France Diagnostic Imaging Equipment Market

France Diagnostic Imaging Equipment Market Size, Share, and COVID-19 Impact Analysis, By Modality (MRI, Computed Tomography, Ultrasound, X-Ray, Nuclear Imaging, and Others), By Portability (Fixed Systems and Mobile/Portable Systems), By Application (Cardiology, Oncology, Neurology, Orthopedics, and Others), By End-User (Hospitals and Diagnostic Centers), and France Diagnostic Imaging Equipment Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Diagnostic Imaging Equipment Market Size Insights Forecasts to 2035

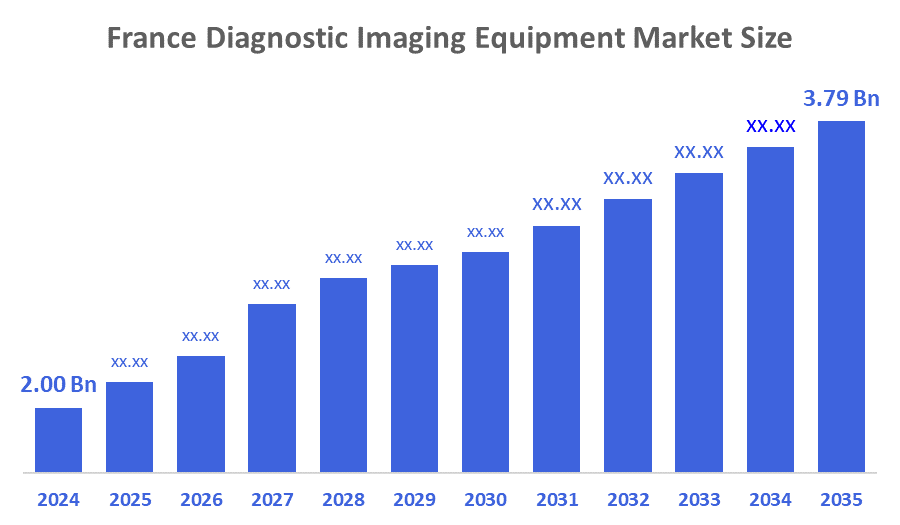

- The France Diagnostic Imaging Equipment Market Size Was Estimated at USD 2.00 Billion in 2024.

- The France Diagnostic Imaging Equipment Market Size is Expected to Grow at a CAGR of Around 6% from 2025 to 2035.

- The France Diagnostic Imaging Equipment Market Size is Expected to Reach USD 3.79 Billion by 2035.

According to a Research Report Published by Decisions Advisors & Consulting, The France Diagnostic Imaging Equipment Market Size is anticipated to Reach USD 3.79 Billion by 2035, Growing at a CAGR of 6% from 2025 to 2035. The France diagnostic imaging equipment market is driven by an ageing population, an increase in chronic diseases, and the rapid pace of technological innovation in the industry. In addition, factors such as the implementation of governmental programs like "Health Innovation 2030", a move towards value-based care, growing investment in healthcare, and the increasing demand for AI-enhanced and digital imaging capabilities.

Market Overview

The France diagnostic imaging equipment market refers to the industry that consists of manufacturing, supplying, and distributing medical equipment (diagnostic imaging devices) used to visualize the internal structures of human beings so that physicians can diagnose patients and plan for treatments. Examples of products in this diagnostic imaging equipment marketplace include X-ray machines, CT scanners, MRI machines, ultrasound instruments, nuclear imaging machines, and mammography machines. Uses for diagnostic imaging devices are seen across several industries (hospitals, diagnostic imaging centers/clinics, and research centers). The growing demand for these diagnostic imaging devices in France is driven by the increasing need for accurate and non-invasive diagnostic imaging products that will not only provide doctors with an accurate diagnosis of a patient, but also help doctors track how well the patient is progressing with their treatment and therefore help the medical community provide advanced medical care.

In France, a high burden of chronic illness and cancer. About 435,000 new cancer patients are diagnosed each year, cancer continues to be one of the leading causes of death, and the need for diagnostic imaging for disease detection, monitoring, and treatment will continue to increase as France's population continues to age, with an increasing percentage of older patients requiring diagnostic imaging for age-related diseases. Approximately 43 percent of consumers living in France receive at least one medical imaging study (e.g., X-ray, CT, MRI, etc.) per year; therefore, there is a significant dependence on various forms of imaging to receive quality healthcare. Additionally, as the population of France continues to grow older, there will be an increase in the number of elderly patients who will require diagnostic imaging for age-related conditions; therefore, there will continue to be increased demand for advanced imaging systems such as CT and MRI technologies. Finally, as imaging technology evolves and preventive care/screening becomes more prevalent, this will provide additional impetus for increased adoption of these technologies and create a solid platform to support the diagnostic imaging equipment sector in France.

Report Coverage

This research report categorizes the market for the France diagnostic imaging equipment market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France diagnostic imaging equipment market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France diagnostic imaging equipment market.

Driving Factors

The primary drivers of the France diagnostic imaging equipment market are the growing incidences of chronic conditions (e.g., cancers, heart/cardio disorders, and neurological diseases) as well as the increasing number of elderly people who require regular imaging as part of monitoring their general health and providing preventative care. Along with these factors are many technological advancements such as Artificial Intelligence (AI) assisted diagnosis, digital imaging, and telemedicine integration, which provide enhanced diagnostic efficiency, increased accuracy, and provide more opportunities for adoption. Furthermore, Federal programs such as France 2030 have provided the necessary support for the financial backing of France's research initiatives, providing both capital and opportunities to advance domestic diagnostic imaging innovation.

Restraining Factors

The France diagnostic imaging equipment market faces several restraining factors. High initial costs of advanced imaging systems, such as MRI and CT scanners, limit adoption, especially among smaller clinics. Strict regulatory requirements for safety, quality, and approvals can delay product launches and increase compliance expenses. Market saturation in urban hospitals creates intense competition among suppliers. Additionally, a shortage of trained radiologists and technical staff can slow equipment utilization and efficiency. Economic pressures and budget constraints in public healthcare settings also restrict investments in new or upgraded imaging technologies.

Market Segmentation

The France diagnostic imaging equipment market share is categorized by modality, portability, application, and end-user.

- The computed tomography segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France diagnostic imaging equipment market is segmented by modality into MRI, computed tomography, ultrasound, x-ray, nuclear imaging, and others. Among these, the computed tomography segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The computed tomography segmental growth is due to its wide clinical applications in detecting and monitoring cancer, cardiovascular diseases, and traumatic injuries, combined with its ability to provide fast, high-resolution, and accurate imaging. Increasing demand for advanced diagnostics in hospitals, emergency care, and outpatient centers, along with technological advancements such as low-dose CT and AI-assisted imaging, further drives adoption.

- The fixed systems segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France diagnostic imaging equipment market is segmented by portability into fixed systems and mobile/portable systems. Among these, the fixed systems segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period. The fixed systems segmental growth is due to their higher imaging precision, advanced capabilities, and suitability for hospitals and large diagnostic centers that require continuous, high-volume usage. These systems, including MRI, CT, and X-ray units, offer superior image quality and integration with hospital information systems, making them essential for comprehensive diagnostics. The growing number of hospital infrastructure developments, replacement of outdated equipment, and demand for reliable, high-performance imaging solutions further drive the adoption and sustained growth of fixed diagnostic imaging systems in France.

- The oncology segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France diagnostic imaging equipment market is segmented by application into cardiology, oncology, neurology, orthopedics, and others. Among these, the oncology segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The oncology segmental growth is due to the increasing prevalence of cancer in France, with approximately 435,000 new cases annually, driving demand for early detection, diagnosis, and treatment monitoring. Advanced imaging modalities such as CT, MRI, PET, and nuclear imaging are critical for accurate tumor identification, staging, and therapy evaluation. Growing awareness of cancer screening programs and rising healthcare expenditure further boost the adoption of diagnostic imaging in oncology.

- The hospitals segment held the largest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France diagnostic imaging equipment market is segmented by end user into hospitals and diagnostic centers. Among these, the hospitals segment held the largest market share in 2024 and is projected to grow at a significant CAGR during the forecast period. The hospital's segmental growth is due to the high patient inflow, availability of advanced infrastructure, and the need for comprehensive diagnostic services in a single location. Hospitals require a wide range of imaging modalities, including MRI, CT, X-ray, ultrasound, and nuclear imaging, to support inpatient care, emergency services, and specialized departments such as oncology and cardiology.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France diagnostic imaging equipment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- GE HealthCare

- FUJIFILM Holdings Corporation

- Canon Medical Systems Corporation

- Hologic Inc.

- Shimadzu Corp.

- Carestream Health Inc.

- Samsung Healthcare (SAMSUNG)

- Agfa-Gevaert NV

- Ziehm Imaging GmbH

- United Imaging Healthcare Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, Sonio Detect received [AS1] CE marking, allowing nationwide release of its AI ultrasound-image-quality software, now backed by Samsung’s acquisition.

- In November 2024, Paris [AS2] Brain Institute inaugurated a 7?Tesla MRI scanner (MAGNETOM Terra.X 7T MRI from Siemens Healthineers), marking a major upgrade to ultra?high?field neuroimaging in France.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Diagnostic Imaging Equipment Market based on the below-mentioned segments:

France Diagnostic Imaging Equipment Market, By Modality

- MRI

- Computed Tomography

- Ultrasound

- X-Ray

- Nuclear Imaging

- Others

France Diagnostic Imaging Equipment Market, By Portability

- Fixed Systems

- Mobile/Portable Systems

France Diagnostic Imaging Equipment Market, By Application

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Others

France Diagnostic Imaging Equipment Market, By End User

- Hospitals

- Diagnostic Centers

Frequently Asked Questions (FAQ)

- What is the CAGR of the France diagnostic imaging equipment market?

The France diagnostic imaging equipment market size is expected to grow at a CAGR of around 6% from 2024 to 2035.

- What is the France diagnostic imaging equipment market size in 2024?

The France diagnostic imaging equipment market size was estimated at USD 2.00 billion in 2024.

- What is the projected market size of the France diagnostic imaging equipment market by 2035?

The France diagnostic imaging equipment market size is expected to reach USD 3.79 billion by 2035.

- What are the key growth drivers of the France diagnostic imaging equipment market?

An aging population, the increasing prevalence of chronic diseases, and rapid technological advancements. Increasing healthcare expenditures and a growing demand for digital and AI-enabled imaging solutions.

- Which end-user segment held the largest market share in 2024?

The hospitals segment held the largest market share in 2024.

- Which modality segment accounted for the largest market share in 2024?

The computed tomography segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 184 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |