France Craft Beer Market

France Craft Beer Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Ales, Lagers, and Others), By Age Group (21?35 Years Old, 40?54 Years Old, and 55 Years and Above), and France Craft Beer Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

France Craft Beer Market Insights Forecasts to 2035

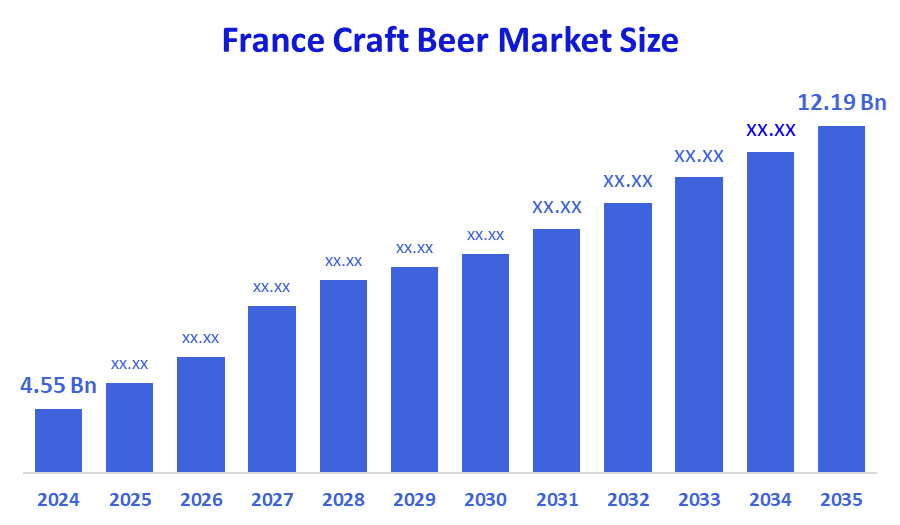

- The France Craft Beer Market Size was estimated at USD 4.55 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.28% from 2025 to 2035

- The France Craft Beer Market Size is Expected to Reach USD 12.19 Billion by 2035

According to a research report published by Spherical Insights & Consulting, the France Craft Beer Market is anticipated to reach USD 12.19 billion by 2035, growing at a CAGR of 9.37% from 2025 to 2035. A key factor driving the market is the growing popularity of craft brewing methods brought on by consumers' growing desire for unusual flavors.

Market Overview

The craft beer industry in France encompasses the production, distribution, and consumption of small-scale, independently brewed beers that focus on artisanal quality, local sourcing, and experimentation. In addition to new product offerings, breweries are utilizing digital channels, apps, virtual tastings, and social media launches to deepen community connections. Partnering with local food artisans, winemakers, and community organizations woven craft beer as part of an extensible experience from menu pairing to festivals. These opportunities show how craft beer is trending in a changing France craft beer landscape, and how breweries are adapting their product development and engagement strategies to reflect 21st consumer behavior. A recent April 2025 report found that 70% of beer brands are now experimenting with digital tastings and virtual tours of the brewery, 54% have launched mobile apps to facilitate consumer engagement, and 45% of drinkers prefer brands that offer a seamless digital experience—indicating the influence digital-first consumers strategies provide form engagement to drive loyalty. As breweries balance imaginative interpretations of brewing with creative digital stories, they are establishing themselves amid France's competitive and dynamic beverage sector while holding local passion and international interest for experiences value.

Report Coverage

This research report categorizes the market for the France craft beer market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France craft beer market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France craft beer market.

Driving Factors

French craft brewers are increasingly looking outside of their borders as they seek to elevate their profile and access new consumers. The growth of exports in 2024 indicates that demand from abroad is increasing, with a limited number of craft beers appearing in specialty bars and retailers in Europe, North America, and Asia. International export helps to not only elevate awareness about the changing landscape of craft beer in France but also to cultivate growth beyond the domestic market. Export-focused brewers use their French brand craftsmanship, natural ingredients, and regional geography, to distinguish their products in the international market. The growing recognition at international beer awards and participation in international craft trade shows has also established credence and notoriety among craft beer producers. These successes have sparked a continued increase in international collaborations and distribution options. The international beer market is developing thus creating interest in French beer, with the "Made in France" being noticed and desired, even in competitive environments.

Restraining Factors

The high production costs of small-scale operations and premium ingredients limit the craft beer market's ability to compete on price with mass-produced beers, among other limiting factors in France. For newcomers, regulatory complexities like stringent labeling and alcohol taxes present additional difficulties. Broader adoption is slowed by consumer loyalty to mainstream beer and wine brands, and distribution is still dispersed with little access to big retail chains.

Market Segmentation

The France craft beer market share is classified into product type and age group.

- The ales segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

France craft beer market is segmented by product type into ales, lagers, and others. Among these, the ales segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to the market's alignment with traditional craft brewing methods, growing consumer preference for artisanal and locally brewed products, and rising consumer demand for strong, hop-forward flavors. Ales provide a wider range of styles, including IPAs, stouts, and pale ales, which appeal to consumers who are more adventurous and value quality.

- The 21–35 years old segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France craft beer market is segmented by age group into 21–35 years old, 40–54 years old, and 55 years and above. Among these, the 21–35 years old segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to has a strong taste for premium, inventive, and artisanal beverages. Through taprooms, festivals, and brewery tours, this group actively seeks out strong flavors like IPAs and fruit-infused ales and participates in experiential consumption. While growing health consciousness fuels demand for alcohol-free craft varieties, their digital fluency improves brand interaction through social media and e-commerce platforms.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within France craft beer market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fermentis by Lesaffre

- Brasserie du Mont Salève

- Brasserie Parisis

- Brasserie de la Senne

- Brasserie La Choulette

- Others

Recent Developments:

- In April 2025, Brasserie de Chambord was opened near the iconic Château de Chambord. Built in late 2024, the sustainable brewery utilized local low-carbon barley and French hops. With a 12,000-hl capacity, it featured a taproom, visitor center, and offered both alcoholic and alcohol-free ranges. It was established through a partnership between Axéréal and the estate

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Craft Beer Market based on the below-mentioned segments:

France Craft Beer Market, By Product Type

- Ales

- Lagers

- Others

France Craft Beer Market, By Age Group

- 21–35 Years Old

- 40–54 Years Old

- 55 Years and Above

FAQ’s

Q: What is the France craft beer market size?

A: France Craft Beer Market is expected to grow from USD 4.55 billion in 2024 to USD 12.19 billion by 2035, growing at a CAGR of 9.37% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Increased consumer preference for artisanal goods, growing distribution networks, creative flavor profiles, demand related to tourism, and encouraging government policies that support regional brewing projects are some of the main factors propelling the craft beer market in France.

Q: What factors restrain the France craft beer market?

A: The French craft beer market is hampered by a number of factors, such as high production costs, a lack of economies of scale, complicated regulations, fierce competition from international brands, and difficulties with marketing, distribution, and consumer education.

Q: Who are the key players in the France craft beer market?

A: Fermentis by Lesaffre, Brasserie du Mont Salève, Brasserie Parisis, Brasserie de la Senne, Brasserie La Choulette, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 177 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |