France Intrauterine Devices Market

France Intrauterine Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Hormonal Intrauterine Device and Copper Intrauterine Device), By Distribution Channel (Hospital, Gynecology Clinics, Community Health Care Centers, and Others), and France Intrauterine Devices Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Intrauterine Devices Market Insights Forecasts to 2035

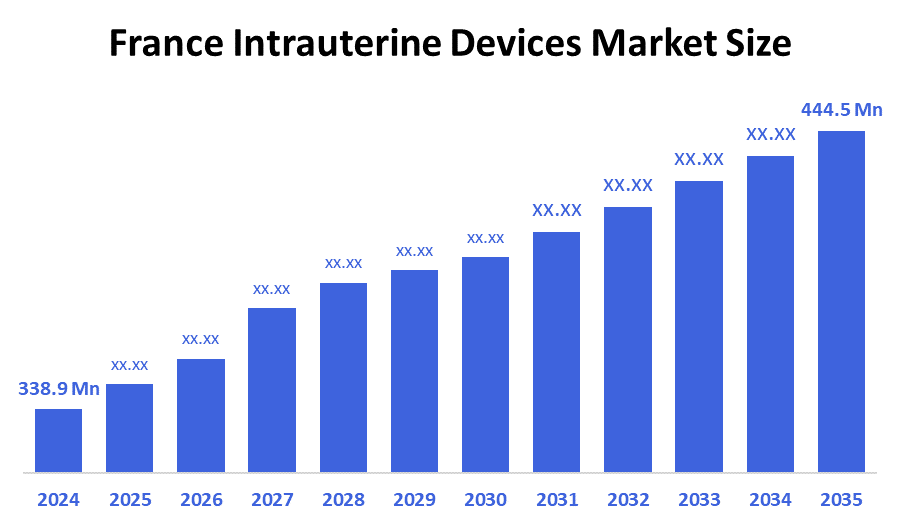

- The France Intrauterine Devices Market Size Was Estimated at USD 338.9 Million in 2024

- The France Intrauterine Devices Market Size is Expected to Grow at a CAGR of Around 2.5% from 2025 to 2035

- The France Intrauterine Devices Market Size is Expected to Reach USD 444.5 million by 2035

According to a research report published by Decision Advisior & Consulting, the France Intrauterine Devices Market size is anticipated to reach USD 444.5 million by 2035, growing at a CAGR of 2.5% from 2025 to 2035. The France intrauterine devices market is driven by increasing awareness of long-acting reversible contraception (LARC) and its benefits, the rise in demand for long-term, low-maintenance birth control, and favorable government and healthcare policies. Specifically, the market benefits from increasing public and professional awareness campaigns, support from France's robust public healthcare system, and reimbursement policies for both hormonal and non-hormonal IUDs.

Market Overview

The intrauterine device market in France encompasses the healthcare and medical device industry of France regarding the creation, certification, availability, and employment of IUDs as a means to prevent unintended pregnancies via the insertion of a T-shaped IUD in the uterus. Both copper-based and hormonal IUDs are available. Factors such as increasing acceptance of LARC, governing mandates, increasing awareness about effective family planning, as well as improved design and safety of intrauterine devices, contribute to the overall health of each ecosystem (availability, access, and use of an intrauterine device-based form of contraception) as it relates to the distribution of intrauterine device solutions throughout France.

Statistics regarding population health and contraceptive usage indicate that France’s demand for intrauterine devices (IUDs) will be accentuated by the fact that approximately 92% of sexually active women of childbearing age who do not want to become pregnant currently use contraception. Despite this, there are still approximately 406,000 unplanned pregnancies each year in France, which corresponds to 37% of all pregnancies, and approximately 50% result in abortion. This suggests that those utilizing user-initiated methods such as pills and condoms are frequently unable to maintain consistent usage, leading to unplanned pregnancies. Additionally, on a national level, the data collected from France National Health Surveys indicates that there has been a shift toward more reliable forms of birth control; specifically, IUDs have become the most commonly utilized contraceptive method in France as of 2023, with an increase of 27.7% of women aged eighteen (18) through forty-nine (49) choosing an IUD as compared to the pill. However, long-acting reversible contraceptives (LARCs), which include IUDs, are still only used by 16% of women who are of reproductive age, indicating significant potential for growth in this area. Collectively, these indicators demonstrate that there exists a considerable public health requirement for expanded access to highly efficacious, low-maintenance contraceptives. Therefore, IUDs within the France market will contribute greatly to the elimination of preventable unplanned pregnancies, the support of reproductive autonomy, and the reduction of social and healthcare costs related to unplanned pregnancies.

Report Coverage

This research report categorizes the market for the France intrauterine devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France intrauterine devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France intrauterine devices market.

Driving Factors

The France intrauterine devices market is driven by growing rates of unintended pregnancies, which have prompted a rise in demand for more reliable contraceptive methods. Growing awareness of the advantages of long-acting reversible contraceptives (LARCs) compared to user-dependent contraceptive options has also contributed to increased adoption rates. The numerous side effects associated with hormonal contraceptive pills have led many women to discontinue use and to seek alternatives such as IUDs. An already existing strong healthcare system, as well as favorable reimbursement policies for IUDs, also facilitates market growth. The continuous advancement of technology in the design of IUDs has further fostered increased acceptance of IUDs among an expanding user base.

Restraining Factors

Lack of information or misunderstandings concerning the safety and suitability of IUDs continue to prevent some women from using them. Fear of the insertion procedure, along with discomfort associated therewith, stops a woman from utilizing IUDs. For some IUD types, up-front costs create an access barrier for those who do not belong to an insurance plan that provides an adequate level of reimbursement. Cultural beliefs surrounding contraceptive methods may slow down the transition from short-term contraceptives to longer-acting reversible contraceptives (i.e., LARC). Finally, insufficient provider training in certain geographic areas limits both the availability and the level of confidence that providers will be able and willing to recommend IUDs.

Market Segmentation

The France intrauterine devices market share is categorized by product and distribution channel.

- The hormonal intrauterine devices segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France intrauterine devices market is segmented by product into hormonal intrauterine devices and copper intrauterine devices. Among these, the hormonal intrauterine devices segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The hormonal intrauterine devices segment's dominance is driven by increasing awareness and acceptance of long-acting reversible contraception (LARC) methods and their dual benefits of effective contraception and management of menstrual symptoms. Their improved comfort, longer lifespan, and favorable safety profile also drive higher adoption.

- The hospitals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France intrauterine devices market is segmented by distribution channel into hospitals, gynecology clinics, community health care centers, and others. Among these, the hospitals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The hospital segment's dominance is driven by the wide availability of specialized gynecologists and trained medical staff, ensuring safe and accurate IUD insertion procedures. Hospitals also offer advanced diagnostic and screening facilities, which increase patient confidence and support comprehensive pre- and post-insertion care. Additionally, a large portion of IUD insertions in France occurs in hospital settings due to higher patient footfall and strong integration with public healthcare services

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France intrauterine devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AbbVie Inc

- Bayer AG

- CooperSurgical

- Eurofins Scientific SE

- Pregna International

- Bayer

- HRA Pharma Merck

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 8, 2020, AbbVie announced that it had completed its acquisition of Allergan, strengthening its position in the intrauterine devices market through Allergan’s LILETTA hormonal IUD and enhancing distribution, marketing, and global access to long-acting reversible contraceptives.

- In May 2022, Perrigo completed its acquisition of HRA Pharma, expanding its women’s health portfolio, which may strengthen access to contraceptive products and potentially impact the intrauterine devices market.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035.Decision Advisior has segmented the France Intrauterine Devices Market based on the below-mentioned segments:

France Intrauterine Devices Market, By Product

- Hormonal Intrauterine Device

- Copper Intrauterine Device

France Intrauterine Devices Market, By Distribution Channel

- Hospital

- Gynecology Clinics

- Community Health Care Centers

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France intrauterine devices market?

The France intrauterine devices market size is expected to grow at a CAGR of around 2.5% from 2024 to 2035.

- What is the France intrauterine devices market size in 2024?

The France intrauterine devices market size was estimated at USD 338.9 million in 2024.

- What is the projected market size of the France intrauterine devices market by 2035?

The France intrauterine devices market size is expected to reach USD 444.5 million by 2035.

- What are the key growth drivers of the France intrauterine devices market?

increasing awareness of long-acting reversible contraception (LARC) and its benefits, the rise in demand for long-term, low-maintenance birth control, and reimbursement policies for both hormonal and non-hormonal IUDs.

- Which distribution channel segment dominated the market in 2024?

The hospitals segment held the largest market share in 2024.

- Which product segment accounted for the largest market share in 2024?

The hormonal intrauterine devices segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 198 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |