France Mobile Virtual Network Operator Market

France Mobile Virtual Network Operator Market Size, Share, and COVID-19 Impact Analysis, By Type (Business, Discount, M2M, Media, Migrant, Retail, Roaming, Telecom, and Others), By Operational Model (Full MVNO, Reseller MVNO, Service Operator MVNO, and Others), By End User (Consumer and Enterprise), and France Mobile Virtual Network Operator Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Mobile Virtual Network Operator Market Insights Forecasts to 2035

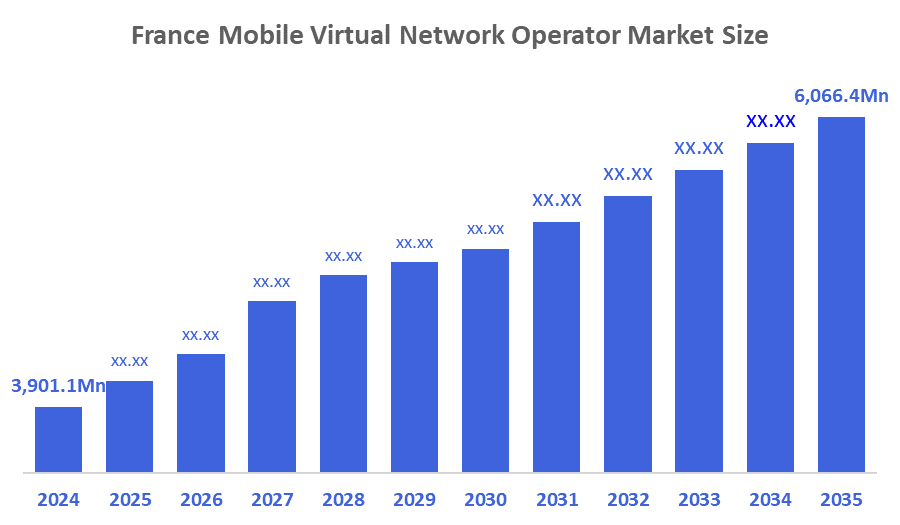

- The France Mobile Virtual Network Operator Market Size Was Estimated at USD 3,901.1 Million in 2024.

- The France Mobile Virtual Network Operator Market Size is Expected to Grow at a CAGR of Around 8.01% from 2025 to 2035.

- The France Mobile Virtual Network Operator Market Size is Expected to Reach USD 6,066.4 Million by 2035.

According To a Research Report Published By Decisions Advisors & Consulting, The France Mobile Virtual Network Operator Market Size Is Anticipated To Reach USD 6,066.4 Million By 2035, Growing At a CAGR of 8.01% From 2025 to 2035. The France mobile virtual network operator market is driven by customers increasingly seeking lower-cost, flexible options for mobile phone service with a supportive regulatory environment that supports competition. Growth in the number of users of 4G/5G as well as usage of data-heavy services has continued, encouraging the expansion of MVNOs. In addition, partnerships with major telecommunications companies create even greater opportunities for local and international MVNOs.

Market Overview

The France mobile virtual network operator market is a part of the telecommunications sector that allows companies to offer mobile services without owning their own mobile network infrastructure. Instead, MVNOs lease capacity on MNO networks and provide customers with their own branded mobile services. The MVNO market in France is composed of a wide range of services and providers that serve different market segments, including low-cost brands, retail-based MVNOs, providers aimed at migrants, media-linked services, and M2M/IoT services. As a result of the strong competition among MVNOs in France and their ability to offer competitive pricing and flexible service models, the MVNO market has become a very popular and competitive market for consumers in France.

The mobile virtual network operator (MVNO) market in France is vital because of the great demand for mobile coverage and population demographics. The data indicates that 98% of the total population (those aged 12 and over) use mobile phones, and approximately 91% of the total population are using smartphones, meaning nearly everyone in France relies on mobile communications for personal communication, business communication, financial services, and many daily life services. Furthermore, there are approximately 74.5 million mobile subscriptions in France, a number greater than the actual number of people who live in France. This demonstrates that there are many individuals with multiple SIM cards and demonstrates a great demand for flexible and inexpensive plans offered by MVNOs. Additionally, a portion of the population (lower-income households and elderly people) continues to be at risk of digital or financial exclusion; therefore, MVNOs provide an essential service to promote financial and digital inclusion by providing competitively priced mobile plans. Overall, these trends indicate MVNOs' importance in providing mobile communications at an affordable price and a flexible service to meet the diverse mobile communication needs of the entire France population.

Report Coverage

This research report categorizes the market for the France mobile virtual network operator market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France mobile virtual network operator market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France mobile virtual network operator market.

Driving Factors

The France mobile virtual network operator market is driven by high demand for affordable and flexible mobile phone plans, supportive regulations guaranteeing access to a mobile network, high levels of smartphone and internet usage, an increase in the number of niche market segments including migrant and retail plans, increased usage of 4G/5G technology, and the development of partnerships with major telecommunications operators, which drive the mobile virtual network operator (MVNO) sector within France.

Restraining Factors

The France mobile virtual network operator market is experiencing restraints due to the high rate of competition with MNOs as well as other MVNOs against each other, therefore putting pressure on pricing and margins. The MVNOs' dependence on a host network results in a lack of control over the quality and coverage of the services offered. Additionally, there is a limited ability for the MVNOs to differentiate their offerings, which creates difficulty for obtaining new customers and retaining existing customers. Lastly, there are ongoing changes to regulations along with increasing operational and marketing costs that will likely limit the growth of the market.

Market Segmentation

The France mobile virtual network operator market share is categorized by type, operational model, and end user.

- The discount segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France mobile virtual network operator market is segmented by type into business, discount, M2M, media, migrant, retail, roaming, telecom, and others. Among these, the discount segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The discount’s segmental growth is due to high consumer demand for affordable and flexible mobile plans, especially among price-sensitive users. Rising competition and economic pressures encourage customers to seek low-cost alternatives to traditional operators. Additionally, supportive regulatory policies and widespread smartphone and internet adoption make discount MVNO plans an attractive and accessible option for a large portion of the population, fueling the segment’s continued expansion.

- The full MVNO segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France mobile virtual network operator market is segmented by operational model into full MVNO, reseller MVNO, service operator MVNO, and others. Among these, the full MVNO segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The full MVNO segmental growth is due to its greater control over services, pricing, and customer experience compared to reseller or service operator models. Full MVNOs can offer customized plans, manage their own billing and customer support, and differentiate through niche or value-added services. This operational independence, combined with growing demand for flexible and affordable mobile solutions, enables full MVNOs to capture a larger market share and attract a diverse customer base, fueling their continued expansion.

- The consumer segment held the largest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France mobile virtual network operator market is segmented by end user into consumer and enterprise. Among these, the consumer segment held the largest market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The consumer segmental growth is driven by rising demand for affordable, flexible, and no-contract mobile plans among individual users. High smartphone and internet penetration, coupled with increasing data consumption for streaming, social media, and digital services, further fuels adoption. Additionally, niche offerings such as discount plans, migrant-focused services, and retail-branded packages appeal to diverse consumer needs, making the segment the largest and supporting its continued expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France mobile virtual network operator market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- EchoStar Corp Class A

- T-Mobile US Inc

- Tesco PLC

- Verizon Communications Inc

- Deutsche Telekom AG

- La Poste Telecom SAS (Bouygues Telecom)

- Syma Mobile

- Lebara France

- NRJ Mobile

- Lyca Mobile SARL

- Auchan Telecom

- Afone Mobile

- Coriolis Télécom

- Transatel (NTT Company)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2024, Nokia extended its infrastructure partnership with Iliad Group to reinforce radio and core upgrades across France.

- In October 2024, Bouygues Telecom launched the B.iG family-focused brand to defend its share in a price-squeezed consumer segment.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Mobile Virtual Network Operator Market based on the below-mentioned segments:

France Mobile Virtual Network Operator Market, By Type

- Business

- Discount

- M2M

- Media

- Migrant

- Retail

- Roaming

- Telecom

- Others

France Mobile Virtual Network Operator Market, By Operational Model

- Full MVNO

- Reseller MVNO

- Service Operator MVNO

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France mobile virtual network operator market?

The France mobile virtual network operator market size is expected to grow at a CAGR of around 8.01% from 2024 to 2035.

- What is the France mobile virtual network operator market size in 2024?

The France mobile virtual network operator market size was estimated at USD 3,901.1 million in 2024.

- What is the projected market size of the France mobile virtual network operator market by 2035?

The France mobile virtual network operator market size is expected to reach USD 6,066.4 million by 2035.

- What are the key growth drivers of the France mobile virtual network operator market?

Rising demand for low-cost and flexible mobile plans, growing adoption of 4G/5G, and data-heavy services further boost MVNO growth. Partnerships with major telecom operators also strengthen market opportunities.

- Which operational model segment dominated the market in 2024?

The full MVNO segment held the largest market share in 2024.

- Which type of segment accounted for the largest market share in 2024?

The discount segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Regional |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |