France Food Preservatives Market

France Food Preservatives Market Size, Share, and COVID-19 Impact Analysis, By Preservative Type (Natural Preservatives and Synthetic Preservatives), By Distribution Channel (Direct Sales and Indirect Sales), By Application (Beverages, Meat/Poultry & Seafood, Snacks, Fruits & Vegetables, Bakery & Confectionery, Dairy & Frozen Products, and Others), By End User (Food Processing Industry and Foodservice), and France Food Preservatives Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

France Food Preservatives Market Insights Forecasts to 2035

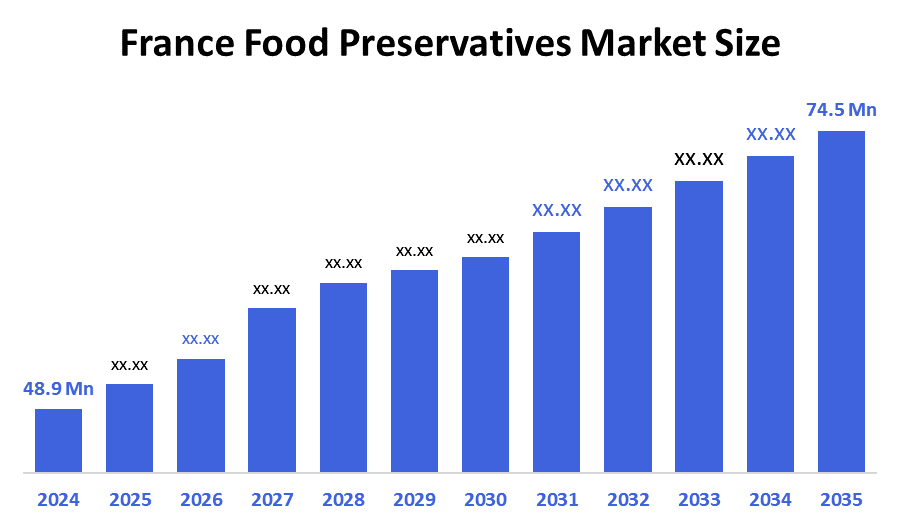

- The France Food Preservatives Market Size Was Estimated at USD 48.9 Million in 2024

- The France Food Preservatives Market Size is Expected to Grow at a CAGR of Around 3.9% from 2025 to 2035

- The France Food Preservatives Market Size is Expected to Reach USD 74.5 Million by 2035

According to a research report published by Decision Advisior & Consulting, the France Food Preservatives Market Size is projected to reach 74.5 million by 2035, growing at a CAGR of 3.9% from 2025 to 2035. The France food preservatives market is driven by consumer demand for processed and convenience-type foods, and in order to maintain food quality and safety while also extending product shelf-life. In addition to these market forces, consumers' desire for natural and clean-label products has prompted food manufacturers to innovate and create safer and less opaque food preservation products.

Market Overview

The France food preservatives market refers to the industry concerning the preservation of foods, is comprises the manufacturing and distribution of preservatives (chemical or natural) that are added to food products to help preserve them from decay and prolong their shelf lives, while also keeping them safe to eat, of good quality, and fresh. The France market for food preservatives consists of both synthetic preservatives, e.g., benzoates, sorbates, & nitrites, as well as natural preservatives, e.g., plant extracts, organic acids, and fermentation-derived products, and serves the industries of dairy, bakery, meats, seafood, beverages, and processed foods.

The food safety and public health issues that France has to deal with have made it imperative for new food preservatives to be able to support France's efforts to mitigate the large numbers of individuals who suffer food safety-related illnesses on an annual basis. According to the national health estimates, France has suffered approximately 1.28-2.23 million foodborne diseases each year, resulting in 16,500-20,800 people being hospitalized, and 250 deaths. In 2022, a total of 1,924 instances of food-related sicknesses affected 16,763 individuals. France’s food waste totals 8.8-9.7 million tons a year. That amount, approximately 3.8-4.3 million tons. The great number of food-related illnesses and food waste generated by France emphasizes the need for food preservatives to be available in France's market. Such preservatives can help reduce or eliminate the chances of food becoming contaminated by microorganisms, extending its shelf life, reducing spoilage, and ultimately, reducing France's food wastage. Food preservatives will also play an important role in protecting public health, providing more reliable food security, and supporting a sustainable and efficient food supply chain for France in the future.

Report Coverage

This research report categorizes the market for the France food preservatives market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France food preservatives market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France food preservatives market.

Driving Factors

There are several key factors that drive the France food preservatives market. The main reasons include increasing consumer demand for processed, packaged, and convenience foods, which will help them prepare meals more quickly. The need for safe food and a longer shelf life (due in large part to the high rate of foodborne illness and spoilage) will continue to spur the increased use of preservatives. Continuing to expand major food segments (e.g., dairy, meat, seafood, baked goods, and ready-to-eat foods) creates greater demand for preservation solutions that allow food products to retain their quality through storage and distribution.

Restraining Factors

There are a number of factors that will inhibit growth within the preservatives market in France. Strict regulations on the type and quantity of preservatives that can be added to foods in Europe, as well as consumer concerns regarding artificial additives, clean-label foods, are likely to limit the market size of synthetic preservatives. Natural sources and innovative methods of preserving have a much higher cost than those used synthetically and may prevent manufacturers from adopting these products. The incorrect or excessive use of preservatives can negatively impact both the flavor and quality of foods, thereby impacting the acceptance and usage of these products within the food industry.

Market Segmentation

The France food preservatives market share is categorized by preservative type, distribution channel, application, and end user.

- The synthetic preservatives segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France food preservatives market is segmented by preservative type into natural preservatives and synthetic preservatives. Among these, the synthetic preservatives segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The synthetic preservatives segmental growth is due to their high effectiveness in preventing microbial growth, spoilage, and oxidation, which ensures longer shelf life for a wide range of food products. They are cost-effective, widely available, and easy to use in industrial food processing, making them a preferred choice for manufacturers.

- The indirect sales segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The France food preservatives market is segmented by distribution channel into direct sales, indirect sales. Among these, the indirect sales segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The indirect sales segmental growth is due to the wide reach and convenience offered by distributors, wholesalers, and retail chains, which makes it easier for food manufacturers to access preservatives in large quantities. Indirect channels also provide efficient supply chain management, bulk purchasing options, and reliable delivery, supporting consistent production for the growing processed and packaged food industry.

- The meat/poultry & seafood segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France food preservatives market is segmented by application into beverages, meat/poultry & seafood, snacks, fruits & vegetables, bakery & confectionery, dairy & frozen products, and others. Among these, the meat/poultry & seafood segment dominated the market share in 2024 and is projected to grow at a substantial CAGR during the forecast period. The meat/poultry & seafood segmental growth is due to the high perishability of these products, which makes preservatives essential for preventing microbial growth, spoilage, and extending shelf life. Rising demand for processed and packaged meat and seafood products in France, along with stricter food safety regulations, drives the need for effective preservation.

- The food processing industry segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France food preservatives market is segmented by end user into food processing industry and foodservice. Among these, the food processing industry segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The food processing industry segmental growth is due to the increasing demand for processed, packaged, and convenience foods in France, which require preservatives to maintain quality, safety, and shelf life. Large-scale manufacturers prefer consistent, reliable, and cost-effective preservation solutions to support mass production and distribution. Additionally, strict food safety regulations and the need to minimize spoilage and food waste further drive the adoption of preservatives in the food processing sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France food preservatives market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DuPont de Nemours, Inc.

- Koninklijke DSM N.V

- Corbion NV

- BASF SE

- Barentz

- Ter Hell & Co. Gmbh

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, Kerry Group launched a natural preservation solution for dairy products designed to extend shelf life without using artificial preservatives. This innovation addresses the growing consumer demand in France for clean-label, healthier, and more sustainable dairy products, reflecting a broader trend toward natural and minimally processed food solutions in the market.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the France Food Preservatives Market based on the following segments:

France Food Preservatives Market, By Preservative Types

- Natural Preservatives

- Synthetic Preservatives

France Food Preservatives Market, By Distribution Channel

- Direct Sales

- Indirect Sales

France Food Preservatives Market, By Application

- Beverages

- Meat/Poultry & Seafood

- Snacks

- Fruits & Vegetables

- Bakery & Confectionery

- Dairy & Frozen Products

- Others

France Food Preservatives Market, By End User

- Food Processing Industry

- Foodservice

Frequently Asked Questions (FAQ)

- What is the CAGR of the France food preservatives market?

The France food preservatives market size is expected to grow at a CAGR of around 3.9% from 2024 to 2035.

- What is the France food preservatives market size in 2024?

The France food preservatives market size was estimated at USD 48.9 million in 2024.

- What is the projected market size of the France food preservatives market by 2035?

The France food preservatives market size is expected to reach USD 74.5 million by 2035.

- What are the key growth drivers of the France food preservatives market?

Rising demand for processed and convenience foods, the need to ensure food safety and extend shelf life, as well as the expanding dairy, bakery, meat, and seafood industries.

- Which distribution channel segment held the largest market share in 2024?

The indirect sales segment held the largest market share in 2024.

- Which preservative type segment accounted for the largest market share in 2024?

The synthetic preservatives segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 201 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |