France Liquid Dietary Supplements Market

France Liquid Dietary Supplements Market Size, Share, and COVID-19 Impact Analysis, By Ingredients (Vitamin, Botanicals, Minerals, Proteins & Amino Acids, Fibers & Specialty Carbohydrates, and Others), By Type (OTC and Prescribed), By Application (Bone & Joint Health, Gastrointestinal Health, Immunity, Cardiac Health, Prenatal Health, and Others), By End User (Adult, Geriatric, Children, Infant, and Others), and France Liquid Dietary Supplements Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Liquid Dietary Supplements Market Insights Forecasts to 2035

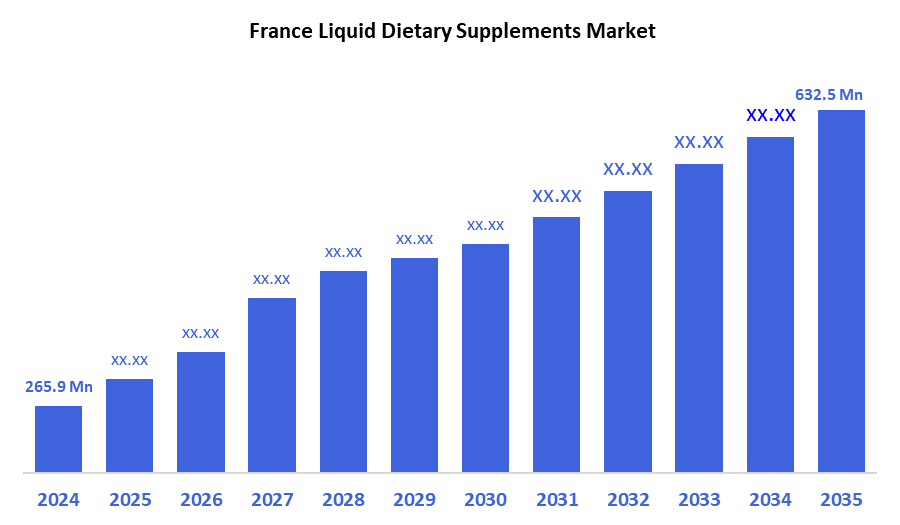

- The France Liquid Dietary Supplements Market Size Was Estimated at USD 265.9 Million in 2024.

- The France Liquid Dietary Supplements Market Size is Expected to Grow at a CAGR of Around 8.2% from 2024 to 2035.

- The France Liquid Dietary Supplements Market Size is Expected to Reach USD 632.5 Million

According to a Research Report Published by Decision Advisiors & Consulting, the France Liquid Dietary Supplements Market size is projected to reach USD 632.5 Million by 2035, Growing at a CAGR of 8.2% from 2025 to 2035. The France liquid dietary supplements market is driven by a growing health-consciouspopulation, an aging demographic, and a greater focus on preventive healthcare. Increased demand for natural, plant-based products like botanicals and functional beverages is also a key driver, as is the convenience and faster absorption of liquid formats compared to pills. The sports nutrition sector, particularly among athletes and fitness enthusiasts, further fuels growth.

Market Overview

The France liquid dietary supplement sector includes products containing vitamins, minerals, herbal extracts, and protein, which provide nutritionally added value in the form of fluids. Supplements come in many forms, such as Liquid supplement beverages, drinks, syrups, tonics, and other liquid supplement types that make them easy to consume if both a child and an adult are to meet all of their nutritional Needs. Supplement to help maintain healthy immune system function, promote healthy digestion, promote energy levels, maintain strong bones, lose excess fat, and maintain overall health. The France liquid dietary supplement sector aims to simplify the process by which you supplement your diet with additional nutrients, due to the relatively easy accessibility of liquid supplements versus the typical food sources.

Liquid dietary supplements have a strong potential market in France, which has a large and growing elderly population with a series of underlying health problems related to lifestyle choices. France provides an attractive opportunity for liquid dietary supplement sales. In relation to its population of 64.4 million people, France also has 7.4 percent living with diabetes, 17.2 percent considered obese, and 30 percent suffering from hypertension (high blood pressure). Because many France people do not get adequate amounts of specific essential vitamins and minerals, particularly calcium, magnesium, iron, and B vitamins, most women, young people, and older adults are experiencing vitamin and mineral deficiencies in at least one of these categories. Approximately one in two adult France people is considered overweight or obese; therefore, the majority will likely develop health problems resulting from poor dietary habits. There exists great potential to offer assistance to this demographic segment by providing liquid nutritional supplements. These products are very beneficial to the consumer due to their rapid absorption and ease of use by individuals of any age. Additionally, as the demand for liquid dietary supplements continues to increase within France, more opportunities exist to assist with the total lack of nutrition, manage chronic diseases, and promote overall health.

Report Coverage

This research report categorizes the market for the France liquid dietary supplements market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France liquid dietary supplements market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France liquid dietary supplements market.

Driving factors

The France liquid dietary supplements market is driven by increased awareness of health issues (and preventative health and wellness), causing consumers to seek out more convenient ways to support their immune system, heart health, digestive system, and overall nutrition, resulting in a rise in liquid dietary supplement sales in France. The France liquid dietary supplements market growth is also driven by the increase in the number of people living with chronic diseases and the growing number of older adults (the Baby Boomer Generation), both of whom often have difficulty taking pills. Thus, there is an increasing demand for liquid supplements because they are considered more convenient to take than pills and allow for easier absorption of nutrients. Liquid dietary supplements are becoming increasingly popular with busy professionals and children, as well as seniors.

Restraining Factors

The France liquid dietary supplements market faces several restraining factors that limit its growth. Regulatory compliance costs are increasing and slowing down the introduction of new products for manufacturers due to strict regulations around ingredient certification, product labelling, and health. The lack of trust in the liquid supplement category is driven by quality, safety, and misleading claims. Additionally, liquid supplements are competing against other products for market share, including fortified foods, functional beverages, and traditional medicine, which are viewed by many consumers as a more trusted or cost-effective option.

Market Segmentation

The France liquid dietary supplements market share is categorized by ingredients, type, application, and end user.

- The botanicals segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The France liquid dietary supplements market is segmented by ingredients into vitamins, botanicals, minerals, proteins & amino acids, fibers & specialty carbohydrates, and others. Among these, the botanicals segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The botanical segmental growth is due to the rising consumer preference for natural and plant-based health solutions in France, driven by increasing awareness of the benefits of herbal extracts and functional botanicals for overall wellness. Consumers are increasingly seeking supplements that support immunity, digestion, stress relief, and energy without synthetic additives or chemicals. The popularity of traditional and herbal remedies, combined with modern formulations in liquid form, makes botanicals convenient and appealing.

- The OTC segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The France liquid dietary supplements market is segmented by type into OTC and prescribed. Among these, the OTC segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The OTC segmental growth is due to the increasing consumer preference for self-care and preventive health solutions in France, allowing individuals to easily access supplements without a prescription. Convenience, ease of purchase through pharmacies, supermarkets, and online stores, and the growing awareness of the benefits of vitamins, minerals, and botanicals for general wellness drive demand.

- The bone & joint health segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France liquid dietary supplements market is segmented by application into bone & joint health, gastrointestinal health, immunity, cardiac health, prenatal health, and others. Among these, the bone & joint health segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The bone & joint health segmental growth is due to the increasing prevalence of osteoporosis, arthritis, and age-related musculoskeletal conditions in France, particularly among the growing elderly population. Rising awareness of the importance of maintaining strong bones and joints through adequate intake of calcium, vitamin D, magnesium, and other nutrients is driving demand.

- The adult held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The France liquid dietary supplements market is segmented by end user into adult, geriatric, children, infant, and others. Among these, the adult segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The adults' segmental growth is due to the increasing health awareness and focus on preventive care among adults in France, who are seeking convenient ways to maintain overall wellness, energy, and immunity. Adults often face lifestyle-related health issues such as stress, poor diet, and sedentary habits, which increase the need for nutritional support through supplements. The preference for easy-to-consume liquid formats makes supplements more appealing to busy working adults. Additionally, the rising prevalence of chronic conditions, nutritional deficiencies, and the desire to support bone, joint, and cardiovascular health further drive the adoption of liquid dietary supplements in the adult population.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France liquid dietary supplements market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nestle Health Science

- Amway Corp

- Herbalife International of America, Inc.

- ADM

- Naturex

- SUPERDIET

- Abbott

- Bayer AG

- Glanbia PLC

- Pfizer Inc.

- Others

Key Target Audience

Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2025, Valbiotis announced that its Phase II/III Lipidrive clinical trial (HEART II) successfully met its primary endpoint, showing a highly significant reduction in LDL cholesterol in individuals with mild to moderate hypercholesterolemia after 3 months, along with excellent safety and tolerability.

- In February 2024, Danone opened a new plant-based beverage facility in Villecomtal-sur-Arros, France, producing oat-based Alpro drinks. The €43 million facility, with high-speed lines, supplies 26 European markets, supporting Danone’s plant-based growth strategy.

- In February 2024, Danone officially opened its upgraded plant-based beverage facility in Villecomtal-sur-Arros, France, specializing in oat-based drinks for its popular Alpro brand.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decision advisior has segmented the France Liquid Dietary Supplements Market based on the below-mentioned segments:

France Liquid Dietary Supplements Market, By Ingredients

- Vitamin

- Botanicals

- Minerals

- Proteins & Amino Acids

- Fibers & Specialty Carbohydrates

- Others

France Liquid Dietary Supplements Market, By Type

- OTC

- Prescribed

France Liquid Dietary Supplements Market, By Application

- Bone & Joint Health

- Gastrointestinal Health

- Immunity

- Cardiac Health

- Prenatal Health

- Others

France Liquid Dietary Supplements Market, By End User

- Adult

- Geriatric

- Children

- Infant

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France liquid dietary supplements market?

The France liquid dietary supplements market size is expected to grow at a CAGR of around 8.2% from 2024 to 2035.

- What is the France liquid dietary supplements market size in 2024?

The France liquid dietary supplements market size was estimated at USD 265.9 million in 2024.

- What is the projected market size of the France liquid dietary supplements market by 2035?

The France liquid dietary supplements market size is expected to reach USD 632.5 million by 2035.

- What are the key growth drivers of the France liquid dietary supplements market?

A growing health-conscious population, an aging demographic, and a greater focus on preventive healthcare. Increased demand for natural, plant-based products. The sports nutrition sector, particularly among athletes and fitness enthusiasts, further fuels growth.

- Which ingredients segment dominated the market share in 2024?

The botanicals dominated the market share in 2024.

- Which application segment accounted for the largest market share in 2024?

The bone & joint health segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 190 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |