact Analysis, By Pressure (Low-Pressure and Atmospheric Pressure), By Application (Wound Healing, Blood Coagulation, Dentistry, Cancer Treatment, and Others), and France Cold Plasma Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Cold Plasma Market Insights Forecasts to 2035

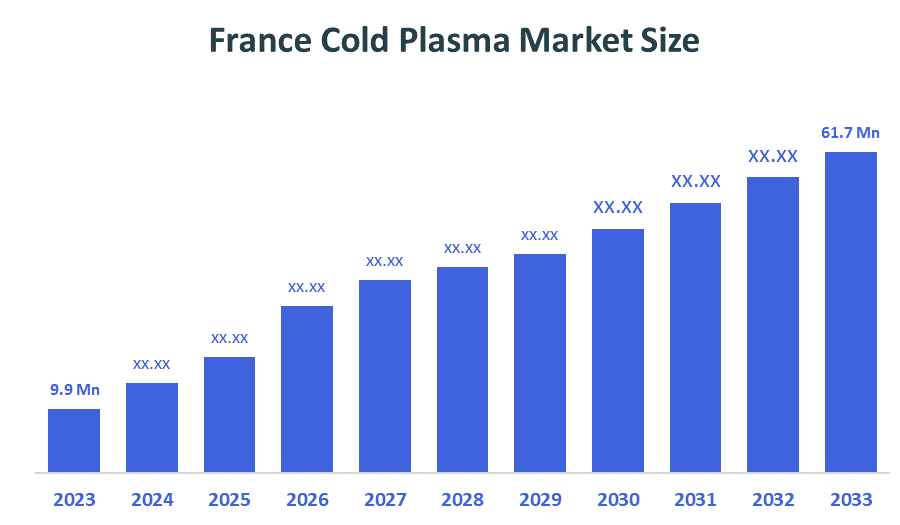

The France Cold Plasma Market Size Was Estimated at USD 9.9 Million in 2024.

The France Cold Plasma Market Size is Expected to Grow at a CAGR of Around 18.1% from 2025 to 2035.

The France Cold Plasma Market Size is Expected to Reach USD 61.7 million by 2035.

According to a Research Report Published by Decision Advisior the France Cold Plasma Market size is anticipated to reach USD 61.7 million by 2035, growing at a CAGR of 18.1% from 2025 to 2035. The France cold plasma market is driven by the increasing integration of cold plasma technology into the healthcare sector for applications like sterilization and wound healing, the demand for non-thermal and eco-friendly solutions in various industries, and government initiatives supporting R&D and innovation. The technology's use in food safety and packaging decontamination, and its role in industrial surface treatment for manufacturing, also contribute to market growth.

Market Overview

The France cold plasma market refers to the sector focused on the production, application, and development of technologies utilizing cold plasma, or partially ionized gases at very low temperatures. Reactive species created by forming cold plasmas are often used for decontamination, sterilization, and surface modification of materials without needing to heat them or use corrosive or damaging chemicals. The main application areas of this type of technology include Healthcare, sterilization of medical devices and wound healing, food processing and packaging to kill microbial contaminants, and environmental decontamination. This marketplace has capitalized on the benefits offered by using cold plasma's non-thermal, chemical-free, environmentally friendly characteristics to provide companies with a safer, more effective, and environmentally friendly method of treating products, materials, and surfaces compared to traditional chemical-based methods or thermal methods.

In France, healthcare-associated infections (HAIs) and antimicrobial-resistant bacterial infections remain significant, affecting about 5% of hospitalized patients at any time. In 2016, around 139,000 hospitalizations were linked to antibiotic-resistant bacteria such as ESBL-producing Enterobacteriaceae and MRSA, increasing mortality risk and hospital stays. Persistent infection risks in surgical settings, long-term care, and routine admissions drive strong demand for effective sterilization and disinfection solutions beyond antibiotics and traditional methods. The national health strategy prioritizes preventing HAIs and antibiotic resistance through enhanced infection prevention and control measures. Cold plasma technologies, capable of sterilizing surfaces, medical devices, and biological materials without heat or harsh chemicals, offer a promising alternative. These factors, high infection incidence, patient safety concerns, and institutional support, concerns regarding patient safety, and the establishment of the France governmental health strategy in support of cold plasma technology, make the market for cold plasma technology likely to experience considerable growth in France.

Report Coverage

This research report categorizes the market for the France cold plasma market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France cold plasma market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France cold plasma market.

Driving Factors

The France cold plasma market is driven by the rising need for advanced sterilization and infection-control solutions due to increasing HAIs and antibiotic-resistant bacteria. Growing cases of chronic wounds and more surgical procedures boost demand for cold plasma in healthcare. Its eco-friendly, chemical-free properties make it attractive for food processing, packaging, and industrial surface treatments. Stricter hygiene and environmental regulations further support adoption. Technological advancements, including portable and atmospheric-pressure systems, continue to broaden their applications across sectors.

Restraining Factors

The France cold plasma market faces several restraining factors. High initial costs of cold plasma equipment and the need for specialized infrastructure and training can discourage smaller healthcare facilities and industrial users. Limited awareness of cold plasma’s capabilities, especially in non-medical sectors. Regulatory complexities and the need for rigorous validation of safety and efficacy in medical and food applications also create barriers. Additionally, competing traditional sterilization and surface-treatment methods, such as chemical disinfectants, autoclaving, and UV systems.

Market Segmentation

The France cold plasma market share is categorized by pressure and application.

The atmospheric pressure segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France cold plasma market is segmented by pressure into low-pressure and atmospheric pressure. Among these, the atmospheric pressure segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The atmospheric pressure segmental growth is due to its greater practicality, lower operating costs, and wider applicability across industries. Easier to install, maintain, and integrate into existing production lines in healthcare, food processing, packaging, textiles, and electronics. Its ability to deliver effective sterilization, surface modification, and decontamination at room temperature enhances convenience and efficiency. Additionally, the rising demand for portable and user-friendly plasma devices in medical and industrial settings supports the rapid expansion of atmospheric pressure cold plasma technologies in France.

The wound healing segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France cold plasma market is segmented by application into wound healing, blood coagulation, dentistry, cancer treatment, and others. Among these, the wound healing segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period. The wound healing segmental growth is due to the rising prevalence of chronic wounds, including diabetic foot ulcers, pressure ulcers, and venous leg ulcers, which require advanced and effective treatment options. Cold plasma promotes faster tissue regeneration, reduces inflammation, and provides strong antimicrobial effects, making it highly suitable for managing infected or slow-healing wounds. With an aging population and increasing rates of diabetes in France, the demand for innovative wound care solutions continues to rise.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France cold plasma market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

G Medical Innovations Holdings Ltd

P2i

Enercon Industries

Henniker Plasma

Nordson Corporation

Adtec Plasma Technology Co. Ltd

Relyon Plasma GmbH

AcXys Plasma Technologies

Plasmatreat

Others

Key Target Audience

Market Players

Investors

End-users

Government Authorities

Consulting and Research Firm

Venture capitalists

Value-Added Resellers (VARs)

Recent Developments

In July 2025, Venture Medical led a €6 million Series A investment in Plasmacure B.V., a Dutch MedTech company developing PLASOMA cold plasma therapy for chronic wound healing. The funding will support regulatory approval, clinical adoption, and expansion of PLASOMA therapy into new markets.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the France Cold Plasma Market based on the below-mentioned segments:

France Cold Plasma Market, By Pressure

Low-Pressure

Atmospheric Pressure

France Cold Plasma Market, By Application

Wound Healing

Blood Coagulation

Dentistry

Cancer Treatment

Others

Frequently Asked Questions (FAQ)

What is the CAGR of the France cold plasma market?

The France cold plasma market size is expected to grow at a CAGR of around 18.1% from 2024 to 2035.

What is the France cold plasma market size in 2024?

The France cold plasma market size was estimated at USD 9.9 million in 2024.

What is the projected market size of the France cold plasma market by 2035?

The France cold plasma market size is expected to reach USD 61.7 million by 2035.

What are the key growth drivers of the France cold plasma market?

Increasing integration of cold plasma technology, the demand for non-thermal and eco-friendly solutions in various industries, and government initiatives supporting R&D and innovation. Contribute to market growth.

Which application segment dominated the market in 2024?

The wound healing segment held the largest market share in 2024.

Which pressure segment accounted for the largest market share in 2024?

The atmospheric pressure segment accounted for the largest market share in 2024

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 160 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |