France Meat Market

France Meat Market Size, Share, and COVID-19 Impact Analysis, By Type (Fresh Meat and Processed Meat) By Product (Poultry, Pork, Beef, Lamb & Goat, Seafood, and Others), and France Meat Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Meat Market Insights Forecasts to 2035

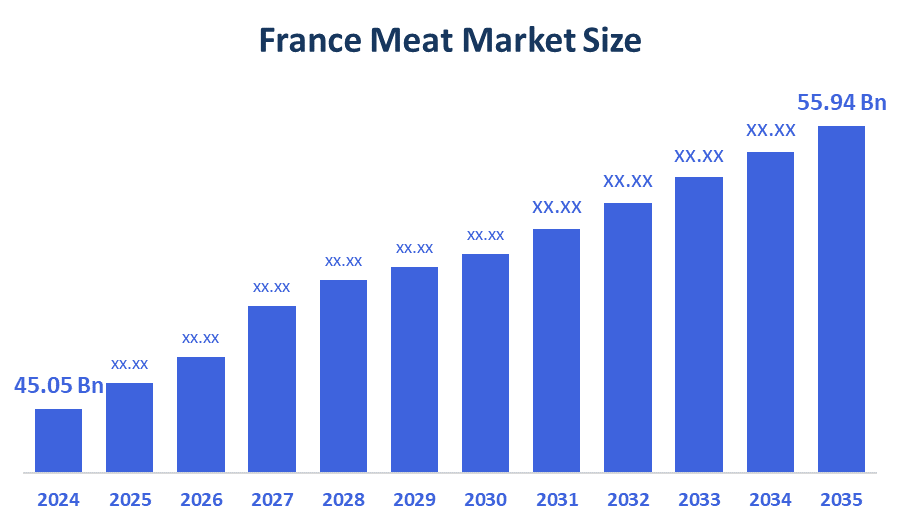

- The France Meat Market Size was estimated at USD 45.05 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 1.99% from 2025 to 2035

- The France Meat Market Size is Expected to Reach USD 55.94 Billion by 2035

According to a research report published by Spherical Insights & Consulting, The France Meat Market is anticipated to reach USD 55.94 Billion by 2035, Growing at a CAGR of 1.99% from 2025 to 2035. Growing interest in flexitarian diets and changing consumer preferences for organic, ethically sourced, and healthier options are driving the market.

Market Overview

The France meat market pertains to the domestic milieu of producing, distributing and consuming food products derived from animals. Additionally, the premium and organic segments present opportunities for the French meat market. It can create products with added value for consumers who are health-conscious. Specialty lines emphasizing quality and traceability can be introduced by retailers. Convenient, high-quality options are in high demand due to growing urban populations. Collaborations with nearby farms increase the legitimacy and genuineness of a brand. Certifications can be used by the market to increase customer confidence. Direct access to niche markets is made possible by e-commerce platforms. It gains from consumers' growing willingness to pay for sustainably and ethically produced meat.

Report Coverage

This research report categorizes the market for the France meat market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France meat market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France meat market.

Driving Factors

The market depends on advancements in technology to preserve the safety and freshness of its products. To increase shelf life, it makes use of creative packaging ideas. Meat is delivered to customers without deteriorating in quality due to cold chain logistics. Processing automation increases efficiency and lowers the risk of contamination. In order to comply with regulations, producers use contemporary methods. Systems for traceability are becoming more and more important for quality control. Safer distribution networks benefit the French meat market. Retailers spend money on cutting-edge storage facilities. Adoption of technology increases consumer trust and market credibility.

Restraining Factors

Growing feed and livestock costs are a problem for the French meat market. The price fluctuations of raw materials put pressure on its margins. Profitability is also impacted by energy and transportation expenses. While maintaining quality, producers find it difficult to keep prices competitive. Smaller players are put under pressure by market consolidation. Operating costs are increased by adhering to stringent regulations. During price increases, consumers might switch to other proteins. To control cost volatility, strategic planning is required. The complexity of production is increased by sustainable sourcing.

Market Segmentation

The France meat market share is classified into type and product.

- The fresh meat segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France meat market is segmented by type into fresh meat and processed meat. Among these, the fresh meat segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to natural and unprocessed products are strongly preferred by consumers. It gains from the cultural dependence on regional ingredients and traditional cooking methods.

- The poultry segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France meat market is segmented by product into poultry, pork, beef, lamb & goat, seafood, and others. Among these, the poultry segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The market is driven by its low cost, low nutritional content, and versatility in a variety of culinary styles. Consumers' growing health consciousness has raised demand for low-fat protein sources, and the growing acceptance of free-range and organic poultry is in line with changing sustainability and animal welfare regulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France meat market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fleury Michon

- Bigard Group

- Cooperl Arc Atlantique

- SVA Jean Rozé

- Socopa Viandes

- Charal

- others

Recent Developments:

- In July 2024, French start-up Gourmey became the first company to apply for EU approval to sell cultivated meat, having submitted its application to EFSA for lab-grown foie gras. The process was expected to take at least 18 months. Applications were also filed in the U.S., U.K., Switzerland, and Singapore, reflecting growing global interest. Gourmey emphasized that no GMOs were used, aligning with EU novel food regulations. Experts noted that food innovation could complement traditional cuisine sustainably.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the France Meat Market based on the below-mentioned segments:

France Meat Market, By Type

- Fresh Meat

- Processed Meat

France Meat Market, By Product

- Poultry

- Pork

- Beef

- lamb & goat

- seafood

- others

FAQ’s

Q: What is the France meat market size?

A: France Meat Market is expected to grow from USD 45.05 billion in 2024 to USD 55.94 billion by 2035, growing at a CAGR of 1.99% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Increased demand for diets high in protein, growing inclination for meat from ethical and organic sources, growing flexitarian lifestyles, and increased consumer attention to sustainability and transparency are the main factors propelling the meat market in France.

Q: What factors restrain the France meat market?

A: Growing plant-based dietary preferences, regulatory pressures on livestock emissions, moral concerns about animal welfare, and growing demand for sustainable, traceable, and low-impact protein substitutes are some of the factors pushing back France's meat market.

Q: Who are the key players in the France meat market?

A: Fleury Michon, Bigard Group, Cooperl Arc Atlantique, SVA Jean Rozé, Socopa Viandes, Charal, others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |