France Confectionery Market

France Confectionery Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Hard-boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, and Others), By Age Group (Children, Adult, and Geriatric), and France Confectionery Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Confectionery Market Insights Forecasts to 2035

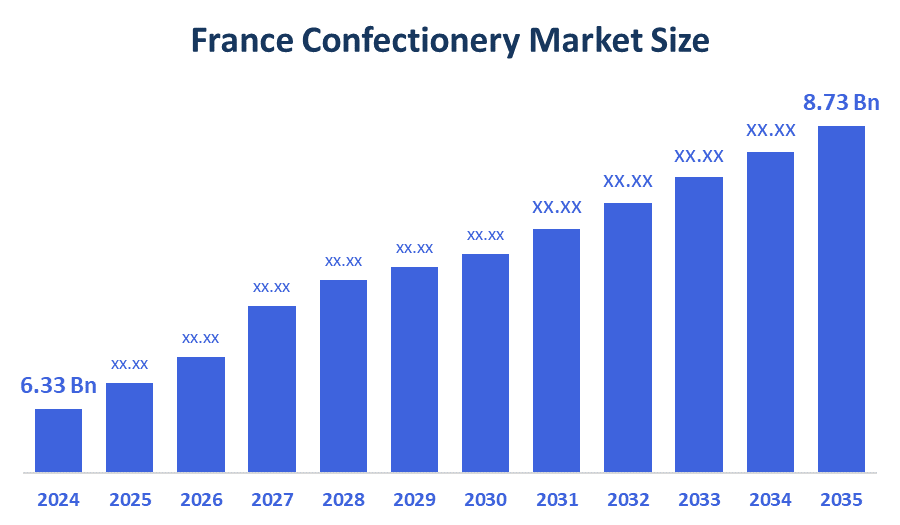

- The France Confectionery Market Size was estimated at USD 6.33 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.97% from 2025 to 2035

- The France Confectionery Market Size is Expected to Reach USD 8.73 Billion by 2035

According to a research report published by Spherical Insights & Consulting, the France Confectionery Market is anticipated to reach USD 8.73 billion by 2035, growing at a CAGR of 2.97% from 2025 to 2035. Rising health consciousness, premiumization, and the growing need for clean-label ingredients are the main factors influencing the confectionery market in France.

Market Overview

The confectionery market in France represents the landscape of commerce surrounding the manufacture, sale, and consumption of food products that have a sweet taste, including products such as chocolate, candies, gums, and baked goods. It is influenced by changing consumer behavior, laws, innovations, and retail dynamics for both domestic and export markets. Further, the market is seeing an increase in demand for high-end confections that are produced using premium ingredients and frequently presented in opulent packaging. Customers' willingness to pay more for unique, decadent treats that are thought to have added value is reflected in this consumer trend. The sudden removal of Cadbury Fingers from French supermarket shelves in late 2024 caused a great deal of public outrage and nostalgia, illustrating how strong emotional bonds with candy brands affect consumer loyalty and perceptions even as tastes change. Gifting culture and seasonal demand, particularly during holiday seasons, are additional factors driving premiumization. In order to provide a better experience, brands are being motivated by this shifting consumer preferences to make investments in craftsmanship, storytelling, and small-batch production. These changes set consumer expectations for quality and innovation and are largely responsible for the growth of the confectionery market in France.

Report Coverage

This research report categorizes the market for the France confectionery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France confectionery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France confectionery market.

Driving Factors

The way confectionery is marketed, sold, and consumed is changing as a result of France's rapid digital adoption. More people are using the internet to research, evaluate, and purchase confections, especially those that offer customized or bespoke options. Businesses are being prompted by this trend to fortify their digital presence through direct-to-consumer (DTC) platforms, mobile-friendly websites, and social media engagement. Influencer collaborations and focused online advertising are being used to establish brand identity and encourage impulsive purchases. Additionally, subscription-based business models and seasonal product releases that create buzz and encourage repeat business are supported by digital channels. The convenience-driven purchasing habits of today's consumers, particularly younger ones, are growing at the same time as e-commerce.

Restraining Factors

The French confectionery market is hampered by a number of factors, such as rising health consciousness that causes people to consume less sugar, regulatory pressures like sugar taxes and labeling requirements, and the competition from healthier snack options like protein bars and plant-based treats. Additionally, profitability and innovation are hampered by shifting raw material costs as well as sustainability issues with sourcing and packaging, especially for conventional confectionery formats.

Market Segmentation

The France confectionery market share is classified into product type and age group.

- The chocolate segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France confectionery market is segmented by product type into hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others. Among these, the chocolate segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. France's growing consumer demand for premium, artisanal, and clean-label products, coupled with broader health-consciousness that also more favorably favors dark and organic chocolate, is impacting demand for chocolate. Seasonal gifting, innovation in flavor profiles, and sustainable sourcing of ingredients also enhance the attractiveness of chocolate, while new retail formats (ex.: convenience stores) and greater flexibility in ordering online further break barriers regarding brand availability and convenience among modern shoppers. Together these trends support the category's position as a leading category and a continued growing presence in the greater confection category.

- The adult segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France confectionery market is segmented by age group and children, adult, and geriatric. Among these, the adult segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to growing consumer demand for high-end, clean-label, and useful treats that fit in with trends in ethical and wellness consumption. Dark chocolate, sugar-free varieties, and organic confections are among the decadent yet health-conscious options that adults are increasingly seeking. Targeted marketing and a variety of retail formats help to support segment expansion, which is also aided by changing lifestyle preferences, increased disposable income, and interest in artisanal and sustainably sourced goods.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France confectionery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tonton Pierrot

- Carambar & Co

- Cemoi

- Chocolaterie Bonnat

- La Maison du Chocolat

- Michel Cluizel

- Others

Recent Developments:

- In January 2024, Europraliné/Trapa (Spain) had launched the Trapa Collection 100% cocoa tablets and Chest Trap milk-chocolate praline box. Both products were gluten-free and palm-oil-free, reflecting growing consumer demand for clean-label treats. Their innovative formulations had earned them the prestigious Flavor of the Year 2024 awards, strengthening their position in the premium European confectionery segment.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the France Confectionery Market based on the below-mentioned segments:

France Confectionery Market, By Product Type

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

France Confectionery Market, By Age Group

- Children

- Adult

- Geriatric

FAQ’s

Q: What is the France confectionery market size?

A: France Confectionery Market is expected to grow from USD 6.33 billion in 2024 to USD 8.73 billion by 2035, growing at a CAGR of 2.97% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: The demand for organic and clean-label products, premiumization trends, artisanal innovation, growing health consciousness, and changing flavor profiles that appeal to younger consumers and wellness-conscious consumers are some of the main growth drivers.

Q: What factors restrain the France confectionery market?

A: The demand for traditional confections is being impacted by competition from functional foods and plant-based substitutes, growing health concerns, sugar taxes, regulatory pressure on additives, and changing consumer preferences toward healthier snacks.

Q: Who are the key players in the France confectionery market?

A: Tonton Pierrot, Carambar & Co, Cemoi, Chocolaterie Bonnat, La Maison du Chocolat, Michel Cluizel, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |