France Digital X-Ray Devices Market

France Digital X-Ray Devices Market Size, Share, and COVID-19 Impact Analysis, By Technology (Computed Radiography and Direct Radiography), By Portability (Fixed Systems and Portable Systems), By Application (Orthopedic, Cancer, Dental, Cardiovascular, and Others), By End User (Hospitals and Diagnostic Centers), and France Digital X-Ray Devices Market Insights, Industry Trends, Forecasts to 2035

Report Overview

Table of Contents

France Digital X-Ray Devices Market Size Insights Forecasts to 2035

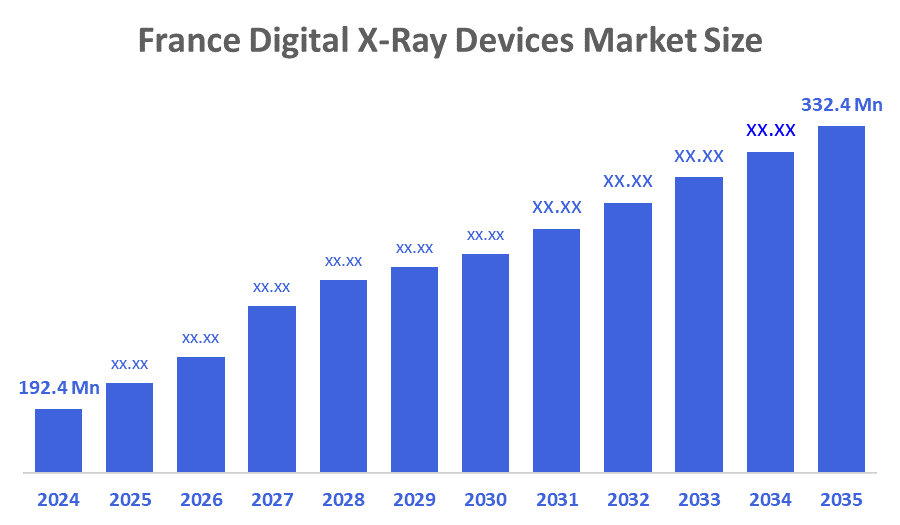

- The France Digital X-Ray Devices Market Size Was Estimated at USD 192.4 Million in 2024

- The France Digital X-Ray Devices Market Size is Expected to Grow at a CAGR of Around 5.1% from 2025 to 2035

- The France Digital X-Ray Devices Market Size is Expected to Reach USD 332.4 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The France Digital X-Ray Devices Market Size is projected to Reach USD 332.4 Million by 2035, Growing at a CAGR of 5.1% from 2025 to 2035. The France digital X-ray devices market is driven by an aging population, government initiatives for digital health, and increased demand for diagnostic imaging for various diseases like cancer and orthopedic conditions. Technological advancements, including AI integration, are also fueling growth by improving diagnostic accuracy and efficiency.

Market Overview

The France digital X-ray devices market is the market for digital radiography equipment in France. Digital radiography systems are in high demand for capturing diagnostic X-ray images and analyzing these images with a computer. This market consists of the sales of fixed and mobile systems for many different purposes, such as orthopedics, dentistry, and general diagnostics, to end-users, including hospitals and diagnostic centers. The increasing number of older adults living in France is leading to more age-related conditions (arthritis, osteoporosis, etc.) that will require continual diagnostic imaging. Additionally, the increasing incidence of chronic diseases (cancer and cardiovascular) will provide impetus for growth within this market. Many more cases of cancer have occurred recently in France and therefore require accurate and timely diagnosis. Many advances have occurred in the area of technology for digital X-ray systems that have improved the quality of the images captured, while also designing systems that will result in the completion of images in a more efficient manner.

In France, the rapid growth of chronic diseases like cancer, heart disease, etc., along with an aging population (about 25% of people over 60), has resulted in dramatic increases in demand for diagnostic imaging services. Today, there are millions of imaging services performed annually, including 15.2 million CT scans (2022), and about 44% of the population gets at least 1 imaging test during their life. With an increase in the utilitarian aspect of preventative care and public health emphasis on early detection, there is a growing need for affordable, accurate, and available imaging solutions throughout France. Digital X-ray units are among the digital imaging solutions available for the France medical system.

The market for digital X-ray equipment within France may be aided through the actions and initiatives of the government. For instance, in November 2021, the Health Minister in France announced an investment plan of 650 million euros to assist with the acceleration of the digital health strategy in France. Part of this funding will also be spent on digital training of health care providers, scientific innovation, and the large-scale deployment of digital health solutions in France and abroad.

Report Coverage

This research report categorizes the market for the France digital X-ray devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France digital X-ray devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France digital X-ray devices market.

Driving Factors

The digital X-ray devices market in France is experiencing growth due to the increasing prevalence of chronic diseases, as well as an aging population, which results in a higher prevalence of age-related diseases, like osteoporosis and arthritis, all of which require regular diagnostic imaging. Additionally, there are multiple factors that are driving the digital X-ray devices market in France, including more available advanced diagnostic tools, continued technology innovation, such as AI integration and the adoption of portable systems; a growing demand for fast diagnostics due to COVID-19; and government and private investment into healthcare infrastructure.

Restraining Factors

The main restraining factors for the France digital x-ray device market are the high initial and ongoing costs, which limit adoption by smaller hospitals and clinics. Other factors include the need for periodic maintenance and upgrades, potential cybersecurity concerns, and the risk of improper image manipulation affecting diagnosis.

Market Segmentation:

The France digital X-ray devices market share is classified into technology, portability, application, and end user.

- The direct radiography segment accounted for the largest market share in 2024 and is predicted to grow at a significant CAGR during the forecast period.

The France digital X-ray devices market is segmented by technology into computed radiography and direct radiography. Among these, the direct radiography segment accounted for the largest market share in 2024 and is predicted to grow at a significant CAGR during the forecast period. The direct radiography segmental growth is driven by its faster image acquisition, superior image quality, and reduced patient radiation dose. The advantages of direct radiography include immediate image viewing and analysis, which enhance diagnostic efficiency, particularly in emergency and high-throughput environments.

- The fixed systems held the largest market share in 2024 and are anticipated to grow at a significant CAGR during the forecast period.

The France digital X-ray devices market is segmented by portability into fixed systems and portable systems. Among these, the fixed systems held the largest market share in 2024 and are anticipated to grow at a significant CAGR during the forecast period. The fixed system segmental growth is due to their suitability for high-throughput environments, advanced features, long-term cost-effectiveness, and integration capabilities with existing hospital infrastructure. Fixed systems are essential for consistent, high-volume imaging in facilities, particularly in specialty areas like orthopedics and oncology, where precise and frequent scans are required, which is a major factor for large hospitals and established healthcare systems.

- The orthopedic segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France digital X-ray devices market is segmented by application into orthopedic, cancer, dental, cardiovascular, and others. Among these, the orthopedic segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period. The orthopedic segmental growth is due to the high prevalence of orthopedic injuries and chronic diseases, the aging population, and the demand for advanced imaging for fracture diagnosis, joint evaluation, and post-surgical assessments. The ongoing need for accurate, clear, and fast imaging to diagnose and manage musculoskeletal conditions is a primary driver for the segment's strong performance.

- The hospitals segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The France digital X-ray devices market is segmented by end user into hospitals and diagnostic centers. Among these, the hospitals segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The hospital's segmental growth is due to their extensive need for high-resolution diagnostic tools to support a wide range of medical services. Hospitals provide comprehensive care, requiring a diverse array of imaging modalities for patient diagnosis and treatment. The increasing demand for early disease detection and the ability to make larger investments in advanced imaging technology, compared to smaller facilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France digital X-ray devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GE Healthcare

- Fujifilm Holdings Corporation

- Canon Medical Systems

- Thales Group

- DMS Imaging

- EOS Imaging

- Stephanos Radiology

- Sedecal France

- Villa Sistemi Medicali France

- Control-X Medical France

- IMIX France

- Protec France

- Inovel Systems

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2025, Nano-X Imaging (NNOX[AS1] ) partnered with Althea France to distribute its CE-marked digital tomosynthesis system, Nanox.ARC, across France hospitals and clinics. Althea France will manage sales, service, and market introduction, leveraging its nationwide network, marking Nano-X’s fourth European distribution deal.

Market Segment

This study forecasts revenue at the Canada, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Digital X-Ray Devices Market based on the below-mentioned segments:

France Digital X-Ray Devices Market, By Technology

- Computed Radiography

- Direct Radiography

France Digital X-Ray Devices Market, By Portability

- Fixed Systems

- Portable Systems

France Digital X-Ray Devices Market, By Application

- Orthopedic

- Cancer

- Dental

- Cardiovascular

- Others

France Digital X-Ray Devices Market, By End User

- Hospitals

- Diagnostic Centers

Frequently Asked Questions (FAQ)

- What is the CAGR of the France digital X-ray devices market?

The France digital X-ray devices market size is expected to grow at a CAGR of around 5.1% from 2024 to 2035

- What is the France digital X-ray devices market size in 2024?

The France digital X-ray devices market size was estimated at USD 192.4 million in 2024.

- What is the projected market size of the France digital X-ray devices market by 2035?

The France digital X-ray devices market size is expected to reach USD 332.4 million by 2035

- What are the main segments of the France digital X-ray devices market?

The France digital X-ray devices market share is segmented based on technology, portability, application, and end user.

- What are some drivers contributing to market growth?

The France digital X-ray devices market is driven by the high prevalence of chronic diseases, an aging population, which leads to a higher prevalence of age-related diseases like arthritis and osteoporosis, increasing demand for advanced diagnostic tools, and technological advancements like the integration of AI.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 255 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |