France Mineral Processing Equipment Market

France Mineral Processing Equipment Market Size, Share, and COVID-19 Impact Analysis, BY MINERAL Mining Sector (Bauxite, Iron, Lithium, and Others), By Equipment Type (Crushers, Feeders, Conveyors, Drills & Breakers, and Others), By Mining Method (Surface Mining and Underground Mining), By Automation Level (Manual, Semi-Automated, Fully Automated, and Others), and France Mineral Processing Equipment Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Mineral Processing Equipment Market Insights Forecasts to 2035

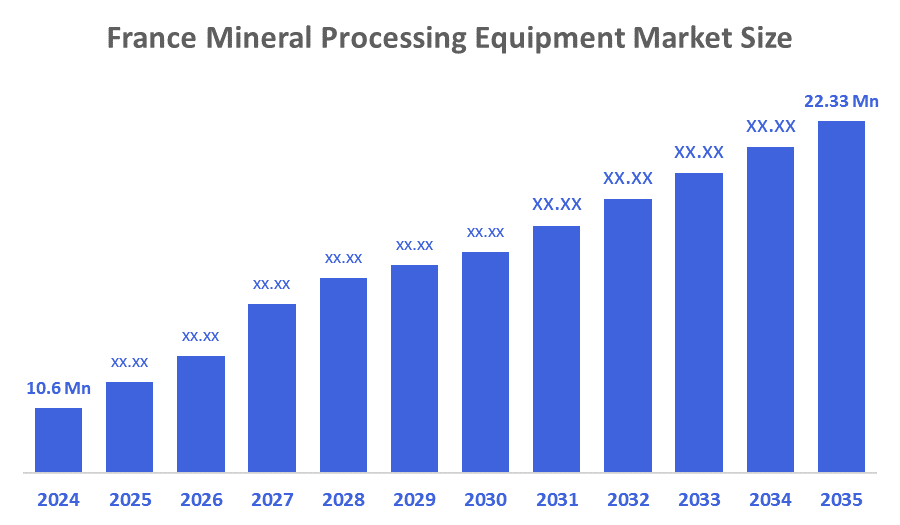

- The France Mineral Processing Equipment Market Size Was Estimated at USD 10.6 Million in 2024.

- The France Mineral Processing Equipment Market Size is Expected to Grow at a CAGR of Around 7.01% from 2025 to 2035.

- The France Mineral Processing Equipment Market Size is Expected to Reach USD 22.33 Million by 2035.

According to a research report published by Decision Advisior & Consulting, the France Mineral Processing Equipment Market size is anticipated to reach USD 22.33 million by 2035, growing at a CAGR of 7.01% from 2025 to 2035. The France mineral processing equipment market is driven by rising demand for critical minerals like lithium, government incentives for modern, energy-efficient processing systems, and growing adoption of automation and digital technologies, all supported by ongoing replacement of aging equipment.

Market Overview

The France mineral processing equipment market refers to the industry that includes production, supply, and employment of machinery and equipment that extract, refine, or prepare minerals such as bauxite, iron, lithium, etc. Mineral processing equipment encompasses numerous types of equipment, such as crushers, feeders, data collection devices, conveyor systems, drilling machinery, breaking machinery, etc., for use in both surface and underground mining. Additionally, the mineral processing equipment market considers various degrees of automation, from manually operated to semi-automated or fully-automated machinery, along with the diverse end-user groups from the mining, metallurgy, and other related manufacturing industries. The France mineral processing equipment market plays a significant role in improving operational efficiency, lowering production costs, and increasing the quality and yield of minerals produced in France.

France’s mineral processing equipment market is increasingly necessary due to the growing demand for critical minerals, including lithium, rare earths, and iron, which are essential for green technologies, electric vehicles, and industrial applications. The market is important strategically, as it supports France’s industrial sovereignty, reduces dependency on imports (particularly from China), and aligns with EU policies such as the Critical Raw Materials Act. Key conditions enabling adoption include ongoing modernization of aging mining and processing facilities, government-backed programs like France 2030 that provide financial incentives and tax support, regulatory pressures for energy-efficient and low-emission operations, rising labor costs and shortages that encourage automation, and increasing investments in surface and underground mining operations. These factors collectively create a strong need, highlight strategic importance, and establish favorable conditions for the growth of the mineral processing equipment market in France.

Report Coverage

This research report categorizes the market for the France mineral processing equipment market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France mineral processing equipment market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France mineral processing equipment market.

Driving Factors

The France mineral processing equipment market is driven by rising demand for critical minerals (especially lithium and rare earths), government support through France 2030 and green-industry incentives, and increasing adoption of automation and digitalized processing systems. Growth is further supported by the need to replace aging equipment fleets and improve energy efficiency to meet stricter environmental regulations. At the same time, modernization of both surface and underground mining operations boosts demand, while challenges such as high investment costs, skilled-labor shortages, and permitting delays shape the pace of market expansion.

Restraining Factors

The France mineral processing equipment market faces several restraining factors, including strict environmental regulations and lengthy permitting procedures that delay project timelines, along with high capital and operating costs that make advanced systems difficult for smaller companies to adopt. The market is further limited by shortages of skilled labor needed to operate and maintain modern, automated equipment, as well as supply-chain vulnerabilities and reliance on imported components that can increase costs and lead to delivery delays.

Market Segmentation

The France mineral processing equipment market share is categorized by mineral mining sector, equipment type, mining method, and automation level.

- The iron segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France mineral processing equipment market is segmented by mineral mining sector into bauxite, iron, lithium, and others. Among these, the iron segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The iron segment's growth is driven by France’s steady demand for iron ore in steel and construction applications, ongoing modernization of processing facilities, and the replacement of aging equipment to enhance efficiency and reduce energy consumption. Additionally, advancements in automated crushing, screening, and separation technologies support higher productivity in iron processing, while government emphasis on strengthening domestic industrial value chains further reinforces investment in this segment.

- The crushers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France mineral processing equipment market is segmented by equipment type into crushers, feeders, conveyors, drills & breakers, and others. Among these, the crushers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The crusher’s segmental growth is driven by the increasing demand for efficient size reduction of mined materials, the modernization and expansion of processing plants, and the replacement of outdated crushing systems with more energy-efficient, high-capacity, and automated models. Additionally, rising demand for advanced crushers that offer improved wear resistance, reduced maintenance requirements, and enhanced productivity further supports the strong growth of this segment in the France mineral processing equipment market.

- The surface mining segment held the largest market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France mineral processing equipment market is segmented by mining method into surface mining and underground mining. Among these, the surface mining segment held the largest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period. The surface mining segmental growth is due to the widespread presence of easily accessible near-surface mineral deposits in France, which makes surface extraction more cost-effective and operationally efficient compared to underground methods. Additionally, surface mining supports higher production volumes with lower equipment and labor requirements, driving continuous demand for crushers, conveyors, and other processing machinery, further contributing to the strong growth of this segment.

- The semi-automated segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France mineral processing equipment market is segmented by automation level into manual, semi-automated, fully automated, and others. Among these, the semi-automated segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The semi-automated segment's growth is driven by its balanced combination of cost-effectiveness and operational efficiency, allowing mining operations to enhance productivity without the high investment required for fully automated systems. Semi-automated equipment also reduces labor dependence while still enabling operator oversight, making it suitable for mines transitioning toward digitalization. Additionally, its easier integration into existing processing lines and lower maintenance complexity support its widespread adoption across France’s mineral processing facilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France mineral processing equipment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Metso Outotec

- Sandvik AB

- FLSmidth A/S

- The Weir Group PLC

- Komatsu Ltd.

- thyssenkrupp Industrial Solutions AG

- Fives Group

- CDE Global Ltd.

- BHS-Sonthofen GmbH

- TAKRAF GmbH

- Terex Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2025, the France company Caremag SAS (subsidiary of Carester SAS) secured €216 million in financing to build a large-scale rare-earth recycling and refining facility in Lacq, southwestern France, boosting future demand for mineral processing equipment.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035.Decision Advisior has segmented the France Mineral Processing Equipment Market based on the below-mentioned segments:

France Mineral Processing Equipment Market, By Mineral Mining Sector

- Bauxite

- Iron

- Lithium

- Others

France Mineral Processing Equipment Market, By Equipment Type

- Crushers

- Feeders

- Conveyors

- Drills & Breakers

- Others

France Mineral Processing Equipment Market, By Mining Method

- Surface Mining

- Underground Mining

France Mineral Processing Equipment Market, By Automation Level

- Manual

- Semi-Automated

- Fully Automated

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France mineral processing equipment market?

The France mineral processing equipment market size is expected to grow at a CAGR of around 7.01% from 2024 to 2035.

- What is the France mineral processing equipment market size in 2024?

The France mineral processing equipment market size was estimated at USD 10.6 million in 2024.

- What is the projected market size of the France mineral processing equipment market by 2035?

The France mineral processing equipment market size is expected to reach USD 22.33 million by 2035.

- What are the key growth drivers of the France mineral processing equipment market?

Rising demand for critical minerals like lithium, government incentives for modern, energy-efficient processing systems, and growing adoption of automation and digital technologies.

- Which equipment type segment dominated the market in 2024?

The crushers segment dominated the market in 2024.

- Which mineral mining sector segment accounted for the largest market share in 2024?

The iron segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 204 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |