France Digital Remittance Market

France Digital Remittance Market Size, Share, and COVID-19 Impact Analysis, By Type (Inward Digital Remittance and Outward Digital Remittance), By Channel (Banks, Money Transfer Operators, Online Platforms, and Others), and France Digital Remittance Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Digital Remittance Market Insights Forecasts to 2035

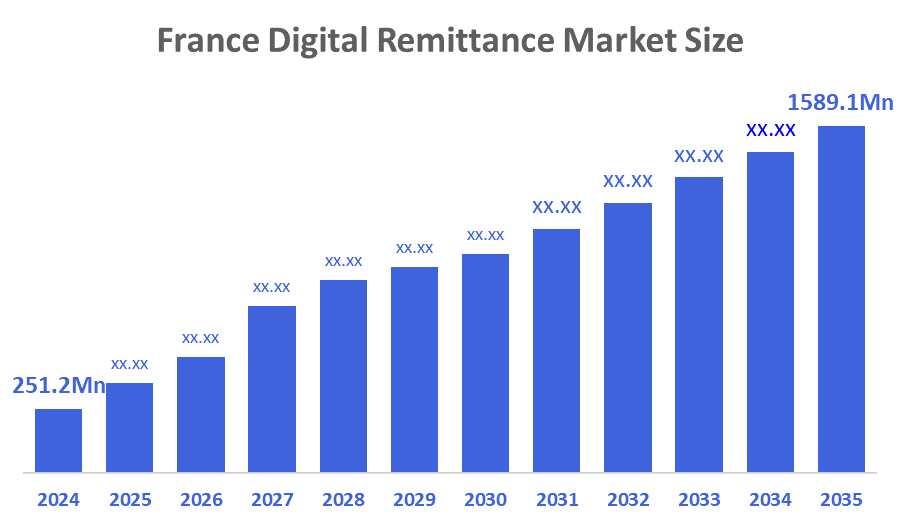

- The France Digital Remittance Market Was Estimated at USD 251.2 Million in 2024.

- The Market Size is Growing at a CAGR of 18.26% between 2025 and 2035.

- The France Digital Remittance market is Anticipated to Reach USD 1589.1 Million by 2035.

According To a Research Report Published By Decisions Advisors & Consulting, The France Digital Remittance Market Size Is Anticipated To hold USD 1589.1 Million By 2035, Growing At a CAGR Of 18.26% From 2025 to 2035. Future opportunities in the France digital remittance market include growing migrant population, rising cross-border e-commerce, mobile-based remittance adoption, fintech innovations, real-time transfers, lower transaction costs, and expanding partnerships between banks and digital payment platforms.

Market Overview

The France digital remittance market is expanding steadily, driven by increasing international migration, globalization of trade, and rising demand for fast, low-cost cross-border money transfers. Digital remittance platforms offer greater convenience, transparency, and reduced transaction fees compared to traditional channels, encouraging wider adoption among individuals and small businesses. High smartphone penetration, strong internet infrastructure, and growing preference for mobile and app-based financial services further support market growth. Fintech companies are introducing innovative features such as real-time transfers, multi-currency wallets, and enhanced security measures. Additionally, supportive regulatory frameworks, increasing financial inclusion, and growing awareness of digital payment solutions are strengthening market penetration, positioning France as a key hub for digital remittance services in Europe.

Report Coverage

This research report categorizes the market for the France digital remittance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France digital remittance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France digital remittance market.

Driving Factors

Migration growth, low-cost transfers, fintech innovation, mobile adoption, real-time payments.

The France digital remittance market is driven by a growing migrant population and increasing cross-border transactions. Rising demand for faster, low-cost, and transparent money transfers encourages digital channel adoption. High smartphone and internet penetration support mobile remittance usage. Fintech innovation, real-time payment technologies, enhanced security features, and competitive pricing models further boost adoption. Additionally, supportive regulatory frameworks and increasing consumer trust in digital financial services are accelerating market growth across personal and business segments.

Restraining Factors

Regulatory complexity, security concerns, pricing pressure, limited digital literacy, infrastructure dependence.

Key restraining factors in the France digital remittance market include strict regulatory and compliance requirements, data security and privacy concerns, intense competition causing pricing pressure, limited digital literacy among some users, and dependence on robust cross-border banking infrastructure.

Opportunities

Mobile remittances, fintech partnerships, real-time transfers, blockchain adoption, migrant growth.

The France digital remittance market presents strong opportunities through increasing adoption of mobile-first payment solutions and real-time cross-border transfers. Expansion of migrant and expatriate populations is boosting remittance volumes. Fintech innovations such as AI-based fraud detection, blockchain-enabled transfers, and multi-currency digital wallets can enhance efficiency and trust. Partnerships between banks, fintech firms, and telecom operators offer scope for wider reach. Additionally, rising demand for low-cost, transparent, and faster remittance services supports long-term market growth.

Market Segmentation

The France digital remittance market share is classified into type and channel.

- The outward digital remittance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France digital remittance market is segmented by type into inward digital remittance and outward digital remittance. Among these, the outward digital remittance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The outward digital remittance segment dominates due to France’s large migrant and expatriate population sending money abroad, rising cross-border employment, increasing overseas education expenses, competitive digital platforms, and growing preference for fast, low-cost, and transparent international transfer services.

- The online platforms segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France digital remittance market is segmented by channel into banks, money transfer operators, online platforms, and others. Among these, the online platforms segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The online platforms segment leads due to ease of use, faster transaction processing, lower transfer costs, wide mobile app adoption, transparent pricing, multi-currency support, and growing consumer trust in fintech-driven digital remittance solutions across France.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France digital remittance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TransferGo

- InstaReM

- Digital Wallet Corporation

- Azimo

- MoneyGram International

- WorldRemit

- Western Union

- Wise

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Europe, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France digital remittance market based on the following segments:

France Digital Remittance Market, By Type

- Inward Digital Remittance

- Outward Digital Remittance

France Digital Remittance Market, By Channel

- Banks

- Money Transfer Operators

- Online Platforms

- Others

FAQ’s

Q: What is the France digital remittance market size?

A: France digital remittance market size is expected to grow from USD 251.2 Million in 2024 to USD 1589.1 Million by 2035, growing at a CAGR of 18.26% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: The France digital remittance market is driven by a growing migrant population and increasing cross-border transactions.

Q: What factors restrain the France digital remittance market?

A: Key restraining factors in the France digital remittance market include strict regulatory and compliance requirements, data security and privacy concerns, intense competition causing pricing pressure, limited digital literacy among some users, and dependence on robust cross-border banking infrastructure.

Q: How is the market segmented by type?

A: The market is segmented into type into inward digital remittance and outward digital remittance.

Q: Who are the key players in the France digital remittance market?

A: Key companies include TransferGo, InstaReM, Digital Wallet Corporation, Azimo, MoneyGram International, WorldRemit, Western Union, and Wise.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Regional |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |