France Diabetes Management Apps Market

France Diabetes Management Apps Market Size, Share, and COVID-19 Impact Analysis, By App Type (Type 1 Diabetes, Type 2 Diabetes, Gestational Diabetes, Pre-diabetes, and Others), By App Functionality (Blood Glucose Monitoring Apps, Insulin Tracking Apps, Diet & Nutrition Planning Apps, Physical Activity Tracking Apps, and Others), By Subscription Model (Freemium, Subscription Based, One Time Purchase, Ad-Supported, Insurance Reimbursement-Based, and Others), By End User (Patients, Healthcare Providers, Payers/Insurance Companies, and Others), and France Diabetes Management Apps Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Diabetes Management Apps Market Insights Forecasts to 2035

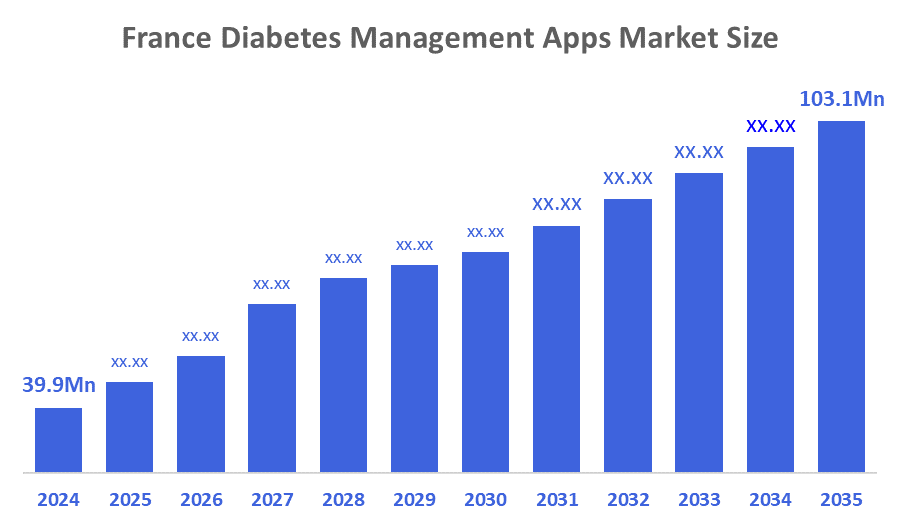

- The France Diabetes Management Apps Market Size Was Estimated at USD 39.9 Million in 2024.

- The France Diabetes Management Apps Market Size is Expected to Grow at a CAGR of Around 9.01% from 2025 to 2035.

- The France Diabetes Management Apps Market Size is Expected to Reach USD 103.1 Million by 2035.

According To a Research Report Published By Decisions Advisors & Consulting, The France Diabetes Management Apps Market Size Is Anticipated To Reach USD 103.1 Million By 2035, Growing At a CAGR Of 9.01% From 2025 to 2035. The France diabetes management apps market is driven by the rising prevalence of diabetes, technological advancements, supportive government policies, growing patient awareness, telehealth adoption, and the integration of apps with healthcare systems.

Market Overview

The?????? France diabetes management apps market refers to the sector of mobile and digital applications specifically designed for individuals with diabetes in France. These apps allow users to keep track of their blood glucose levels, record medication and insulin use, control diet and exercise, and receive reminders or learn from easy-to-use resources. Some of them also offer integration with wearable devices, continuous glucose monitors, and healthcare systems to facilitate remote monitoring, personalized care, and better disease management. The market includes both consumer-oriented apps and clinically integrated solutions that healthcare providers use to improve diabetes care and patient outcomes.

Diabetes is a significant and rapidly growing public health problem in France. The number of diabetics is estimated to be more than 4 million adults. The prevalence has been going up gradually for the last several years and is now nearly 6% of the population. The number of people receiving diabetes treatment has been growing nonstop, and there are now more than 4.3 million people being treated, thus demonstrating the increasing burden of this chronic disease. In addition, the incidence of diabetes among the younger generation is going up as well, as evidenced by the figure of more than 31,000 children and adolescents under 20 with type 1 diabetes in the most recent data, while annual rates have been rising in the last ten ??????years.

These numbers point to a large and increasing population requiring complex daily care out of which some are blood glucose monitoring, medication management, lifestyle adaptations, and prevention of complications. The high and growing prevalence calls for the importance and necessity of digital solutions that can effectively support patients, for example, mobile apps for diabetes management, which enable patients to be continuously self-monitoring, help compliance with the prescribed treatment, make communication with healthcare professionals easier, and therefore contribute to the reduction of the health and economic burden of diabetes in the long term in France.

Report Coverage

This research report categorizes the France diabetes management apps market based on various segments and regions, forecasting revenue growth and analyzing trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France diabetes management apps market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France diabetes management apps market.

Driving Factors

The?????? French market for diabetes management apps is influenced by factors such as the increasing number of diabetes cases, innovations in connected devices and analytics, favorable government policies, patient awareness, the use of telehealth, healthcare system integration, and a population that is comfortable with technology, which are all contributing to the demand for effective digital diabetes care ??????solutions.

Restraining Factors

The?????? France diabetes management apps market experiences limitations due to data privacy and security concerns that may hinder patient and provider adoption. The high prices of the devices and the low digital literacy among certain populations additionally limit the usage of such apps. Challenges in regulations and doubts of doctors about new ideas slow down the work slower in getting new solutions. Besides that, problems of compatibility with healthcare systems lower the efficiency of these apps in ??????general.

Market Segmentation

The France diabetes management apps market share is categorized by app type, app functionality, subscription model, and end user.

- The type 2 diabetes segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France diabetes management apps market is segmented by app type into type 1 diabetes, type 2 diabetes, gestational diabetes, pre-diabetes, and others. Among these, the type 2 diabetes segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The type 2 diabetes segment's growth is due to its high prevalence in France and rising lifestyle-related risk factors such as obesity and sedentary habits. Growing patient awareness of disease management further drives adoption. Advanced app features, including monitoring, personalized care, and telehealth integration, support sustained market growth.

- The blood glucose monitoring apps segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France diabetes management apps market is segmented by app functionality into blood glucose monitoring apps, insulin tracking apps, diet & nutrition planning apps, physical activity tracking apps, and others. Among these, the blood glucose monitoring apps segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The blood glucose monitoring apps’ segmental growth is driven by the essential need for continuous and accurate glucose tracking among diabetes patients in France. Rising patient awareness about managing blood sugar to prevent complications further drives adoption. The increasing use of connected devices and integration with healthcare systems enhances their effectiveness. Additionally, the convenience of real-time monitoring, personalized insights, and automated alerts supports sustained market growth.

- The subscription-based segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France diabetes management apps market is segmented by subscription model into freemium, subscription-based, one-time purchase, ad-supported, insurance reimbursement-based, and others. Among these, the subscription-based segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The subscription-based segment's growth is due to users’ preference for continuous access to advanced features, personalized insights, and integration with devices and healthcare systems. Regular updates, support, and analytics enhance engagement and usability. Its predictable pricing and long-term value encourage sustained adoption for effective diabetes management.

- The patients segment held the largest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France diabetes management apps market is segmented by end user into patients, healthcare providers, payers/insurance companies, and others. Among these, the patients segment held the largest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period. The patients’ segmental growth is due to the direct need for self-management tools among individuals with diabetes in France. Rising awareness of glucose monitoring, diet, and medication adherence drives adoption. Real-time tracking, personalized insights, and device integration empower patients, supporting sustained market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France diabetes management apps market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, subscription-based strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Laboratories

- Medtronic

- Dexcom

- Roche

- Boehringer Ingelheim

- Johnson & Johnson

- Sanofi

- Novo Nordisk

- Ascensia Diabetes Care

- Glooko

- Omada Health

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2024, Medtronic received FDA clearance for its new InPen app, enabling the launch of its Smart MDI system with Simplera CGM, combining a smart insulin pen and disposable continuous glucose monitor for real?time, personalized diabetes management.

- In March 2022, Glooko, a digital diabetes management company, acquired DIABNEXT, a Paris-based diabetes care platform. The addition of DIABNEXT's app expands Glooko's offerings with a unique platform that helps better customize the patient experience and enhance health outcomes for individuals with diabetes.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Diabetes Management Apps Market based on the below-mentioned segments:

France Diabetes Management Apps Market, By App Type

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes

- Pre-diabetes

- Others

France Diabetes Management Apps Market, By App Functionality

- Blood Glucose Monitoring Apps

- Insulin Tracking Apps

- Diet & Nutrition Planning Apps

- Physical Activity Tracking Apps

- Others

France Diabetes Management Apps Market, By Subscription Model

- Freemium

- Subscription Based

- One-Time Purchase

- Ad-Supported

- Insurance Reimbursement-Based

- Others

France Diabetes Management Apps Market, By End User

- Patients

- Healthcare Providers

- Payers/Insurance Companies

- Others

Frequently Asked Questions (FAQ)

- What is the France diabetes management apps market size in 2024?

The France diabetes management apps market size was estimated at USD 39.9 million in 2024.

- What is the projected market size of the France diabetes management apps market by 2035?

The France diabetes management apps market size is expected to reach USD 103.1 million by 2035.

- What is the CAGR of the France diabetes management apps market?

The France diabetes management apps market size is expected to grow at a CAGR of around 9.01% from 2024 to 2035.

- What are the key growth drivers of the France diabetes management apps market?

Rising prevalence of diabetes, technological advancements, supportive government policies, growing patient awareness, telehealth adoption, and the integration of apps with healthcare systems.

- Which app functionality segment dominated the market in 2024?

The blood glucose monitoring apps segment dominated the market in 2024.

- Which app type segment accounted for the largest market share in 2024?

The type 2 diabetes segment accounted for the largest market share in 2024.

- What segments are covered in the France diabetes management apps market report?

The France diabetes management apps market is segmented on the basis of app type, app functionality, subscription model, and end user.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Regional |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |