France Cryptocurrency Market

France Cryptocurrency Market Size, Share, and COVID-19 Impact Analysis, By Type (Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, and Others), By Component (Hardware and Software), and France Cryptocurrency Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Cryptocurrency Market Insights Forecasts to 2035

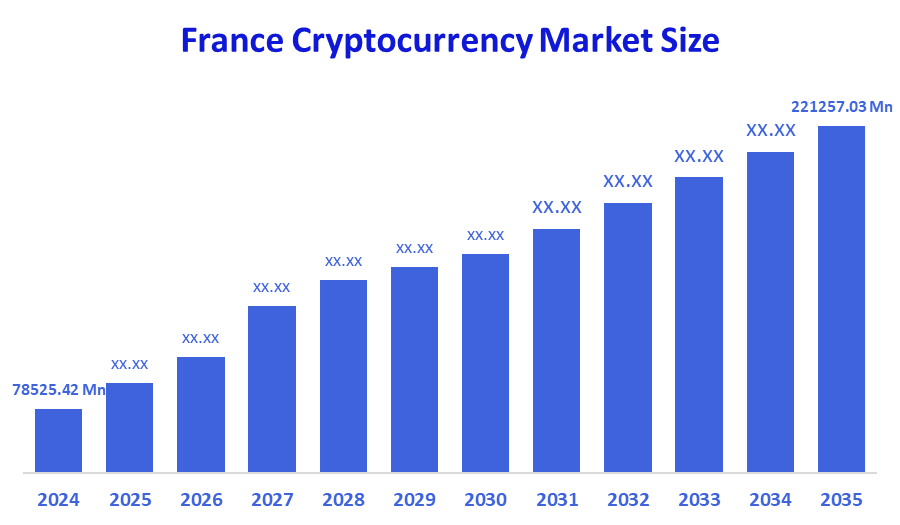

- The France Cryptocurrency Market Size was estimated at USD 78525.42 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.87% from 2025 to 2035

- The France Cryptocurrency Market Size is Expected to Reach USD 221257.03 Million by 2035

According to a research report published by Spherical Insights & Consulting, the France Cryptocurrency Market is anticipated to reach USD 221257.03 million by 2035, growing at a CAGR of 9.87% from 2025 to 2035. Investor demands for safer tools and platforms have sparked advancements in blockchain security and user protection laws.

Market Overview

The cryptocurrency landscape in France refers to the ecosystem of activities surrounding digital assets, including trading, investments, infrastructures, and regulatory solutions, centered around blockchain-based currencies and blockchain-based technology in France's financial and technological ecosystem. This includes institutional and retail participation in the marketplace, the development of decentralized finance innovation, and the integration of crypto solutions in different sectors of the economy, all framed in evolving EU regulations and national fintech initiatives. Additionally, the French cryptocurrency market offers many avenues for investment for those seeking to take advantage of the burgeoning trend. One option is investing in established cryptocurrencies like Bitcoin or Ethereum, which have demonstrated reliability and overall acceptance. Another avenue is investing in blockchain projects or start-ups located in France that are creating new ventures in the cryptocurrency space. And finally: trading altcoins or investing in initial coin offerings (ICOs) of up-and-coming French projects could also carry opportunity. Investors must also conduct solid research, consistent learning of regulations, and evaluation of risk associated with investing in the volatile cryptocurrency markets in France.

Report Coverage

This research report categorizes the market for the France cryptocurrency market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France cryptocurrency market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France cryptocurrency market.

Driving Factors

The French government has put policies in place to draw in blockchain and cryptocurrency businesses, encouraging investment and innovation in the sector. In France, more and more people and companies are using cryptocurrency exchanges and trading platforms. As more consumers and investors incorporate digital assets into their financial operations, the French cryptocurrency market is expected to continue expanding.

Restraining Factors

The absence of clear government guidelines, regulatory uncertainty, and possible tax ramifications for investors are some of the major obstacles facing the French cryptocurrency market. The French cryptocurrency regulatory environment is still developing, which causes uncertainty for investors and companies involved in this market. Furthermore, unclear regulations regarding the tax treatment of cryptocurrencies may cause misunderstandings and discourage prospective market participants.

Market Segmentation

The France cryptocurrency market share is classified into type and component.

- The bitcoin segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France cryptocurrency market is segmented by type into bitcoin, ethereum, bitcoin cash, ripple, litecoin, dashcoin, and others. Among these, the bitcoin segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to growing public awareness of digital currencies, growing institutional adoption, and growing demand for decentralized financial assets. Investor confidence was further increased by the EU's MiCA framework's regulatory clarity, and wider use was encouraged by France's growing fintech sector and the incorporation of bitcoin into payment and savings systems.

- The software segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France cryptocurrency market is segmented by component into hardware and software. Among these, the software segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Driven by the growth of wallet apps, trading platforms, and blockchain-based financial services. Innovation was stimulated by the MiCA framework's clear regulations, and the need for safe, scalable, and intuitive software solutions was increased by growing institutional and retail adoption.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan electrodeposited copper foils market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ledger

- Flowdesk

- Paymium

- Kaiko

- Coinhouse

- Request Finance

- Bitstack

- Others

Recent Developments:

- In July 2025, CoinShares, a prominent European cryptocurrency investment company, had obtained a ‘Markets in Crypto-Assets’ (MiCA) license in France through its subsidiary, CoinShares Asset Management. This regulatory achievement had established the company as the first continental European asset manager to operate under the EU’s new cryptocurrency framework, which had been revealed in June 2025.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Cryptocurrency Market based on the below-mentioned segments:

France Cryptocurrency Market, By Type

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

France Cryptocurrency Market, By Component

- Hardware

- Software

FAQ’s

Q: What is the France cryptocurrency market size?

A: The France Cryptocurrency Market is expected to grow from USD 78525.42 million in 2024 to USD 221257.03 million by 2035, growing at a CAGR of 9.87% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Major contributor to the growth of the cryptocurrency market in France includes Blockchain innovations, institutional adoption, regulatory clarity, increased retail engagement, improved digital infrastructure, ESG-aligned crypto services, and a higher demand for secure decentralized finance services.

Q: What factors restrain the France cryptocurrency market?

A: Restraining factors that impede the wider integration and sustainable growth of the cryptocurrency market in France include regulatory uncertainty, cybersecurity risks, limited institutional adoption, market volatility, public skepticism, fragmented infrastructure, and compliance challenges.

Q: Who are the key players in the France cryptocurrency market?

A: Ledger, Flowdesk, Paymium, Kaiko, Coinhouse, Request Finance, Bitstack, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |