France Diabetes Devices Market

France Diabetes Devices Market Size, Share, and COVID-19 Impact Analysis, By Device Type (Monitoring Devices and Management Devices), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Sales, and Others), By End User (Hospitals & Clinics, Home-Care Settings, Diabetes Specialty Centers, Ambulatory Surgical Centers, Pharmacies & Retail Outlets, and Others), and Diabetes Devices Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Diabetes Devices Market Insights Forecasts to 2035

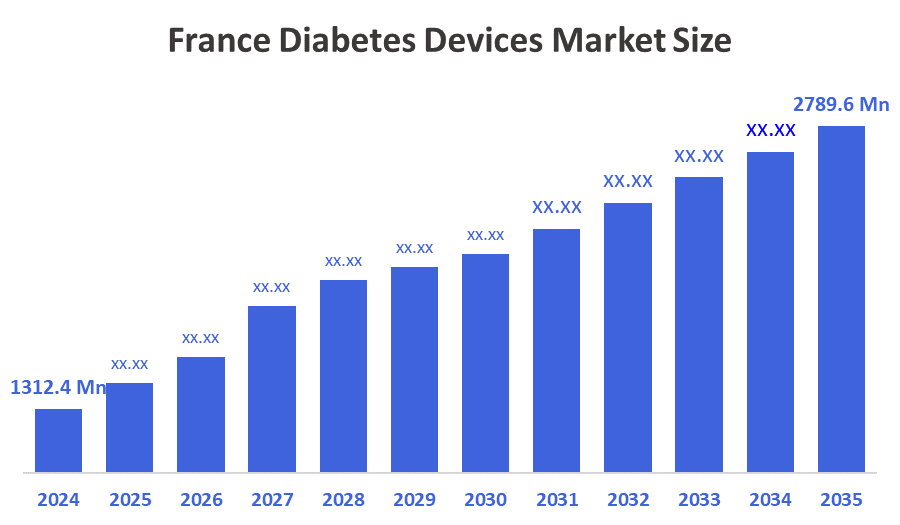

- The France Diabetes Devices Market Size Was Estimated at USD 1312.4 Million in 2024

- The France Diabetes Devices Market Size is Expected to Grow at a CAGR of Around 7.1% from 2024 to 2035

- The France Diabetes Devices Market Size is Expected to Reach USD 2789.6 Million by 2035

According to a research report published by Decision Advisors, the France Diabetes Devices Market size is projected to reach USD 2789.6 million by 2035, growing at a CAGR of 7.1% from 2025 to 2035. The France diabetes devices market is driven by the increasing prevalence of diabetes, technological advancements in connected devices, and an expanding digital health ecosystem that integrates patient data with electronic health records. strong government support through robust reimbursement policies and public health programs, which encourage the adoption of advanced technologies like continuous glucose monitors.

Market Overview

The France diabetes devices market refers to the France healthcare industry that includes all medical devices used for the diagnosis, monitoring, and management of diabetes. This market covers a wide range of products, such as blood glucose meters, continuous glucose monitoring systems, insulin pumps, pen injectors, insulin delivery devices, and related consumables. These devices are used in hospitals, clinics, and home settings to help patients maintain proper blood sugar levels, manage insulin therapy, and prevent diabetes-related complications. The market growth is driven by the rising prevalence of diabetes, increasing awareness of self-monitoring, technological advancements in devices, and government healthcare initiatives.

The France diabetes devices market will be shaped by a growing need for more advanced, connected, and patient-friendly technologies. As diabetes cases continue to rise, there will be increasing demand for continuous glucose monitoring (CGM) systems, smart insulin pens, connected insulin pumps, and digital health platforms that allow remote monitoring and real-time glucose tracking. Trends such as home-based diabetes management, integration of glucose data with electronic health records, AI-supported decision tools, and the expansion of telemedicine will become more common. The France government strongly supports this shift through national reimbursement for CGM devices, funding for digital health and medical technology innovation under programs like France 2030, and the approval of remote-monitoring tools such as Glooko XT for reimbursed telemonitoring. These initiatives, along with universal healthcare and strong chronic-disease policies, encourage wider adoption of advanced diabetes devices and help improve long-term management for patients across the country.

Report Coverage

This research report categorizes the market for the France diabetes devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France diabetes devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France diabetes devices market.

Driving Factors

The France diabetes devices market is driven by the increasing prevalence of diabetes due to factors like a sedentary lifestyle, obesity, and an aging population. Other key drivers include technological advancements in devices like CGMs and insulin pumps, growing awareness of diabetic care, and supportive government policies and universal healthcare, which increase healthcare spending and access to treatment.

Restraining Factors

The main restraining factors for the France diabetes devices market are the high cost of advanced devices and consumables, which creates affordability issues for some patients, and the strict price control regulations that limit premium surcharges for new technologies. Other challenges include reimbursement concerns, the need for skilled healthcare professionals to operate advanced equipment, and the complex registration processes for new products.

Market Segmentation

The France diabetes devices market share is categorized by device type, distribution channel, and end user.

- The monitoring devices segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France diabetes devices market is segmented by device type into monitoring devices and management devices. Among these, the monitoring devices accounted for the largest market share in 2024 and are expected to grow at a significant CAGR during the forecast period. The monitoring devices’ segmental growth is driven by the increasing prevalence of diabetes and the growing adoption of advanced technologies like continuous glucose monitoring (CGM) systems. These devices are crucial for both daily self-monitoring and more sophisticated real-time tracking.

- The retail pharmacies segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The France diabetes devices market is segmented by distribution channel into hospital pharmacies, retail pharmacies, online sales, and others. Among these, the retail pharmacies segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The retail pharmacies’ segmental growth is driven by their wide accessibility to patients, convenience for regular purchases of glucose meters, test strips, insulin pens, and other consumables, and the ability to provide over-the-counter sales and patient counseling. Pharmacies also benefit from strong distribution networks, making them a primary channel for device sales.

- The hospitals & clinics segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France diabetes devices market is segmented by end user into hospitals & clinics, home-care settings, diabetes specialty centers, ambulatory surgical centers, pharmacies & retail outlets, and others. Among these, the hospitals & clinics segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period. These settings handle a high volume of patients, especially those needing continuous monitoring (like CGM) and more complex care. Hospitals and specialized clinics also have the procurement power to invest in advanced diabetes devices and trained staff to operate them. Additionally, favorable reimbursement policies (especially for CGM) encourage clinics and hospitals to prescribe and use these technologies early in the care pathway

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France diabetes devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DexCom Inc

- Abbott

- Roche

- Novo Nordisk

- Medtronic

- Ypsomed Holding AG

- Arkray

- Sanofi SA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, Novo Nordisk announced a major investment of over USD 2.3 billion to expand its production facility in Chartres, France, to meet the soaring demand for its GLP-1 diabetes and weight-loss drugs, such as Ozempic and Wegovy, and related injector pens.

- In January 2025, Glooko, Inc., a global integrated digital health company connecting patients, providers, biopharma, and medical device partners, announced that its Glooko XT solution has been approved for reimbursement by the HAS and the Commission Nationale (CNEDiMTS) in France.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the France diabetes devices market based on the below-mentioned segments:

France Diabetes Devices Market, By Device Type

- Monitoring Devices

- Management Devices

France Diabetes Devices Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Sales

- Others

France Diabetes Devices Market, By End User

- Hospitals & Clinics

- Home-Care Settings

- Diabetes Specialty Centers

- Ambulatory Surgical Centers

- Pharmacies & Retail Outlets

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |