France Diet & Nutrition Apps Market

France Diet & Nutrition Apps Market Size, Share, and COVID-19 Impact Analysis, By Platform (Android and iOS), By Service (Paid and Free), By Device (Smartphones and Tablets), and France Diet & Nutrition Apps Market Size Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Diet & Nutrition Apps Market Size Insights Forecasts to 2035

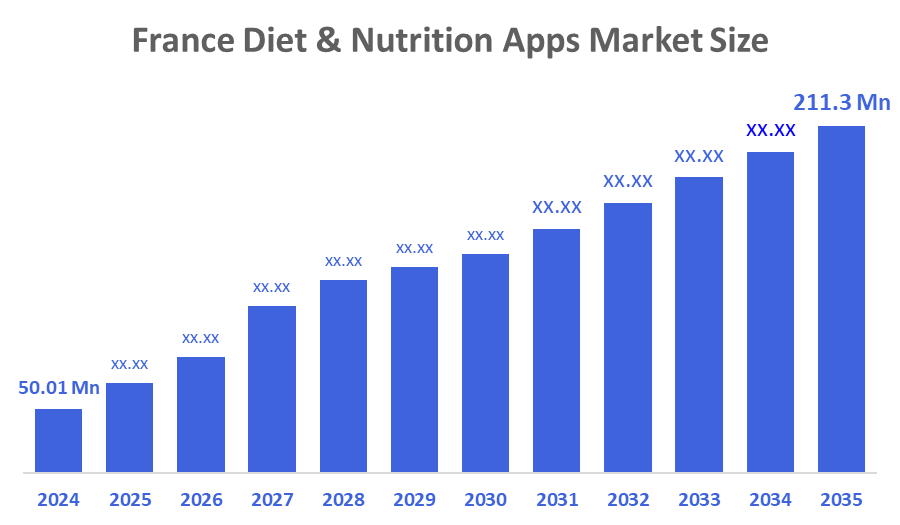

- The France Diet & Nutrition Apps Market Size Was Estimated at USD 50.01 Million in 2024.

- The France Diet & Nutrition Apps Market Size is Expected to Grow at a CAGR of Around 14% from 2025 to 2035.

- The France Diet & Nutrition Apps Market Size is Expected to Reach USD 211.3 Million by 2035.

According to a Research Report Published by Decisions Advisors & Consulting, The France Diet & Nutrition Apps Market Size is Anticipated to Reach USD 211.3 Million by 2035, Growing at a CAGR of 14% from 2025 to 2035. The France diet & nutrition apps market is driven by increasing health awareness, rising smartphone adoption, growing interest in personalized nutrition, demand for weight management solutions, integration of AI and wearable technologies, and government initiatives promoting healthy lifestyles.

Market Overview

The?????? France diet & nutrition apps market is the segment of the digital health industry in France that is specifically focused on mobile and web-based applications that are created in order to assist users in managing their diet, recording their nutrition intake, monitoring their calories, supporting their weight management, and promoting their overall health and wellness. Also, these apps typically include the features of tailored meal planning, nutritional advice, exercise tracking, and, in some cases, AI-powered suggestions for healthy lifestyle encouragement among France ??????consumers.

France?????? struggles with diet-related health problems on a large scale, which has led to a rise in demand for diet and nutrition apps. Almost half of the adults are overweight or obese. Obesity is the cause of about 18% of the adult population, which increases the risk of cardiovascular diseases, diabetes, and other chronic illnesses. Unhealthy dietary habits make the situation worse, as only 24% of women and 18% of men adults consume fruits and vegetables in accordance with the recommendations. Moreover, 8% of French adults (approximately 4 million people) are living with diabetes, a condition that is mostly related to overweight and lifestyle factors. These numbers emphasize the necessity of the urgent provision of easily accessible means that offer personalized diet guidance, nutrition monitoring, and lifestyle promotion. The statement is in line with the growing significance of diet and nutrition apps in ??????France.

Report Coverage

This research report categorizes the market for the France diet & nutrition apps market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France diet & nutrition apps market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France diet & nutrition apps market.

Driving Factors

The?????? France diet & nutrition apps market is driven by factors such as the growing rate of obesity and diabetes, the increasing health consciousness of people, the widespread use of smartphones and the internet, the demand for personalized nutrition and weight management solutions, the incorporation of AI and wearable technologies, and government initiatives encouraging preventive healthcare and healthy ??????lifestyles.

Restraining Factors

The?????? main factors that limit the growth of the France diet & nutrition apps market are concerns about data privacy and security, low user engagement over time, limited digital literacy of the elderly, users' skepticism about the app accuracy, high competition among apps, costs of subscriptions, and difficulties in integrating apps with the clinical healthcare ??????systems.

Market Segmentation

The France diet & nutrition apps market share is categorized by platform, service, and device.

- The IOS segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France diet & nutrition apps market is segmented by platform into Android and IOS. Among these, the IOS segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The IOS segment's growth is due to the high adoption of Apple devices in France, a strong base of premium and health-conscious users, greater willingness to pay for subscription-based apps, superior app performance and security, seamless integration with Apple Health and wearables, and frequent updates supporting personalized nutrition features.

- The paid segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France diet & nutrition apps market is segmented by service into paid and free. Among these, the paid segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The paid segmental growth is driven by increasing demand for premium features such as personalized meal plans, advanced nutrition analytics, ad-free experiences, AI-driven recommendations, expert consultations, and seamless integration with wearable devices, along with higher consumer willingness to pay for effective, results-oriented health and nutrition solutions.

- The smartphones segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France diet & nutrition apps market is segmented by device into smartphones and tablets. Among these, the smartphones segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The smartphones segment's growth is due to high smartphone penetration across France, ease of app installation and daily use, continuous internet connectivity, widespread use of mobile health platforms, real-time tracking of diet and activity, integration with wearables, and increasing consumer preference for convenient, on-the-go nutrition management solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France diet & nutrition apps market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- MyFitnessPal

- Lifesum

- MyNetDiary

- Yummly

- MyNetDiary

- Lifesum

- MyFitnessPal

- Fooducate

- Carb Manager

- MyMacros+

- PlateJoy

- Weight Watchers

- Lose It

- FatSecret

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, MyFitnessPal unveiled its Summer 2024 release, introducing enhanced nutrition tracking and personalization features, strengthening its global offering and supporting rising adoption across the France diet and nutrition apps market amid growing digital health awareness .

- In February 2025, Lifesum launched an AI-powered multimodal meal tracker, enhancing personalized nutrition through image, voice, and text inputs, supporting innovation and user engagement in the France diet and nutrition apps market as demand for smart health solutions rises.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Diet & Nutrition Apps Market based on the below-mentioned segments:

France Diet & Nutrition Apps Market, By Platform

- Android

- iOS

France Diet & Nutrition Apps Market, By Service

- Paid

- Free

France Diet & Nutrition Apps Market, By Device

- Smartphones

- Tablets

Frequently Asked Questions (FAQ)

- What is the France diet & nutrition apps market size in 2024?

The France diet & nutrition apps market size was estimated at USD 50.01 million in 2024.

- What is the projected market size of the France diet & nutrition apps market by 2035?

The France diet & nutrition apps market size is expected to reach USD 211.3 million by 2035.

- What is the CAGR of the France diet & nutrition apps market?

The France diet & nutrition apps market size is expected to grow at a CAGR of around 14% from 2024 to 2035.

- What are the key growth drivers of the France diet & nutrition apps market?

Increasing health awareness, rising smartphone adoption, growing interest in personalized nutrition, demand for weight management solutions, and integration of AI and wearable technologies.

- Which service segment dominated the market in 2024?

The paid segment dominated the market in 2024.

- Which platform segment accounted for the largest market share in 2024?

The IOS segment accounted for the largest market share in 2024.

- What segments are covered in the France diet & nutrition apps market report?

The France diet & nutrition apps market is segmented on the basis of platform, service, and device.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 235 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |