France e-KYC Market

France e-KYC Market Size, Share, and COVID-19 Impact Analysis, By Product (Identity Authentication and Matching, Video Verification, Digital ID Schemes, and Enhanced vs Simplified Due Diligence), By Deployment Mode (cloud-based and on-premises), and France e-KYC Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France e-KYC Market Size Insights Forecasts to 2035

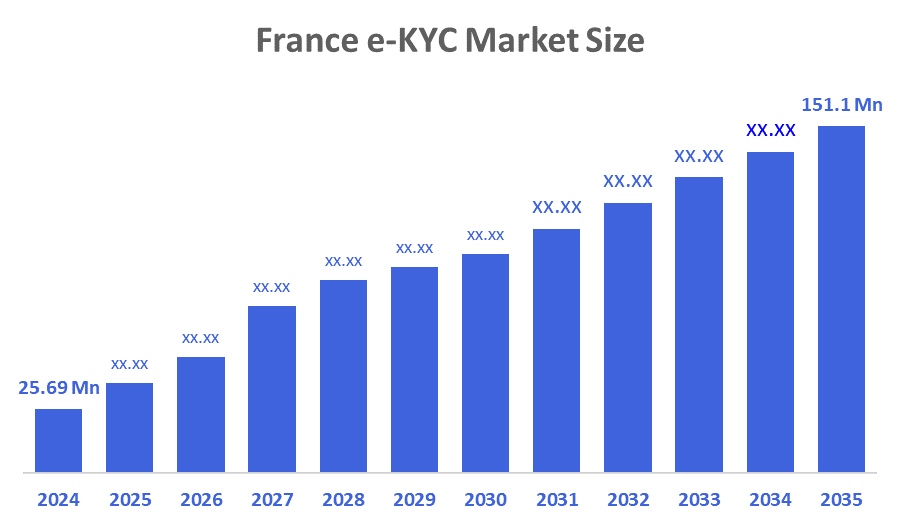

- The France e-KYC Market Size was estimated at USD 25.69 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 17.47% from 2025 to 2035

- The France e-KYC Market Size is Expected to Reach USD 151.01 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The France e-KYC Market Size is anticipated to Reach USD 151.01 Million by 2035, Growing at a CAGR of 17.47% from 2025 to 2035. The market is expanding as a result of the rise in digital banking and online financial services in France.

Market Overview

E-KYC in France includes technology and services used to complete customer verification with electronic means. Using some combination of biometric ID verification, artificial intelligence, and secure online platforms, businesses can establish customer identities electronically and prevent fraud, while still adhering to AML and CTF laws and regulations. Additionally, growth opportunities abound in the e-KYC market, especially as technological developments continue to change the scene. As machine learning and artificial intelligence (AI) grow in popularity, businesses can use these technologies to improve the accuracy and efficiency of their e-KYC procedures. At a CAGR of 40%, the banking industry's use of AI is projected to increase from $3.2 billion in 2020 to $64 billion by 2026. This expansion offers substantial chances to incorporate AI-powered e-KYC solutions to expedite risk assessment and customer onboarding.

Report Coverage

This research report categorizes the market for the France e-KYC market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France e-KYC market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France e-KYC market.

Driving Factors

A positive market outlook is provided by the French regulatory framework. France follows the European Union's anti-money laundering (AML) directives and the General Data Protection Regulation (GDPR), both of which require stringent identity verification processes. Because sophisticated e-KYC solutions offer safe, compliant, and efficient ways to authenticate customers' identities in real-time, banks are under increasing pressure to implement them in order to ensure compliance with these regulations. The French regulatory authorities are adamant about the necessity of good customer due diligence (CDD) practices, and they encourage businesses to invest in digital solutions that enable effective compliance.

Restraining Factors

Teaching clients about the advantages and security of e-KYC procedures is difficult. Many people are still ignorant of the procedures in place to protect their data and how e-KYC operates. Therefore, in order to promote acceptance of these digital verification processes, organizations must invest in consumer education and trust-building initiatives. Overcoming these obstacles will require putting strong security measures in place and guaranteeing transparency in data handling procedures.

Market Segmentation

The France e-KYC market share is classified into product and deployment mode.

- The identity authentication and matching segment dominated the market in 2024, approximately 95% and is projected to grow at a substantial CAGR during the forecast period.

The France e-KYC market is segmented by product into identity authentication and matching, video verification, digital id schemes, and enhanced vs simplified due diligence. Among these, the identity authentication and matching segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to the growing need for safe digital onboarding in the telecom, fintech, and banking industries. Adoption of AI-powered document-matching, biometric verification, and facial recognition technologies improves efficiency and accuracy while lowering fraud risks and satisfying strict regulatory compliance requirements.

- The cloud-based segment dominated the market in 2024, approximately 92% and is projected to grow at a substantial CAGR during the forecast period.

The France e-KYC market is segmented by deployment mode into cloud-based and on-premises. Among these, the cloud-based segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by its capacity to facilitate quick digital transformation in the banking, fintech, and telecom industries as well as its scalability and cost effectiveness. Faster onboarding, regulatory compliance, and fraud prevention are made possible by an increasing reliance on SaaS-based e-KYC platforms; accuracy and data security are improved by developments in AI, biometrics, and secure cloud infrastructure.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France e-KYC market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Vneuron Risk & Compliance

- Kernel Analytics

- IDnow

- Onfido

- Ubble

- ARIADNEXT

- Trustpair

- Synaps

- others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France e-KYC Market based on the below-mentioned segments:

France e-KYC Market, By Product

- Identity Authentication and Matching

- Video Verification

- Digital ID Schemes

- Enhanced vs Simplified Due Diligence

France e-KYC Market, By Deployment Mode

- Cloud-based

- On-premises

FAQ’s

Q: What is the France e-KYC market size?

A: France e-KYC Market is expected to grow from USD 25.69 million in 2024 to USD 151.01 million by 2035, growing at a CAGR of 17.47% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Growing adoption of digital banking, strict regulatory compliance, developments in AI and biometrics, and the growing need for safe, effective identity verification across financial services are the factors driving the French e-KYC market.

Q: What factors restrain the France e-KYC market?

A: The widespread embrace and scalability of the French e-KYC market are hampered by high implementation costs, data privacy concerns, regulatory complexity, low awareness among smaller institutions, and integration issues with legacy systems.

Q: Who are the key players in the France e-KYC market?

A: Vneuron Risk & Compliance, Kernel Analytics, IDnow, Onfido, Ubble, ARIADNEXT, Trustpair, Synaps, others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 155 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |