France Food Enzymes Market

France Food Enzymes Market Size, Share, and COVID-19 Impact Analysis, By Type (Carbohydrases, Proteases, Lipases, and Others), By Source (Microbial, Plant, Animal, and Others), By Application (Dairy, Baking, Beverages, Meat, and Others), and France Food Enzymes Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Food Enzymes Market Insights Forecasts to 2035

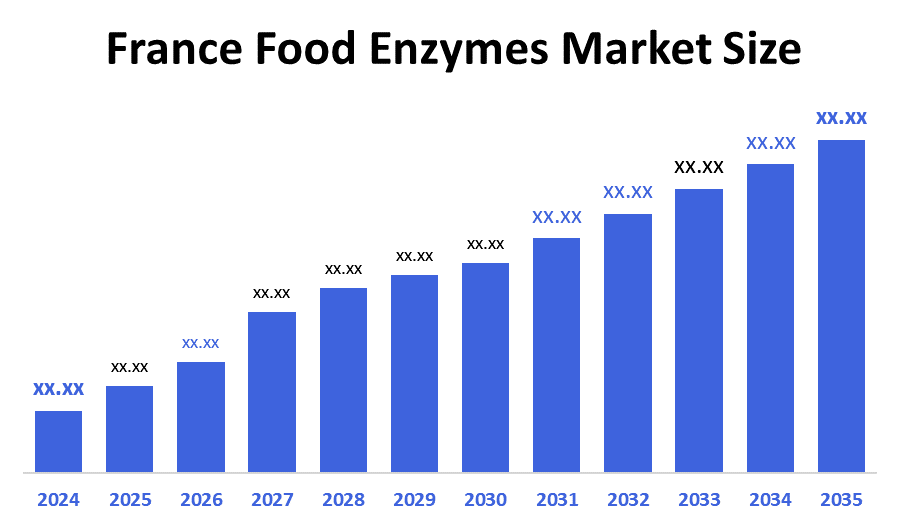

- The France Food Enzymes Market Size is Expected to Grow at a CAGR of Around 3.6% from 2025 to 2035

- The France Food Enzymes Market Size is expected to reach at a substantial share by 2035

According to a research report published by Decision Advisior & Consulting, the France Food Enzymes Market size is anticipated to grow at a CAGR of 3.6% from 2025 to 2035. The France food enzymes market is driven by the growing demand for processed and convenience foods, where enzymes are used to improve texture, flavor, and shelf life. Increasing consumer preference for clean-label and natural ingredients is pushing manufacturers to use enzymes as natural alternatives to chemical additives. The expansion of dairy, bakery, meat, and beverage industries further fuels demand, as enzymes enhance product quality and processing efficiency.

Market Overview

The France food enzymes market refers to the sector of the France food industry that involves the production, distribution, and use of enzymes as biocatalysts to improve the quality, safety, and functionality of food products. Food enzymes are natural proteins that accelerate specific biochemical reactions in food processing, such as breaking down starches, proteins, and fats, enhancing flavor, texture, and shelf life. This market serves various sectors, including dairy, bakery, meat, beverages, and processed foods, and includes both industrial enzymes and additive enzymes. Driven by the growing demand for processed and convenience foods, where enzymes are used to improve texture, flavor, and shelf life. Increasing consumer preference for clean-label and natural ingredients is pushing manufacturers to use enzymes as natural alternatives to chemical additives. The expansion of dairy, bakery, meat, and beverage industries further fuels demand, as enzymes enhance product quality and processing efficiency

France's implementation of food enzymes reflects the growing public health and quality concerns about food. According to Sante Publique France, the number of foodborne illnesses in France is between 1.28 and 2.23 million/year, resulting in between 16,500 and 20,800 people being hospitalized and around 250 dying each year due to foodborne illness. Many of these illnesses are caused by Salmonella and Campylobacter that contaminate meat, dairy products, bakery products, and ready-to-eat foods. According to Statistiques Developpement Durable, France generates between 8.8 and 9.7 million tons of food waste per year, with between 3.8 and 4.3 million tons of edible food wasted as a result of spoilage and improper storage. Changes in consumer preferences for more processed, functional, and clean-label foods are also driving the need for food enzymes that help improve food safety, extend shelf life and maintain quality, decrease the use of chemical additives, and enhance processing efficiency. These factors are contributing to the importance of the food enzymes market in France.

Report Coverage

This research report categorizes the market for the France food enzymes market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France food enzymes market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France food enzymes market.

Driving Factors

Rising demand for processed foods and convenience foods in France is driving the growth of the food enzymes industry in France. Busy lifestyles coupled with an increase in consumption of ready-to-eat products and packaged products have led to greater reliance on food enzymes to develop desirable characteristics such as texture, flavor, and shelf-life. An increasing number of consumers are requesting a clean label and natural ingredients, which will lead to increased reliance on food enzymes as the most reliable and safest substitute for chemical additives. Increasingly expanding food categories such as dairy, bakery, meat, and beverage create a high demand for food enzyme products.

Restraining Factors

The France enzymes market is subject to a number of restrictions. Costs associated with the production of enzymes and the advanced enzyme technologies could inhibit the acceptance of these enzymes by small and medium-sized food manufacturers. The stringent requirements imposed on food manufacturers by European Union (EU) Member States and their respective countries will delay new entrants into the market for enzyme products. The storage and stability limitations of some enzymes make them difficult to handle and incorporate into food production.

Market Segmentation

The France food enzymes market share is categorized by type, source, and application.

- The carbohydrases segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France food enzymes market is segmented by type into carbohydrases, proteases, lipases, and others. Among these, the carbohydrases segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The carbohydrases segmental growth is due to their wide use in the bakery, dairy, and beverage industries. These enzymes improve texture, sweetness, and shelf life, catering to the increased consumer demand for high-quality processed foods. Their importance in bioethanol generation for sustainable food processing further strengthens their dominance.

- The microbial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France food enzymes market is segmented by source into microbial, plant, animal, and others. Among these, the microbial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The microbial segmental growth is due to their low cost, adaptability, and long-term viability. Enzymes derived from microorganisms such as fungi and bacteria are widely utilized in the baking, dairy, and brewing industries, meeting the demand for clean-label and environmentally friendly solutions.

- The dairy segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France food enzymes market is segmented by application into dairy, baking, beverages, meat, and others. Among these, the dairy segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dairy segmental growth is due to its wide use in the bakery, dairy, and beverage industries. These enzymes improve texture, sweetness, and shelf life, catering to the increased consumer demand for high-quality processed foods. Their importance in bioethanol generation for sustainable food processing further strengthens their dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France food enzymes market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novozymes

- DSM

- Chr. Hansen

- Associated British Foods (ABF)

- DuPont

- Kerry Group

- Corbion

- Koninklijke DSM N.V.

- Advanced Enzyme Technologies Ltd.

- Amano Enzyme, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2021, Amano Enzyme Inc. introduced Umamizyme Pulse, a non-GMO enzyme designed for use in a variety of plant-based protein products. This enzyme enhances the umami flavor in plant proteins, improving taste and palatability, and supporting the growing demand in France and globally for plant-based and clean-label food products.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the France Food Enzymes Market based on the below-mentioned segments:

France Food Enzymes Market, By Type

- Carbohydrases

- Proteases

- Lipases

- Others

France Food Enzymes Market, By Source

- Microbial

- Plant

- Animal

- Others

France Food Enzymes Market, By Application

- Dairy

- Baking

- Beverages

- Meat

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France food enzymes market?

The France food enzymes market size is expected to grow at a CAGR of around 3.6% from 2024 to 2035.

- What are the key growth drivers of the France food enzymes market?

Increasing consumer preference for clean-label and natural ingredients. The expansion of dairy, bakery, meat, and beverage industries further fuels demand, as enzymes enhance product quality and processing efficiency.

- Which source segment dominated the market in 2024?

The microbial segment dominated the market in 2024.

- Which type of segment accounted for the largest market share in 2024?

The carbohydrases segment accounted for the largest market share in 2024.

- What segments are covered in the France food enzymes market Report?

The France food enzymes market is segmented based on type, source, and application.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 188 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |