France Insulin Infusion Pump Market

France Insulin Infusion Pump Market Size, Share, and COVID-19 Impact Analysis, By Type (Traditional Insulin Pumps and Patch Pumps), By Technology (Smart Pumps and Conventional Pumps), By End User (Hospitals, Home Care Settings, Diabetes Clinics, and Others), and France Insulin Infusion Pump Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Insulin Infusion Pump Market Insights Forecasts to 2035

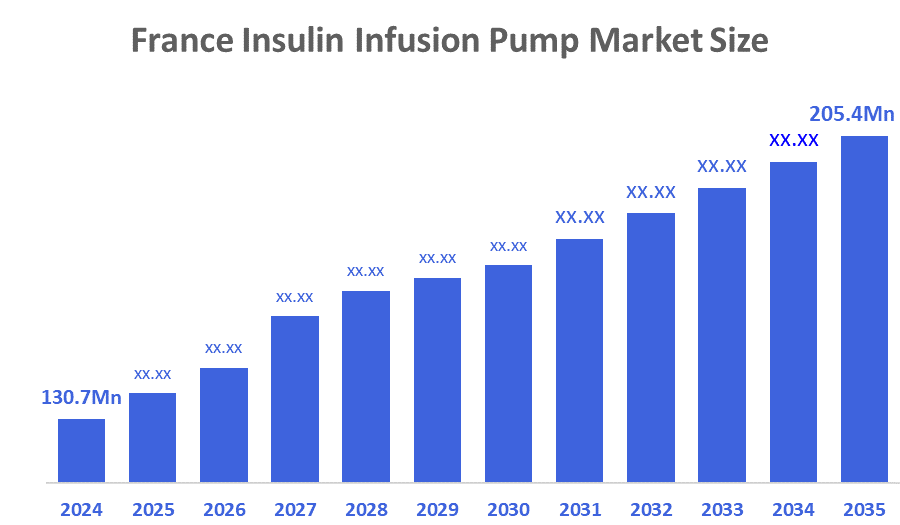

- The France Insulin Infusion Pump Market Size Was Estimated at USD 130.7 Million in 2024.

- The France Insulin Infusion Pump Market Size is Expected to Grow at a CAGR of Around 4.2% from 2025 to 2035.

- The France Insulin Infusion Pump Market Size is Expected to Reach USD 205.4 Million by 2035.

According To a Research Report Published By Decisions Advisors and Consulting, The France Insulin Infusion Pump Market Size Is Anticipated To Reach USD 205.4 Million By 2035, Growing At a CAGR Of 4.2% From 2025 to 2035. The France insulin infusion pump market is driven by the rising number of diabetes cases, growing awareness of advanced insulin delivery methods, and increasing use of continuous insulin pumps for better glucose control. Technological improvements like smart pumps and CGM integration, along with supportive healthcare policies and reimbursement options, further boost market growth.

Market Overview

The France insulin infusion pump market consists of wearable medical devices used to continuously and accurately deliver insulin to people with diabetes. With these devices, users have an improved method of managing their blood glucose levels than they currently have through the use of standard insulin injection therapy, as insulin infusion pumps provide users with the ability to adjust and receive real-time insulin delivery. The France insulin infusion pump industry encompasses all types of infusion pumps, along with the additional equipment required to use these infusion pumps, such as infusion sets and accessories, and the various sites where they will be utilized, such as hospitals and home healthcare environments.

France is experiencing a rapid growth in the number of individuals who have diabetes, with approximately 4 million citizens already diagnosed with diabetes, and this number will continue to rise as the average age of the country’s population increases and their lifestyles change. The growing number of diabetes patients creates a public health challenge due to the potential complications of diabetes; however, the use of continuous glucose management (CGM) devices has been known to enhance glucose control and decrease the need for multiple daily injections of insulin, thereby improving the quality of life for many people with type 1 diabetes and a large percentage of people with type 2 diabetes who require insulin therapy. The France government has demonstrated strong support for advanced diabetes care services through the support of the France National Health Service in establishing payment support for advanced diabetes care solutions, including insulin infusion pumps, which have significantly reduced costs for patients and have encouraged increased adoption. Additionally, public health initiatives aimed at improving diabetic management and prevention efforts and developing advanced diabetes management solutions, such as insulin infusion pumps, continually highlight the need for advanced diabetes management solutions in France.

Report Coverage

This research report categorizes the market for the France insulin infusion pump market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France insulin infusion pump market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France insulin infusion pump market.

Driving Factors

The France insulin infusion pump market is driven by the rising prevalence of diabetes, especially among aging and younger populations requiring long-term insulin therapy. Growing awareness of advanced diabetes management, along with the shift toward continuous and precise insulin delivery, boosts demand. Technological advancements such as smart pumps, integration with continuous glucose monitoring (CGM), and mobile app connectivity further encourage adoption. Supportive healthcare policies, government-funded initiatives, and strong reimbursement coverage for insulin pumps also play a key role in driving market growth in France.

Restraining Factors

The France insulin infusion pump market faces challenges such as the high cost of insulin pumps and related consumables, which can limit adoption despite reimbursement options. Some patients may find pumps difficult to use or uncomfortable to wear, affecting acceptance. Technical issues like device malfunctions or infusion set failures also create concerns. Additionally, limited awareness among certain patient groups, the need for proper training, and strict regulatory requirements can slow market growth.

Market Segmentation

The France insulin infusion pump market share is categorized by type, technology, and end user.

- The traditional insulin pumps segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France insulin infusion pump market is segmented by type into traditional insulin pumps and patch pumps. Among these, the traditional insulin pumps segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The traditional insulin pump segment's growth is due to its proven reliability, widespread use, and advanced, customizable insulin delivery features. Continued improvements in design and ease of use further support its strong market position.

- The smart pumps segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France insulin infusion pump market is segmented by technology into smart pumps and conventional pumps. Among these, the smart pumps segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The smart pump’s segmental growth is due to its advanced features like real-time glucose monitoring, automatic insulin adjustments, and improved data tracking. These pumps offer more convenient, precise, and personalized diabetes management, and rising demand for connected healthcare devices further strengthens their position in the France market.

- The home care settings segment held the largest market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France insulin infusion pump market is segmented by end user into hospitals, home care settings, diabetes clinics, and others. Among these, the home care settings segment held the largest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period. The home care setting’s segmental growth is due to the increasing preference for self-managed diabetes care, rising awareness of insulin pump therapy among patients, and the convenience of continuous insulin delivery at home. Supportive healthcare policies, reimbursement programs, and the availability of user-friendly devices also encourage wider adoption in home care settings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France insulin infusion pump market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers and acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medtronic France

- Insulet Corporation

- Roche Diabetes Care France

- Ypsomed France

- SOOIL Development Co.Ltd.

- Tandem Diabetes Care

- Beta Bionics

- Diabeloop

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, Medtronic launched its MiniMed 780G insulin infusion pump in France, incorporating advanced features like automated insulin delivery and real-time glucose monitoring for improved diabetes management.

- In October 2023, Roche expanded the availability of its Accu-Chek Solo insulin infusion pump in France, focusing on enhancing patient experience through seamless integration with mobile apps for better monitoring and control.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Insulin Infusion Pump Market based on the below-mentioned segments:

France Insulin Infusion Pump Market, By Type

- Hardware

- Traditional insulin pumps

- Services

- Others

France Insulin Infusion Pump Market, By Technology

- Smart Pumps

- Conventional Pumps

France Insulin Infusion Pump Market, By End User

- Hospitals

- Home Care Settings

- Diabetes Clinics

- Other

Frequently Asked Questions (FAQ)

- What is the CAGR of the France insulin infusion pump market?

The France insulin infusion pump market size is expected to grow at a CAGR of around 4.2% from 2024 to 2035.

- What is the France insulin infusion pump market size in 2024?

The France insulin infusion pump market size was estimated at USD 130.7 million in 2024.

- What is the projected market size of the France insulin infusion pump market by 2035?

The France insulin infusion pump market size is expected to reach USD 205.4 million by 2035.

- What are the key growth drivers of the France insulin infusion pump market?

rising number of diabetes cases, growing awareness of advanced insulin delivery methods, and increasing use of continuous insulin pumps for better glucose control. Technological improvements.

- Which end-user segment held the largest market share in 2024?

The home care segment held the largest market share in 2024.

- Which technology segment accounted for the largest market share in 2024?

The smart pumps accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Regional |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |