France Fluoroscopy Systems Market

France Fluoroscopy Systems Market Size, Share, By Product (Fluoroscopy Devices and C-arms), By Mobility (Orthopedic, Cardiovascular, Pain Management & Trauma, Neurology, General Surgery, and Others), By End Use (Hospitals & Specialty Clinics and Diagnostic Imaging Centers), and France Fluoroscopy Systems Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Fluoroscopy Systems Market Insights Forecasts to 2035

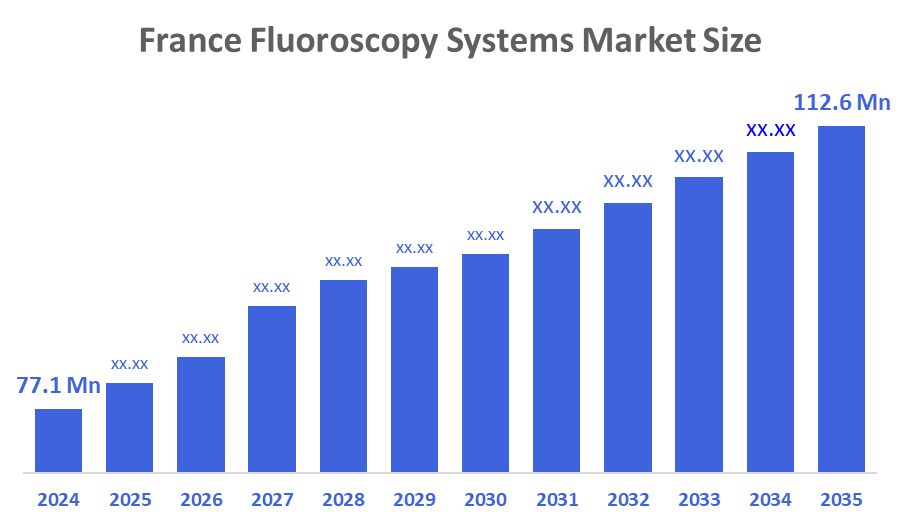

- France Fluoroscopy Systems Market Size 2024: USD 77.1 Mn

- France Fluoroscopy Systems Market Size 2035: USD 112.6 Mn

- France Fluoroscopy Systems Market CAGR 2024: 3.5%

- France Fluoroscopy Systems Market Segments: Product, Mobility, and End Use.

The France fluoroscopy systems market consists of medical imaging devices that capture real-time X-ray images for diagnostic and interventional procedural purposes. Such systems find their applications in cardiology, gastroenterology, orthopedics, and surgical guidance fields, thus allowing minimally invasive treatments. The market is inclusive of fixed, mobile, and C-arm systems with the addition of software and accessories. The market expansion is attributable to the technology improvements, a growing need for real-time imaging, and a rising healthcare infrastructure in France.

The fluoroscopy systems market in France is positively influenced by the France 2030 Health Innovation Plan that commits around €90 million for medical imaging innovation and related activities. Safety in fluoroscopy is guaranteed by regulatory recommendations from HAS and radiation standards set at the European level, whereas public investments make it possible for the latest fluoroscopy equipment to be used in hospitals and diagnostic centers all over France, thus contributing to better imaging and diagnostic services.

The fluoroscopy systems market in France is embracing AI-enabled and digital fluoroscopy technologies more and more to get higher diagnostic accuracy and better workflow efficiency. The AI-assisted analysis capabilities are the interpreting physician's quality of work, while at the same time, the total time for the scans is reduced. Less radiation and pediatric protocols are the main focuses. Thus, safety is improved. Due to these improvements, high-quality fluoroscopy becomes available to more hospitals and imaging centers throughout France.

Market Dynamics of the France Fluoroscopy Systems Market:

The France fluoroscopy systems market is driven by the increasing need for minimally invasive procedures as well as the increasing occurrence of chronic and pediatric diseases. Technological advancements such as AI-enabled and low-dose fluoroscopy are helping to enhance the accuracy of the diagnosis and the safety of the patient. The government programs, such as France 2030, in addition to the strict radiation regulations, are going to be the main factors that will support the widespread use of these devices in hospitals and imaging centers.

The France fluoroscopy systems market faces limitations due to the expensive advanced equipment and the lack of sufficiently trained radiologists, which hinder adoption in small hospitals and complicated procedures. The tight radiation regulations and long approval procedures are also making it difficult for new technologies to be introduced quickly, while limited awareness and accessibility are causing the utilization to be lower in some areas.

The French fluoroscopy equipment sector is moving toward the increasing acceptance and integration of artificial intelligence and digital technologies into its fluoroscopy configurations, thus increasing diagnostic accuracy and workflow efficiencies. By using AI, radiologists have the tools necessary to improve the quality of interpretations, thereby improving the quality of scans while reducing overall scan time. The emphasis on both radiation reduction and pediatric protocols provides the safest method of creating the best possible results from the fluoroscopy. All of these technological advances are allowing more hospitals and imaging centers in France to access higher-quality fluoroscopy services.

Market Segmentation

The France Fluoroscopy Systems Market share is classified into product, mobility, and end use.

By Product:

The France fluoroscopy systems market is divided by product into fluoroscopy devices and C-arms. Among these, the fluoroscopy devices segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth of the fluoroscopy devices segment is due to their wide application in diagnostic and interventional procedures, including cardiology, orthopedics, and gastroenterology. Their real-time imaging capabilities, ease of use, and compatibility with pediatric protocols make them highly preferred in hospitals and diagnostic centers.

By Mobility:

The France fluoroscopy systems market is divided by mobility into orthopedic, cardiovascular, pain management & trauma, neurology, general surgery, and others. Among these, the orthopedic segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The orthopedic segment dominates because the increasing prevalence of musculoskeletal disorders, fractures, and sports-related injuries requires accurate real-time imaging for diagnosis and surgical guidance. The adoption of minimally invasive orthopedic procedures and the need for precise intraoperative imaging further drive demand for fluoroscopy systems in orthopedic care. Technological advancements, such as digital integration and low-dose imaging, are further driving adoption and market expansion.

By End Use:

The France fluoroscopy systems market is divided by end use into hospitals & specialty clinics and diagnostic imaging centers. Among these, the hospitals & specialty clinics segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The hospitals & specialty clinics segment’s dominance is due to the availability of advanced imaging infrastructure, specialized radiologists, and comprehensive patient care services. Hospitals handle a higher volume of diagnostic and interventional procedures, including complex and pediatric cases, which drives greater adoption of fluoroscopy systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the France fluoroscopy systems market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in France Fluoroscopy Systems Market:

- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Canon Medical Systems

- Shimadzu Corporation

- Ziehm Imaging

- Carestream Health

- Agfa?Gevaert Group

- Stephanix

- Trixell

- Others

Recent Developments in France Fluoroscopy Systems Market:

- In December 2024, Siemens Healthineers introduced the Luminos Q.namix platform, a next?generation fluoroscopy and radiography system with remote? or tableside operation, AI?powered workflows, intuitive controls, and dose optimization, designed to improve efficiency and image quality in clinical imaging.

- In September 2025, Canon Medical unveiled its Alphenix 4D CT combined with the Aquilion ONE / INSIGHT Edition in Europe, highlighting the first global installation at CHU?Montpellier and strengthening advanced interventional imaging capabilities in France’s fluoroscopy and hybrid imaging market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Fluoroscopy Systems market based on the below-mentioned segments:

France Fluoroscopy Systems Market, By Product

- Fluoroscopy Devices

- C-arms

France Fluoroscopy Systems Market, By Mobility

- Orthopedic

- Cardiovascular

- Pain Management & Trauma

- Neurology

- General Surgery

- Others

France Fluoroscopy Systems Market, By End Use

- Hospitals & Specialty Clinics

- Diagnostic Imaging Centers

FAQ

- What is the France fluoroscopy systems market size in 2024?

The France fluoroscopy systems market size was estimated at USD 77.1 million in 2024.

- What is the projected market size of the France fluoroscopy systems market by 2035?

The France fluoroscopy systems market size is expected to reach USD 112.6 million by 2035.

- What is the CAGR of the France fluoroscopy systems market?

The France fluoroscopy systems market size is expected to grow at a CAGR of around 3.5% from 2024 to 2035.

- What are the key growth drivers of the France fluoroscopy systems market?

The increasing need for minimally invasive procedures and the increasing occurrence of chronic and pediatric diseases. Technological advancements. The government programs, such as France 2030.

- Which product segment dominated the market in 2024?

The fluoroscopy devices segment dominated the market in 2024.

- What segments are covered in the France fluoroscopy systems market report?

The France fluoroscopy systems market is segmented on the basis of product, mobility, and end use.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |