France Epilepsy Drugs Market

France Epilepsy Drugs Market Size, Share, and COVID-19 Impact Analysis, By Product (First-Generation Antiepileptics, Second-Generation Antiepileptics, Third-Generation Antiepileptics, and Others), By Distribution Channel (Retail Pharmacies and Hospital Pharmacies), and France Epilepsy Drugs Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Epilepsy Drugs Market Insights Forecasts to 2035

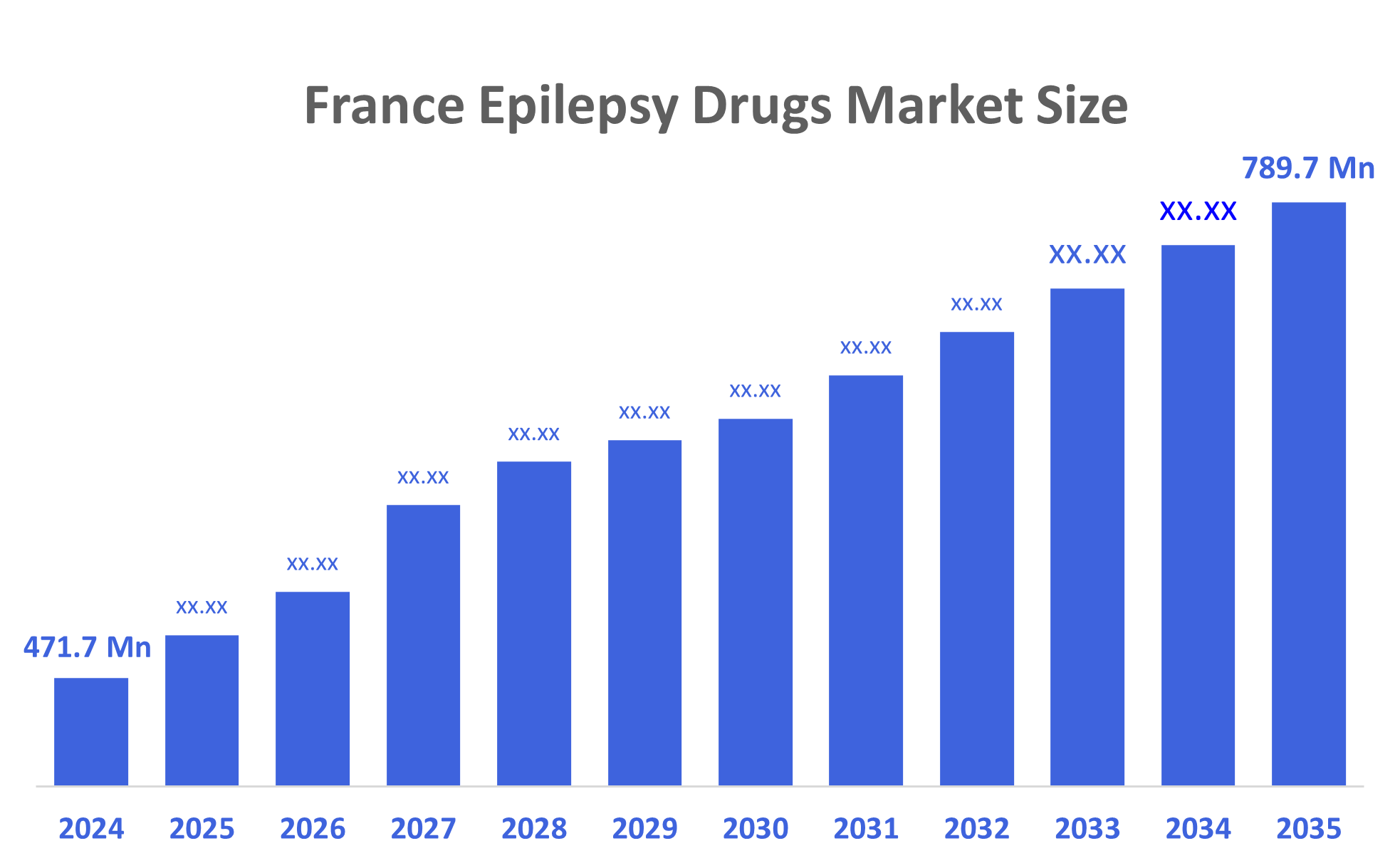

- The France Epilepsy Drugs Market Size Was Estimated at USD 471.7 Million in 2024.

- The France Epilepsy Drugs Market Size is Expected to Grow at a CAGR of Around 4.8% from 2024 to 2035.

- The France Epilepsy Drugs Market Size is Expected to Reach USD 789.7 Million By 2035.

According to a research report published by Decisions Advisors, The France Epilepsy Drugs Market Size is Projected to Reach USD 789.7 Million by 2035, growing at a CAGR of 4.8% from 2025 to 2035. The French epilepsy drug market is driven by an aging population and rising awareness, coupled with advancements in drug development, leading to more effective and safer treatments. Other drivers include a focus on improving diagnostic capabilities, accessibility, and heavy investment in research and development for new therapies.

Market Overview

The France epilepsy drugs market refers to the market for antiepileptic drugs (AEDs) in France, which are medications used to control and treat recurring seizures in people with epilepsy. The market encompasses the sale of various types of AEDs, including first-generation, second-generation, and third-generation drugs. It is driven by the increasing prevalence of epilepsy, rising investment in R&D, and an aging population. Factors such as the type of seizure, the patient's health, and government regulations also influence this market.

The France epilepsy drugs market is expected to grow in the coming years because more people, especially older adults, are being diagnosed, and many patients still need better treatments. Some people do not respond well to current medicines. According to patient-advocacy groups, the total number of people living with epilepsy in France is close to 700,000, or about 1% of the population. Each year, around 40,000 new cases are diagnosed, according to figures reported by clinical experts. About 30% of patients have drug-resistant epilepsy, epilepsy affects around 685,000 customer, according to national health system data, which represents about 10.2 cases per 1,000 inhabitants, so there is demand for new drugs, safer options, and more personalized treatments. To support this, the France government is investing large amounts of money in health research, new drug development, and digital health technologies. It has created special research centers called bioclusters, as well as university hospital institutes, to help scientists, doctors, and companies work together. The Paris Brain Institute and its NeurAL program also help new startups develop innovative epilepsy treatments. In addition, the country’s Health Data Hub and epilepsy research projects make it easier for experts to use real patient data to study the disease and improve treatments. All these efforts create a strong environment for developing new epilepsy therapies and meeting the needs of patients in France.

Report Coverage

This research report categorizes the market for the France epilepsy drugs market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France epilepsy drugs market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France epilepsy drugs market.

Driving Factors

The main drivers of the France epilepsy drugs market are the rising prevalence of epilepsy, driven by an aging population and factors like CNS infections and accidents, coupled with increasing diagnosis rates and public awareness. Market growth is further supported by advancements in research and development, resulting in innovative anti-epileptic drugs with enhanced efficacy and safety profiles. Rising awareness about epilepsy, better diagnostic tools, and early detection contribute to increased treatment uptake. Additionally, favorable regulatory and reimbursement policies, coupled with growing healthcare expenditure, enhance access to both established and novel therapies. The integration of digital health tools, such as remote monitoring and telemedicine, also supports better disease management, adherence, and overall market expansion.

Restraining Factors

Restraining factors for the France epilepsy drugs market include side effects like drowsiness and dizziness, generic competition that erodes branded drug revenue, and the challenge of treating refractory (drug-resistant) epilepsy, where current medications are not effective. Other factors include high costs for some newer drugs and stringent regulatory processes for new drug approvals.

Market Segmentation

The France epilepsy drug market share is categorized by product and distribution channel.

- The third-generation antiepileptic segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France epilepsy drugs market is segmented by product into first-generation antiepileptics, second-generation antiepileptics, third-generation antiepileptics, and others. Among these, the third-generation antiepileptic segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The third-generation antiepileptic segmental growth is due to their superior efficacy, reduced side effects, and improved tolerability compared to older drugs. These newer medications have a favorable safety profile, fewer drug interactions, and a broader range of action, making them suitable for treating various seizure types, including those that are resistant to other treatments. This improved patient compliance and therapeutic effectiveness have driven their market dominance.

- The retail pharmacies segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The France epilepsy drugs market is segmented by distribution channel into retail pharmacies and hospital pharmacies. Among these, the retail pharmacies held the largest market share in 2024 and are anticipated to grow at a significant CAGR during the forecast period. The retail pharmacies’ segmental growth is due to their widespread accessibility and convenience for patients, along with the expertise of pharmacists who provide crucial guidance on medication use. offering a primary point of access for prescription medications and a wide range of both branded and generic antiepileptic drugs (AEDs).

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France epilepsy drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Jazz Pharmaceuticals PLC

- Sumitomo Pharma Co., Ltd.

- Neurelis

- GlaxoSmithKline

- Eisai Co Ltd

- Otsuka Pharmaceutical

- Sanofi SA

- Pfizer Inc

- Abbott Laboratories

- Novartis AG ADR

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2021, Angelini Pharma, an international pharmaceutical company that recently acquired the biopharmaceutical company Arvelle Therapeutics, announced that the European Commission (EC) had granted marketing authorization for ONTOZRY for the adjunctive treatment of focal-onset seizures with or without secondary generalization in adult patients who have not been adequately controlled despite a history of treatment with at least two anti-epileptic medicinal products.

- In October 2025, the partnership between SK Biopharmaceuticals and Eurofarma involves establishing a joint venture called Mentis Care, which will operate an AI-based digital health platform for epilepsy management. This initiative aligns with an industry-wide trend toward using innovative digital channels and data-driven insights to improve patient care and expand pharmaceutical reach.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Epilepsy Drugs Market based on the below-mentioned segments:

France Epilepsy Drugs Market, By Product

- First-Generation Antiepileptics

- Second-Generation Antiepileptics

- Third-Generation Antiepileptics

- Others

France Epilepsy Drugs Market, Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |