France Continuous Glucose Monitoring Market

France Continuous Glucose Monitoring Market Size, Share, and COVID-19 Impact Analysis, By Component (Transmitters, Sensors, Receivers, and Others), By End User (Hospitals and homecare), and France Continuous Glucose Monitoring Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Continuous Glucose Monitoring Market Insights Forecasts to 2035

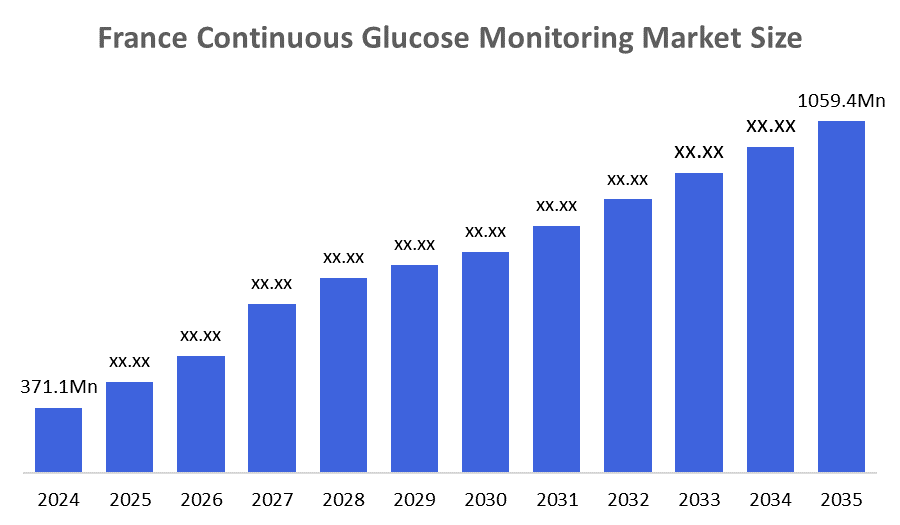

- The France Continuous Glucose Monitoring Market Size Was Estimated at USD 371.1 Million in 2024.

- The France Continuous Glucose Monitoring Market Size is Expected to Grow at a CAGR of Around 10.01% from 2025 to 2035.

- The France Continuous Glucose Monitoring Market Size is Expected to Reach USD 1059.4 Million by 2035.

According To a Research Report Published By Advisors Decisions & Consulting, The France Continuous Glucose Monitoring Market Size Is Anticipated To Reach USD 1059.4 Million By 2035, Growing At a CAGR Of 10.01% From 2025 to 2035. The France continuous glucose monitoring market is driven by rising diabetes prevalence and growing demand for real-time, accurate glucose tracking. Technological advancements such as smartphone integration, longer sensor life, and improved accuracy boost adoption. An aging population and increased focus on proactive, personalized diabetes management further fuel market growth.

Market Overview

The France continuous glucose monitoring market refers to the industry focused on the development, distribution, and use of real-time glucose monitoring systems that track blood glucose levels continuously throughout the day. These devices use sensors placed under the skin to measure interstitial glucose and transmit data to receivers, smartphones, or insulin pumps. CGM systems are widely used by individuals with type 1 and type 2 diabetes to improve glycemic control, reduce hypoglycemia risk, and support personalized diabetes management. The market includes sensors, transmitters, receivers, integrated insulin delivery systems, and related software used across hospitals, clinics, and home-care settings.

The France continuous glucose monitoring market is expanding as rising diabetes cases and growing awareness of glycemic control increase the need for advanced monitoring solutions. CGM systems are becoming essential because they provide real-time glucose data, reduce the risk of hypoglycemia, and support better long-term diabetes management compared to traditional finger-prick methods. France’s adoption conditions are highly favorable, supported by national health insurance reimbursement for several CGM devices, government focus on digital health, and an aging population with higher susceptibility to metabolic disorders. Additionally, increasing acceptance of connected health technologies, smartphone integration, and demand for personalized, proactive care further strengthen the importance and widespread adoption of CGM systems across the country.

Report Coverage

This research report categorizes the market for the France continuous glucose monitoring market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France continuous glucose monitoring market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France continuous glucose monitoring market.

Driving Factors

The France continuous glucose monitoring market is driven by the rising prevalence of diabetes and increasing awareness of the benefits of continuous, real-time glucose tracking. Technological advancements such as longer-lasting sensors, smartphone connectivity, and improved accuracy enhance user convenience and clinical outcomes. Supportive government policies and reimbursement programs make CGM devices more accessible to patients. Additionally, growing adoption of digital health tools, demand for personalized diabetes management, and a rising aging population further accelerate market growth.

Restraining Factors

The France continuous glucose monitoring market faces several restraining factors, including the high cost of CGM devices and replacement sensors, which can limit adoption among uninsured or low-income patients. Some users experience discomfort or skin irritation from sensor insertion, affecting long-term adherence. Limited awareness of CGM benefits in certain patient groups, along with reluctance to shift from traditional glucometers, also slows uptake.

Market Segmentation

The France continuous glucose monitoring market share is categorized by component and end user.

- The sensors segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France continuous glucose monitoring market is segmented by component into transmitters, sensors, receivers, and others. Among these, the sensors segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The sensors segment's growth is driven by increasing demand for real-time and continuous glucose data, as sensors serve as the core functional element of CGM systems. The growing diabetic population, coupled with expanding reimbursement coverage for sensor-based monitoring, further supports strong market uptake. Additionally, rising preference for integrated digital health solutions and smartphone connectivity enhances the appeal and widespread use of CGM sensors in France.

- The home care segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France continuous glucose monitoring market is segmented by end user into hospitals and home care. Among these, the home care segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The home care segmental growth is driven by rising demand for convenient self-monitoring, user-friendly CGM devices with smartphone connectivity, and supportive reimbursement policies. Increasing use of remote monitoring and a growing diabetic population further accelerate the adoption of CGM systems in home settings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France continuous glucose monitoring market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Laboratories

- Dexcom, Inc

- Medtronic plc

- Roche Diabetes Care

- Ypsomed Holding AG

- A. Menarini Diagnostics

- Senseonics Holdings, Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, DexCom announced the availability [AS1] of its Dexcom ONE real-time CGM sensor via reimbursement in France. Dexcom’s announcement brings the company’s real-time CGM technology to half a million more people with diabetes in France.

- In August 2024, Medtronic collaborated with Abbott to integrate Abbott's [AS2] FreeStyle Libre CGM technology with its insulin delivery systems, aiming to provide more comprehensive diabetes management solutions.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Continuous Glucose Monitoring Market based on the below-mentioned segments:

France Continuous Glucose Monitoring Market, By Component

- Transmitters

- Sensors

- Receivers

- Others

France Continuous Glucose Monitoring Market, By End User

- hospitals

- Homecare

Frequently Asked Questions (FAQ)

- What is the France continuous glucose monitoring market size in 2024?

The France continuous glucose monitoring market size was estimated at USD 371.1 million in 2024.

- What is the projected market size of the France continuous glucose monitoring market by 2035?

The France continuous glucose monitoring market size is expected to reach USD 1059.4 million by 2035.

- What is the CAGR of the France continuous glucose monitoring market?

The France continuous glucose monitoring market size is expected to grow at a CAGR of around 10.01% from 2024 to 2035.

- What are the key growth drivers of the France continuous glucose monitoring market?

Rising diabetes prevalence and growing demand for real-time, accurate glucose tracking. Technological advancements. An aging population and increased focus on proactive, personalized diabetes management further fuel market growth.

- Which end-user segment dominated the market in 2024?

The home care segment dominated the market in 2024.

- Which component segment accounted for the largest market share in 2024?

The Sensors segment accounted for the largest market share in 2024.

- What segments are covered in the France continuous glucose monitoring market report?

The France continuous glucose monitoring market is segmented on the basis of component and end user.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Regional |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |