France Core Banking Software Market

France Core Banking Software Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution and Service), By End Use (Banks, Financial Institutions, and Others), and France Core Banking Software Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Core Banking Software Market Insights Forecasts to 2035

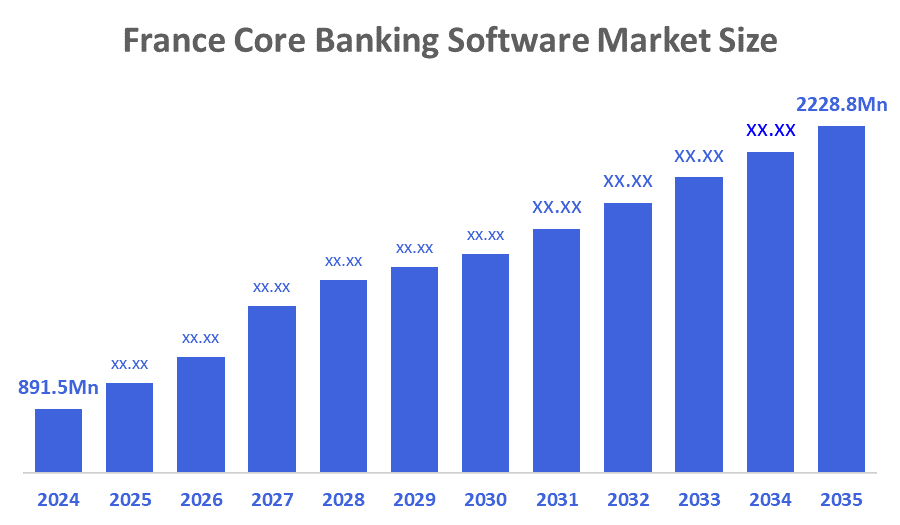

- The France Core Banking Software Market Was Estimated at USD 891.5 Million in 2024.

- The Market Size is Growing at a CAGR of 8.69% between 2025 and 2035.

- The France Core Banking Software market is Anticipated to Reach USD 2228.8 Million by 2035.

According To a Research Report Published By Decisions Advisors & Consulting, The France Core Banking Software Market Is Anticipated To Hold USD 2228.8 Million By 2035, Growing At a CAGR Of 8.69% From 2025 to 2035. Future opportunities in the France core banking software market include digital transformation initiatives, cloud-based banking adoption, fintech collaborations, enhanced customer experience solutions, regulatory compliance automation, AI-driven analytics, and modernization of legacy banking systems.

Market Overview

The France core banking software market is experiencing significant growth, driven by increasing digitalization in the banking sector and the need for enhanced operational efficiency. Banks and financial institutions are modernizing legacy systems to provide seamless, real-time services to customers, including online banking, mobile banking, and integrated payment solutions. Cloud-based deployments and Software-as-a-Service (SaaS) models are gaining traction due to their scalability, cost-effectiveness, and flexibility. The market is further propelled by regulatory compliance requirements, growing competition from fintech companies, and rising demand for personalized banking experiences. Advanced technologies such as artificial intelligence, machine learning, and blockchain are being integrated into core banking solutions to improve analytics, risk management, and fraud detection, positioning the market for sustained growth in the coming years.

Report Coverage

This research report categorizes the market for the France core banking software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France core banking software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France core banking software market.

Driving Factors

Digitalization, cloud adoption, fintech competition, AI integration, regulatory compliance.

The France core banking software market is driven by increasing digitalization and modernization of banking systems to enhance operational efficiency and customer experience. Rising demand for real-time banking services, cloud-based deployments, and regulatory compliance automation further accelerates adoption. Fintech competition encourages banks to integrate AI, machine learning, and advanced analytics into core systems. Additionally, the need for secure, scalable, and flexible banking platforms, along with cost-effective SaaS solutions, supports market expansion across retail, corporate, and investment banking sectors.

Restraining Factors

High costs, legacy system resistance, security concerns, complex integration, regulations.

Key restraining factors in the France core banking software market include high implementation and maintenance costs, resistance to change from legacy systems, data security and privacy concerns, complex integration with existing infrastructure, and regulatory compliance challenges across financial institutions.

Opportunities

Cloud solutions, AI integration, fintech partnerships, digital banking, regulatory technology.

The France core banking software market offers opportunities through the adoption of cloud-based and SaaS solutions, enabling cost-effective, scalable, and flexible operations. Integration of AI, machine learning, and data analytics can enhance customer experience, risk management, and fraud detection. Fintech collaborations and digital banking initiatives provide avenues for innovation and market expansion. Additionally, growing demand for real-time payments, personalized banking services, and regulatory technology solutions presents significant growth potential for core banking software providers.

Market Segmentation

The France core banking software market share is classified into component and end use.

- The solution segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France core banking software market is segmented by component into solution and service. Among these, the solution segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The solution segment dominates due to banks’ need for modernized core systems, real-time processing, digital banking capabilities, regulatory compliance support, AI-driven analytics, enhanced customer experience, and scalable, efficient software that replaces outdated legacy infrastructure across financial institutions.

- The banks segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France core banking software market is segmented by end use into banks, financial institutions, and others. Among these, the banks segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Driven by increasing digital transformation initiatives, modernization of legacy systems, and the growing demand for efficient, real-time, and customer-centric banking services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France core banking software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Jack Henry & Associates

- Temenos

- Fidelity National Financial

- Unisys

- Fiserv

- Capgemini

- Infosys

- HCL Technologies

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Europe, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France core banking software market based on the following segments:

France Core Banking Software Market, By Component

- Solution

- Service

France Core Banking Software Market, By End Use

- Banks

- Financial Institutions

- Others

FAQ’s

Q: What is the France core banking software market size?

A: France core banking software market size is expected to grow from USD 891.5 Million in 2024 to USD 2228.8 Million by 2035, growing at a CAGR of 8.69% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: The France core banking software market is driven by increasing digitalization and modernization of banking systems to enhance operational efficiency and customer experience.

Q: What factors restrain the France core banking software market?

A: Key restraining factors in the France core banking software market include high implementation and maintenance costs, resistance to change from legacy systems, data security and privacy concerns, complex integration with existing infrastructure, and regulatory compliance challenges across financial institutions.

Q: How is the market segmented by component?

A: The market is segmented into component into solution and service.

Q: Who are the key players in the France core banking software market?

A: Key companies include Jack Henry & Associates, Temenos, Fidelity National Financial, Unisys, Fiserv, Capgemini, Infosys, and HCL Technologies.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Regional |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |