France Lithium-ion Battery Market

France Lithium-ion Battery Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt, Lithium Manganese Oxide, Others), By Power Capacity (0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, More than 60000mAh), and France Lithium-ion Battery Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Lithium-ion Battery Market Insights Forecasts to 2035

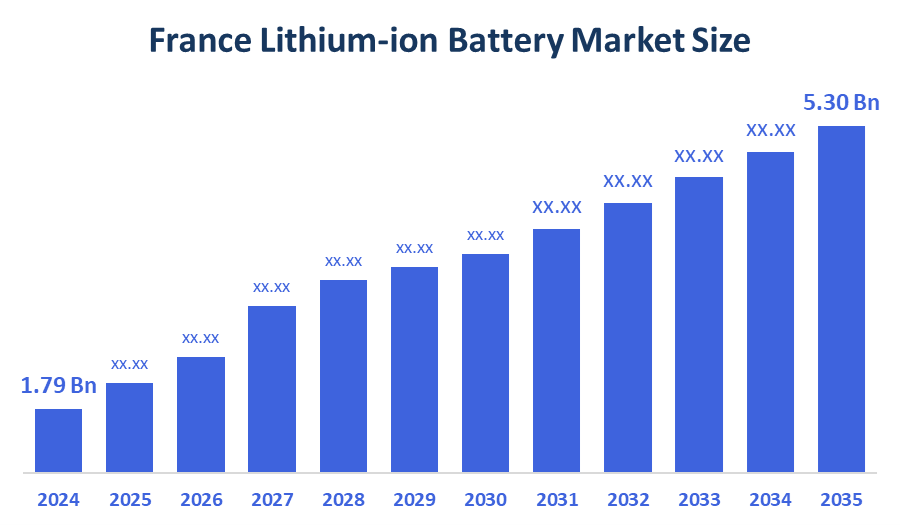

- The France Lithium-ion Battery Market Size was estimated at USD 1.79 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.37% from 2025 to 2035

- The France Lithium-ion Battery Market Size is Expected to Reach USD 5.30 Billion by 2035

According to a research report published by Spherical Insights & Consulting, The France Lithium-ion Battery Market is anticipated to reach USD 5.30 Billion by 2035, growing at a CAGR of 10.37% from 2025 to 2035. The French market for lithium-ion batteries is anticipated to grow as a result of the rising demand for electric cars.

Market Overview

The France lithium-ion battery market refers to the national ecosystem around the production, distribution, and use of lithium-ion battery technologies across diverse sectors. It encompasses energy storage systems, electric mobility, consumer electronics, and industrial systems, reinforced with innovative technologies, sustainable development objectives, and government-supported electrification initiatives. Additionally, the goal of massive investments in gigafactories, like the ones in Hauts-de-France, is to increase domestic battery manufacturing capacity and lessen dependency on imports. Improvements in battery technology, such as increased energy density and quicker charging times, are also helping the market. These developments enhance performance and expand the range of applications beyond EVs to include stationary energy storage for grids. Manufacturers are being pushed to concentrate on recycling and creating batteries with lower carbon footprints by environmental regulations and EU-wide climate targets. The competitive landscape is being shaped by supply chain localization initiatives and collaborations among battery manufacturers, automakers, and energy firms. France is positioned as a key hub in Europe's lithium-ion battery value chain as a result of businesses investigating sustainable sourcing and substitutes for essential minerals in response to the growing demand for raw materials.

Report Coverage

This research report categorizes the market for the France lithium-ion battery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the lithium-ion battery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the lithium-ion battery market.

Driving Factors

The idea of raising more money for lithium-ion battery recycling is a result of France's efforts to address environmental issues. As a result, the industry becomes more sustainable. Additionally, France's underlying message of less reliance on foreign-based factories supports the notion of domestically produced batteries for easier job creation and economic growth. The current market demonstrates a new trend of automakers working with battery producers to improve battery performance and streamline supply chains. France is increasingly investing in specialized research and development to improve battery efficiency and reduce costs.

Restraining Factors

The market for lithium-ion batteries in France is constrained by a number of factors, such as high production costs, restricted domestic availability of vital raw materials like cobalt and lithium, and difficult recycling and disposal issues. Further obstacles to sustainability and compliance are energy-intensive manufacturing processes and strict environmental regulations. Scalability and long-term cost efficiency for domestic producers are further limited by competition from alternative battery chemistries and global supply chain dependencies.

Market Segmentation

The lithium-ion battery market share is classified into product type and power capacity

- The lithium iron phosphate segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The lithium-ion battery market is segmented by product type into lithium cobalt oxide, lithium iron phosphate, lithium nickel manganese cobalt, lithium manganese oxide, and others. Among these, the lithium iron phosphate segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to its outperforms other lithium-ion chemistries in terms of thermal stability, safety profile, and lifespan. It is perfect for industrial applications, energy storage systems, and electric vehicles due to its affordability and ability to withstand overheating. Demand is also being accelerated by growing adoption by top EV manufacturers and encouraging government policies that support sustainable energy solutions, making LFP the go-to option for scalable and dependable battery technologies.

- The 10000mAh to 60000mAh segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The lithium-ion battery market is segmented by power capacity into 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, and more than 60000mAh. Among these, the 10000mAh to 60000mAh segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the growing need for high-capacity lithium-ion batteries in energy storage systems, industrial machinery, and electric cars. This capacity range is perfect for supporting electrification and grid stability because these applications demand higher energy densities, longer operating cycles, and dependable performance. The growth of the automotive, logistics, and infrastructure sectors is also being accelerated by developments in battery technology, cost reduction, and government policies that encourage the use of clean energy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the lithium-ion battery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Saft Groupe

- Forsee Power

- Verkor

- Leclanché

- EasyLi

- Olenergies

- Others

Recent Developments:

- In July 2025, Manitou Group and Hangcha Group had planned a joint venture in Le Mans, France, to produce and distribute lithium-ion batteries, pending European competition approval. The venture targeted replacing lead-acid batteries in industrial vehicles, boosting efficiency, lifespan, and supporting the electrification of new product lines, including the Manitou ME LIFT forklift range.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Lithium-ion Battery Market based on the below-mentioned segments:

France Lithium-ion Battery Market, By Product Type

- Lithium Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt

- Lithium Manganese Oxide

- Others

France Lithium-ion Battery Market, By Power Capacity

- 0 to 3000mAh

- 3000mAh to 10000mAh

- 10000mAh to 60000mAh

- More than 60000mAh

FAQ’s

Q: What is the lithium-ion battery market size?

A: France Lithium-ion Battery Market is expected to grow from USD 1.79 billion in 2024 to USD 5.30 billion by 2035, growing at a CAGR of 10.37% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Lithium-ion battery market growth is primarily driven by the growing demand for electric vehicles, the integration of renewable energy, technological advancements, favorable government policies, and growing adoption in consumer electronics and industrial applications.

Q: What factors restrain the lithium-ion battery market?

A: The market for lithium-ion batteries is particularly constrained by high production costs, a shortage of raw materials, safety issues, difficult recycling procedures, and environmental laws that affect widespread use in the energy storage and automotive industries.

Q: Who are the key players in the lithium-ion battery market?

A: Saft Groupe, Forsee Power, Verkor, Leclanché, EasyLi, Olenergies, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 222 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |