France High-Performance Liquid Chromatography Market

France High-Performance Liquid Chromatography Market Size, Share, and COVID-19 Impact Analysis, By Product (Instruments, Consumables & Accessories, Software, and Others), By Application (Clinical Research, Diagnostics, Forensic, and Others), By End User (Pharmaceutical & Biotech Companies and Academic & Research Institutions), and France High-Performance Liquid Chromatography Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France High-Performance Liquid Chromatography Market Insights Forecasts to 2035

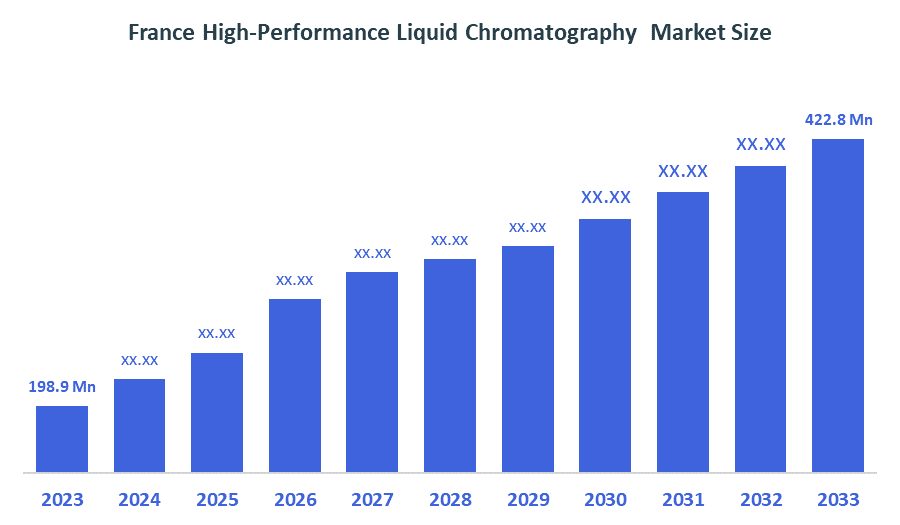

- The France High-Performance Liquid Chromatography Market Size Was Estimated at USD 198.9 Million in 2024.

- The France High-Performance Liquid Chromatography Market Size is Expected to Grow at a CAGR of Around 7.1% from 2025 to 2035.

- The France High-Performance Liquid Chromatography Market Size is Expected to Reach USD 422.8 million by 2035.

According to a Research Report Published by Decision Advisior & Consulting, the France High-Performance Liquid Chromatography Market size is anticipated to reach USD 422.8 million by 2035, growing at a CAGR of 7.1% from 2025 to 2035. The France high-performance liquid chromatography market is driven by the growth of the pharmaceutical and biopharmaceutical industries, increased R&D investments in life sciences, and the demand for accurate quality control and analysis in various sectors like food safety and clinical diagnostics. Rising chronic disease and cancer cases increase demand for advanced clinical diagnostics. Technological advancements, such as the development of more advanced systems like Ultra-High-Performance Liquid Chromatography (UHPLC), further propel market growth by offering greater speed, precision, and automation

Market Overview

The France high-performance liquid chromatography market refers to the commercial landscape for HPLC instruments, consumables, and related services within France. HPLC is an advanced analytical technique used to separate, identify, and quantify components in complex mixtures based on their chemical properties. This market includes HPLC systems (analytical, preparative, and ultra-high-performance), columns, solvents, reagents, and accessories, as well as software for data acquisition and analysis. HPLC is widely employed across pharmaceutical, biotechnology, food & beverage, environmental, and clinical research sectors for applications such as drug development, quality control, food safety testing, and clinical diagnostics

The adoption of high-performance liquid chromatography (HPLC) in France is driven by the country’s strong focus on healthcare, pharmaceutical research, and food safety, reflecting both population health needs and industrial demands. France has a population of approximately 68 million, with a significant burden of chronic diseases and rising cancer cases, including nearly 484,000 new cancer diagnoses in 2022, necessitating advanced drug development, clinical diagnostics, and therapeutic monitoring. The pharmaceutical and biotechnology sectors are highly active, producing complex biologics, generics, and novel therapeutics that require precise analytical techniques like high-performance liquid chromatography for quality control and regulatory compliance. Additionally, growing awareness of food safety, environmental monitoring, and clinical research further increases the need for HPLC systems. These factors collectively highlight the importance of the France HPLC market in supporting accurate, high-throughput, and reliable analysis across healthcare, research, and industrial applications.

Report Coverage

This research report categorizes the market for the France high-performance liquid chromatography market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France high-performance liquid chromatography market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France high-performance liquid chromatography market.

Driving Factors

The France high-performance liquid chromatography (HPLC) market is driven by the country’s robust pharmaceutical and biotechnology sector, where growing drug development, biologics, and generics production require HPLC for quality control, validation, and regulatory compliance. The high prevalence of chronic diseases and cancer fuels demand for clinical diagnostics, therapeutic monitoring, and biomarker analysis. Technological advancements such as UHPLC, automated systems, and high-throughput solutions enhance efficiency and sensitivity. Additionally, increasing food safety testing, environmental monitoring, and expanding R&D activities in academic and industrial labs contribute to the market’s strong growth.

Restraining Factors

The France high-performance liquid chromatography (HPLC) market faces restraints due to the high cost of advanced HPLC instruments and consumables, which can limit adoption among smaller laboratories. Complex operation and maintenance requirements necessitate skilled personnel, adding to operational challenges. Additionally, long analysis times for certain samples and the availability of alternative analytical techniques, such as gas chromatography or spectrometry, may slow adoption. Budget constraints in academic and smaller research institutions also restrict widespread deployment of high-end HPLC systems.

Market Segmentation

The France high-performance liquid chromatography market share is categorized by product, application, and end user.

- The instruments segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France high-performance liquid chromatography market is segmented by product into instruments, consumables & accessories, software, and others. Among these, the instruments segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The instruments' segmental growth is due to the increasing demand for high-precision analytical tools in pharmaceutical, biotechnology, and research laboratories across France. Rising adoption of HPLC instruments for drug development, quality control, clinical diagnostics, and food safety testing, coupled with technological advancements such as ultra-high-performance HPLC (UHPLC) and automated systems, enhances efficiency, accuracy, and throughput.

- The clinical research segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France high-performance liquid chromatography market is segmented by application into clinical research, diagnostics, forensics, and others. Among these, the clinical research segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period. The clinical research segmental growth is due to the increasing investment in drug discovery, development of biologics, and clinical trials in France. HPLC is extensively used for analyzing complex biological samples, validating drug formulations, and monitoring biomarkers, making it essential in research workflows. Additionally, the rising prevalence of chronic diseases and cancer drives the need for advanced analytical techniques in pharmaceutical and biotechnology R&D, further boosting the adoption of HPLC in clinical research applications.

- The pharmaceutical & biotech companies segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The France high-performance liquid chromatography market is segmented by end user into pharmaceutical & biotech companies and academic & research institutions. Among these, the pharmaceutical & biotech companies segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The pharmaceutical & biotech companies’ segmental growth is due to the increasing demand for drug development, biologics production, and quality control testing in France. HPLC is widely used for analyzing complex drug formulations, ensuring regulatory compliance, and supporting R&D activities, making this segment the largest contributor to market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France high-performance liquid chromatography market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Waters Corp

- Thermo Fisher Scientific Inc

- Agilent Technologies Inc

- Shimadzu Corp

- Sartorius AG

- PerkinElmer

- Bio-Rad Laboratories Inc

- Merck KGaA

- Gilson

- Danaher Corp

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, Bayer and Thermo Fisher Scientific have teamed up to develop next-generation sequencing companion diagnostics (CDx) to support the rollout of precision cancer medicines from Bayer AG, a move that could drive demand for advanced analytical tools such as high-performance liquid chromatography (HPLC) in supporting drug development and quality testing across oncology labs

- In October 2024, Agilent Technologies Inc. launched its second-generation Agilent InfinityLab LC Series portfolio, which includes the 1290 Infinity II LC, 1260 Infinity II Prime LC, and 1260 Infinity II LC systems. All the models are also offered in biocompatible versions, which advance performance and versatility for broad applications of liquid chromatography.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035.Decision Advisior has segmented the France High-Performance Liquid Chromatography Market based on the below-mentioned segments:

France High-Performance Liquid Chromatography Market, By Product

- Instruments

- Consumables & Accessories

- Software

- Others

France High-Performance Liquid Chromatography Market, By Application

- Clinical Research

- Diagnostics

- Forensic

- Others

France High-Performance Liquid Chromatography Market, By End User

- Pharmaceutical & Biotech Companies

- Academic & Research Institutions

Frequently Asked Questions (FAQ)

- What is the CAGR of the France high-performance liquid chromatography market?

The France high-performance liquid chromatography market size is expected to grow at a CAGR of around 7.1% from 2024 to 2035.

- What is the France high-performance liquid chromatography market size in 2024?

The France high-performance liquid chromatography market size was estimated at USD 198.9 million in 2024.

- What is the projected market size of the France high-performance liquid chromatography market by 2035?

The France high-performance liquid chromatography market size is expected to reach USD 422.8 million by 2035.

- What are the key growth drivers of the France high-performance liquid chromatography market?

Increased R&D investments in life sciences and the demand for accurate quality control and analysis in various sectors like food safety and clinical diagnostics. Technological advancements, such as the development of more advanced systems like Ultra-High-Performance Liquid Chromatography.

- Which application segment dominated the market in 2024?

The clinical research segment held the largest market share in 2024.

- Which product segment accounted for the largest market share in 2024?

The instruments segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |