France Endoscopy Devices Market

France Endoscopy Devices Market Size, Share, and COVID-19 Impact Analysis, By Device Type (Endoscopes, Visualization Equipment, Operative Devices, Accessories & Consumables, and Others), By Application (Gastroenterology, Pulmonology, Cardiology, ENT Surgery, Gynecology, Neurology, and Others), By End User (Hospitals, Ambulatory Surgery Centers, Outpatient Diagnostic Facilities, and Others), By Usage (Reusable Endoscopes, Single-Use/Disposable Endoscopes, Reprocessing Equipment & Consumables, and Others), and France Endoscopy Devices Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Endoscopy Devices Market Insights Forecasts to 2035

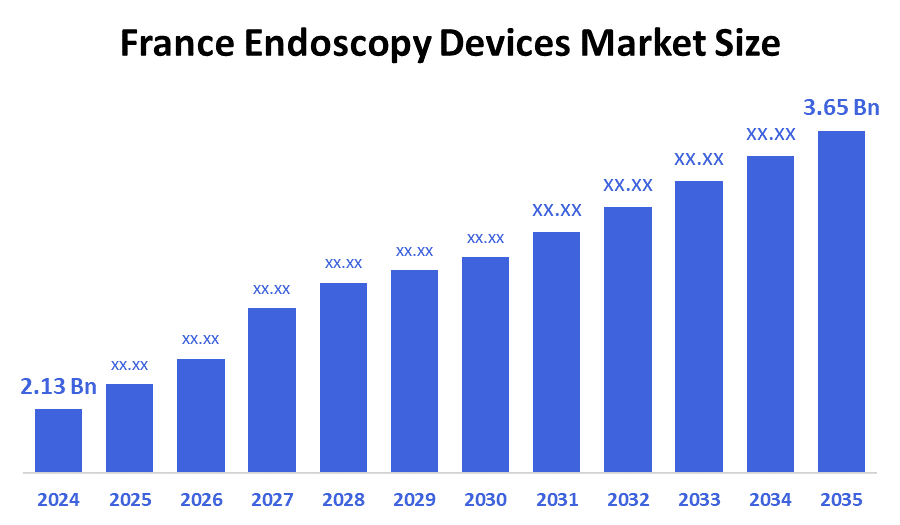

- The France Endoscopy Devices Market Size Was Estimated at USD 2.13 Billion in 2024

- The France Endoscopy Devices Market Size is Expected to Grow at a CAGR of Around 5.02% from 2025 to 2035

- The France Endoscopy Devices Market Size is Expected to Reach USD 3.65 Billion by 2035

According to a research report published by Decision Advisior & Consulting, the France Endoscopy Devices Market size is anticipated to reach USD 3.65 billion by 2035, growing at a CAGR of 5.02% from 2025 to 2035. The France endoscopy devices market is driven by an aging population, the rising prevalence of gastrointestinal and respiratory diseases, and the increasing demand for minimally invasive procedures. Key growth factors also include technological advancements like AI-powered systems and disposable endoscopes, government cancer screening programs, and the shift of procedures to ambulatory centers.

Market Overview

The France endoscopy devices market refers to the segment of the France medical-device industry that produces, distributes, and uses devices to perform procedures with endoscopes (flexible or rigid tubes that allow viewing inside the body). The endoscopy devices market has a vast array of products, which include endoscopes, the systems for visualizing and documenting what is seen through an endoscope, operative endoscopic instruments, related accessories, and consumables for these devices. They are used by all types of specialties (gastroenterology, pulmonology, urology, gynecology, ENT, orthopedics, etc.), and therefore represent a significant portion of the France endoscopy devices market. The France endoscopy devices market supports minimally invasive interventions, which ultimately lead to improved patient outcomes and facilitate the movement toward the use of advanced diagnostic and surgical devices in healthcare in France.

The prevalence of gastrointestinal disease in France drives substantial growth for endoscopic devices. Currently, more than 5 million individuals have digestive disorders. Out of this number, approximately 1 million individuals have chronic conditions, including colorectal cancer, liver disease, and IBD. In the most recent yearly statistics, over 45,000 individuals died of digestive cancers, of which 18,000 were due to colorectal cancer. In addition, the growing number of chronic diseases, including Crohn’s disease and ulcerative colitis, leads to increased demand for colonoscopes daily. Almost every hospital patient has an endoscopic procedure performed, with 64% of all admissions being colonoscopies and 33% of all admissions being upper GI endoscopies. Due to the current high prevalence and trend of intestinal conditions and their corresponding increase in procedures performed with a high volume, the ongoing need for an endoscope will continue to be strong. Therefore, there will continue to be a high demand for endoscopic devices in hospitals and in the gastroenterology area.

Report Coverage

This research report categorizes the market for the France endoscopy devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France endoscopy devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France endoscopy devices market.

Driving Factors

The France endoscopy devices market is primarily driven by the growing prevalence of chronic and age-related diseases, rising demand for minimally invasive procedures, and continuous technological advancements such as high-definition imaging, AI-assisted diagnostics, and single-use endoscopes. Additionally, an aging population, expanding healthcare infrastructure, and supportive reimbursement policies further stimulate the adoption of advanced endoscopic systems across hospitals and ambulatory surgical centers, collectively contributing to steady market growth.

Restraining Factors

The France endoscopy devices market faces several restraining factors, including the high cost of advanced endoscopic equipment and associated maintenance, which limits adoption among smaller hospitals and clinics. Budget constraints in public healthcare facilities often delay equipment upgrades, while stringent regulatory requirements under the EU-MDR create slow market entry for new devices. In addition, a shortage of trained endoscopists and technical staff hampers the effective use of advanced systems, and persistent challenges related to infection control and complex reprocessing of reusable endoscopes reduce provider confidence. The presence of refurbished or older devices as cost-saving alternatives further suppresses demand for newer, high-end technologies.

Market Segmentation

The France endoscopy devices market share is categorized by device type, application, end user, and usage.

- The endoscopes segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France endoscopy devices market is segmented by device type into endoscopes, visualization equipment, operative devices, accessories & consumables, and others. Among these, the endoscopes segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The endoscopes segmental growth is due to the rising demand for minimally invasive diagnostic and therapeutic procedures, increasing prevalence of gastrointestinal, respiratory, and urological disorders, and the expanding use of advanced imaging technologies that enhance diagnostic accuracy. Continuous technological innovations, improved ergonomics, and greater clinical preference for endoscopes as first-line diagnostic tools further strengthen this segment’s dominance in the France market.

- The gastroenterology segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France endoscopy devices market is segmented by application into gastroenterology, pulmonology, cardiology, ENT surgery, gynecology, neurology, and others. Among these, the gastroenterology segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The gastroenterology segmental dominance is due to the high prevalence of gastrointestinal disorders such as colorectal cancer, inflammatory bowel disease, GERD, and gastrointestinal bleeding, which drives a consistently high volume of endoscopic procedures. Increasing emphasis on early disease detection, widespread adoption of colonoscopy for routine screening programs, and strong clinical preference for endoscopic interventions over invasive surgical approaches further strengthen this segment.

- The hospitals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France endoscopy devices market is segmented by end user into hospitals, ambulatory surgery centers, outpatient diagnostic facilities, and others. Among these, the hospitals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The hospital's segmental growth is due to the high volume of complex diagnostic and therapeutic procedures performed in hospital settings, supported by advanced infrastructure and the availability of skilled medical professionals. Hospitals are better equipped to invest in high-cost, technologically advanced endoscopy systems such as high-definition and AI-assisted platforms, which enhance procedural capabilities and patient outcomes.

- The reusable endoscopes segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France endoscopy devices market is segmented by usage into reusable endoscopes, single-use/disposable endoscopes, reprocessing equipment & consumables, and others. Among these, the reusable endoscopes segment dominated the market share in 2024 and is projected to grow at a significant CAGR during the forecast period. The reusable endoscopes' segmental dominance is due to their widespread adoption across hospitals and specialty clinics, driven by their long-term cost efficiency and suitability for handling high procedure volumes. Despite advances in single-use technologies, reusable endoscopes remain preferred because of their durability, compatibility with a wide range of visualization and operative systems, and established reprocessing workflows within healthcare facilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France endoscopy devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Boston Scientific Corporation

- CONMED Corporation

- Cook Group Incorporated

- Fujifilm Holdings Corporation

- Hoya Corporation

- Johnson & Johnson

- Karl Storz SE & Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2023, Stryker Corporation began the initial release of its next -generation advanced visualization platform, known as the 1788 Platform. This platform is designed to enhance endoscopic and minimally invasive surgical procedures across multiple specialties.

- In May 2025, FUJIFILM Healthcare Europe launched the ELUXEO EG-840T and the specially designed narrow EG-840TP, as part of the new 800 Series ELUXEO Endoscopes. This device is made for observation & diagnosis and for advanced endoscopic treatment, particularly supporting procedures such as endoscopic mucosal resection (EMR) and endoscopic submucosal dissection (ESD) for early-stage gastrointestinal cancers.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the France Endoscopy Devices Market based on the below-mentioned segments:

France Endoscopy Devices Market, By Device Type

- Endoscopes

- Visualization Equipment

- Operative Devices

- Accessories & Consumables

- Others

France Endoscopy Devices Market, By Application

- Gastroenterology

- Pulmonology

- Cardiology

- ENT Surgery

- Gynecology

- Neurology

- Others

France Endoscopy Devices Market, By End User

- Hospitals

- Ambulatory Surgery Centers

- Outpatient Diagnostic Facilities

- Others

France Endoscopy Devices Market, By Usage

- Reusable Endoscopes

- Single-Use/Disposable Endoscopes

- Reprocessing Equipment & Consumables

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France endoscopy devices market?

The France endoscopy devices market size is expected to grow at a CAGR of around 5.02% from 2024 to 2035.

- What is the France endoscopy devices market size in 2024?

The France endoscopy devices market size was estimated at USD 2.13 billion in 2024.

- What is the projected market size of the France endoscopy devices market by 2035?

The France endoscopy devices market size is expected to reach USD 3.65 billion by 2035.

- What are the key growth drivers of the France endoscopy devices market?

An aging population, the rising prevalence of gastrointestinal and respiratory diseases, and the increasing demand for minimally invasive procedures. Technological advancements, government cancer screening programs, and the shift of procedures to ambulatory centers.

- Which application segment dominated the market in 2024?

The gastroenterology segment held the largest market share in 2024.

- Which device type segment accounted for the largest market share in 2024?

The endoscopes segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 188 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |