France Medical Imaging Market

France Medical Imaging Market Size, Share, and COVID-19 Impact Analysis, By Technology (X-ray, Magnetic Resonance Imaging, Ultrasound, Computed Tomography, Nuclear Imaging, and Others), By End User (Hospitals and Diagnostic Imaging Centers), and France Medical Imaging Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Medical Imaging Market Insights Forecasts to 2035

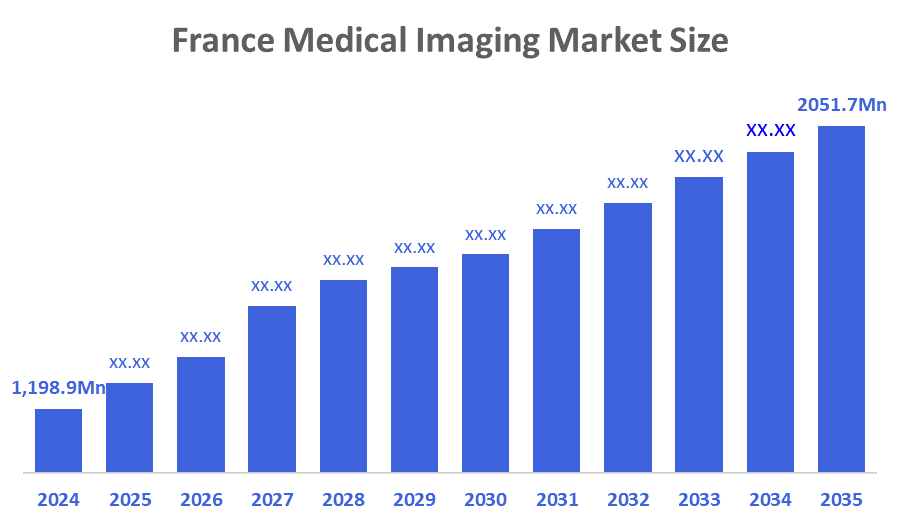

- The France Medical Imaging Market Size Was Estimated at USD 1,198.9 Million in 2024

- The France Medical Imaging Market Size is Expected to Grow at a CAGR of Around 5.01% from 2025 to 2035

- The France Medical Imaging Market Size is Expected to Reach USD 2051.7 Million by 2035

According To a Research Report Published By Decisions Advisors & Consulting, The France Medical Imaging Market Size is Anticipated To Reach USD 2051.7 Million By 2035, Growing At a CAGR of 5.01% From 2025 to 2035. The France medical imaging equipment market is driven by the rising prevalence of chronic diseases such as cancer, cardiovascular, and neurological disorders. Increasing healthcare expenditure and investment in advanced diagnostic technologies fuel market growth. An aging population boosts demand for regular medical imaging. Expansion of hospital infrastructure and focus on preventive healthcare further support market growth.

Market Overview

The France medical imaging market includes all of the technology and equipment used to create images of the body's internal structures (e.g., CT scans, MRIs, and ultrasounds) for diagnosing, monitoring, and treating illnesses. Medical imaging modalities include X-rays, MRI, CT, ultrasound, and nuclear medicine, plus hybrid imaging equipment. The market includes hospitals and diagnostic centers that use these devices to treat patients, as well as the maintenance, sale, and technological advances that make delivering good-quality medical imaging service possible within France.

In France there is an increased demand for medical imaging due to a large number of chronic and lifestyle-related medical conditions. Approximately 3.7 million consumers in France had cancer in 2024. Cardiovascular disease is still the number one cause of death in France, with over 1.5 million adults having cardiovascular disease. Other disorders, such as Alzheimer's and other forms of dementia, affect approximately 1.2 million individuals in France, and the number of people with dementia will continue to rise as the population ages. France is facing an aging population, which means that more than 20% of the France population is aged 65 or older. Because of this increase in the population's average age, there is a growing need for more frequent diagnostic imaging procedures to monitor the health of older individuals.

The growing number of obese and diabetic individuals in France, as well as the growing incidence of lifestyle-related illnesses, is contributing to the increasing use of medical imaging equipment for the early detection and accurate diagnosis of diseases, as well as for planning the treatment of patients. Therefore, the medical imaging equipment market is a key component in France's healthcare system.

Report Coverage

This research report categorizes the market for the France medical imaging market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France medical imaging market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France medical imaging market.

Driving Factors

The France medical imaging market is driven by the rising prevalence of chronic and lifestyle-related diseases, including cancer, cardiovascular disorders, and neurological conditions, which create strong demand for early and accurate diagnostics. An aging population, with over 20% of citizens aged 65 and above, further increases the need for regular imaging to monitor age-related health issues. Technological advancements such as AI-assisted imaging, 3D imaging, and hybrid modalities enhance diagnostic accuracy and efficiency, while growing healthcare expenditure and expansion of hospitals and diagnostic centers support wider adoption.

Restraining Factors

The France medical imaging market is severely impacted by the cost of advanced imaging technology and the high maintenance costs associated with such technology, resulting in limited adoption and utilization within smaller healthcare facilities. Additionally, strict regulations and lengthy approval processes delay the entry of new devices into the marketplace and limit the number of devices available to care providers. Limited numbers of trained radiologists and technicians limit the ability to utilize optimal diagnostic imaging technology for patient care. Finally, concerns regarding patient exposure to radiation have limited the adoption and utilization of certain imaging modalities.

Market Segmentation

The France medical imaging market share is categorized by technology and end user.

- The ultrasound segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France medical imaging market is segmented by technology into X-ray, magnetic resonance imaging, ultrasound, computed tomography, nuclear imaging, and others. Among these, the ultrasound segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the widespread use of ultrasound for non-invasive, real-time imaging across various medical applications, including obstetrics, cardiology, and musculoskeletal diagnostics. Its safety, cost-effectiveness, portability, and ease of use make it highly preferred in hospitals, clinics, and diagnostic centers. Additionally, technological advancements such as 3D/4D imaging and Doppler capabilities further enhance its diagnostic accuracy and expand its adoption in France.

- The hospitals segment held the largest market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France medical imaging market is segmented by end user into hospitals and diagnostic imaging centers. Among these, the hospitals segment held the largest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period. The hospital’s segmental growth is due to increasing demand for advanced diagnostic imaging services, the rising prevalence of chronic and lifestyle-related diseases, and significant investments in healthcare infrastructure. Hospitals are increasingly adopting sophisticated imaging technologies such as MRI, CT, and PET scanners to provide comprehensive in-house diagnostic solutions. Expansion of healthcare facilities further drives the growth of the hospital segment in France’s medical imaging market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France medical imaging market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GE Aerospace

- Koninklijke Philips NV

- Siemens Healthineers AG ADR

- Canon Inc

- Mindray Medical International

- FUJIFILM Holdings Corp

- Carestream Health - HCIS business

- Hitachi Ltd

- Samsung Electronics Co Ltd

- Koning, PerkinElmer

- Konica Minolta Inc

- Esaote

- Hologic Inc

- Varex Imaging Corp

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, SuperSonic Imagine announced the launch of the Aixplorer Mach 30 ultrasound scanner, featuring advanced capabilities such as SonicPad for intuitive control and enhanced imaging techniques. This new system was showcased at various conferences in France and is designed to improve diagnostic efficiency and accuracy.

- In June 2023, Carestream Health unveiled several new imaging technologies at the AHRA 2023 conference, including the DRX-Rise Mobile X-ray System and the DRX-LC Detector. These innovations are designed to improve diagnostic confidence and enhance patient and provider experiences while maintaining budget efficiency.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Medical Imaging Market based on the below-mentioned segments:

France Medical Imaging Market, By Technology

- X-ray

- Magnetic Resonance Imaging

- Ultrasound

- Computed Tomography

- Nuclear Imaging

- Others

France Medical Imaging Market, By End User

- Hospitals

- Diagnostic Imaging Centers

Frequently Asked Questions (FAQ)

- What is the CAGR of the France medical imaging market?

The France medical imaging market size is expected to grow at a CAGR of around 5.01% from 2024 to 2035.

- What is the France medical imaging market size in 2024?

The France medical imaging market size was estimated at USD 1,198.9 million in 2024.

- What is the projected market size of the France medical imaging market by 2035?

The France medical imaging market size is expected to reach USD 2051.7 million by 2035.

- What are the key growth drivers of the France medical imaging market?

Rising health consciousness, increasing sports and fitness participation, growing demand for clean-label and plant-based products, and wider availability through e-commerce and retail channels.

- Which end-user segment held the largest market share in 2024?

The hospitals segment held the largest market share in 2024.

- Which technology segment accounted for the largest market share in 2024?

The ultrasound accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Regional |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |