France Obesity Treatment Market

France Obesity Treatment Market Size, Share & Trends Analysis Report By Drug Class (GLP-1 Receptor Agonists, Lipase Inhibitors, Appetite Suppressants, Other Drug Class), By Route of Administration (Parenteral, Oral), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Other Distribution Channel), And Segment Forecasts to 2035

Report Overview

Table of Contents

France Obesity Treatment Market Insights Forecasts to 2035

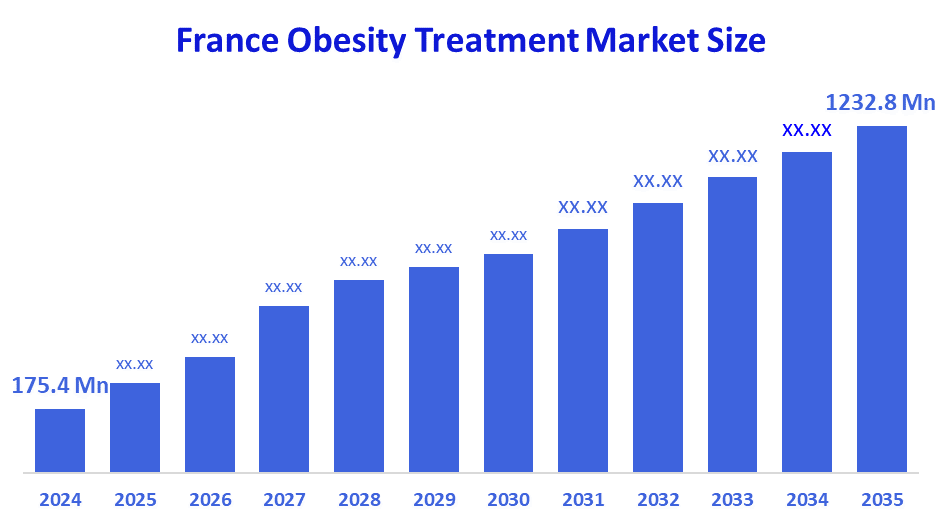

- France Obesity Treatment Market Size 2024: USD 175.4 Mn

- France Obesity Treatment Market Size 2035: USD 1232.8 Mn

- France Obesity Treatment Market CAGR 2024: 19.4%

- France Obesity Treatment Market Segments: Drug Class, Route of Administration, Distribution Channel

The France obesity, treatment market comprises medical solutions that are specially designed for the direct management of obesity and to help reduce the condition by suppressing the appetite, increasing the feeling of fullness, or blocking the absorption of fats. These include treatments such as GLP, 1 receptor agonists, lipase inhibitors, and appetite suppressants that are generally used in adults with obesity or in those who are overweight and have additional conditions like diabetes, cardiovascular disorders, and metabolic syndrome. The growing rate of obesity in France together with an increasing awareness of its risks to health is the main driver of demand for such effective pharmacological interventions.

The growth of the market is enabled by drug innovations such as semaglutide, tirzepatide, and liraglutide, which along with their improved efficacy, also result in increased patient compliance. Access to the drugs is made possible through retail and hospital pharmacies, while the parenteral and oral routes give patients the option to choose their preferred mode of administration. Adoption is further facilitated by government initiatives such as public, health campaigns, reimbursement schemes, and policies that promote obesity management. Research on next, generation GLP, 1 analogs, combination therapies, and the opening of outpatient and telemedicine, supported obesity programs are some of the future opportunities that will make France a major hub of advanced obesity treatment solutions.

Market Dynamics of the France Obesity Treatment Market:

The France obesity treatment market is mainly influenced by the continuous rise of obesity and related chronic diseases, the increased awareness of weight management, and the gradual acceptance of pharmacological therapies such as GLP, 1 receptor agonists and lipase inhibitors. Furthermore, the demand for the market is being supported by government programs aimed at promoting healthier lifestyles, along with the growing trend of minimally invasive and outpatient treatment approaches.

The market is limited by the high price of obesity drugs, the side effects caused by certain medications, strict regulatory approvals, and a low level of patient adherence to long, term therapies, which altogether slow down the market expansion.

The France obesity treatment market is going to be full of potential openings with the invention of advanced, generation drugs such as semaglutide and tirzepatide, the innovations in oral and parenteral formulations, and the increasing clinical research investments. The growth of the market and patient access will be further facilitated by the retail and hospital pharmacy network expansions along with digital health solutions for weight management.

Market Segmentation

The France Obesity Treatment Market share is classified into drug class, route of administration, and distribution channel.

By Drug Class:

The France obesity treatment market is divided by drug class into GLP-1 receptor agonists, lipase inhibitors, appetite suppressants, and other drug classes. Among these, the GLP-1 receptor agonists segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The expansion of this portion is mainly attributed to the demonstration of its clinical efficacy in the reduction of the significant amount of weight, strong physician's choice, increasing patient awareness for safer pharmacological options and GLP, 1 therapies adoption for obesity management in the long, term in France.

By Route of Administration:

The France obesity treatment market is divided by route of administration into parenteral and oral. Among these, the parenteral segment dominated the share in 2024 and is expected to grow at a significant CAGR during the forecast period. Such segment is expanding due to injectable drugs' higher bioavailability, better patient adherence in the chronic obesity treatment, physician recommendation for injectable GLP, 1 therapies and patient preference for advanced treatments with clinically proven outcomes.

By Distribution Channel:

The France obesity treatment market is divided by distribution channel into retail pharmacies, hospital pharmacies, and other distribution channels. Among these, the hospital pharmacies segment dominated the share in 2024 and is expected to grow at a notable CAGR during the forecast period. The increase in its usage is a result of hospital, led obesity management programs, structured patient monitoring, professional supervision of pharmacotherapy, hospital increasing adoption of new obesity drugs, and care team integration.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the France obesity treatment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in France Obesity Treatment Market:

- Novo Nordisk

- Eli Lilly and Company

- Sanofi

- Pfizer

- Hoffmann?La Roche

- EktaH

- Laboratoires Servier

Recent Developments in France Obesity Treatment Market:

In October 2024, Novo Nordisk made Wegovy (semaglutide 2.4 mg), a once weekly injectable GLP1 receptor agonist for obesity, available for sale in France. This new product release gives patients access to another drug therapy option for weight management; however, since the product is not yet nationally reimbursed, the decision to use the drug and its affordability still depend on the patients.

In February 2025, Allurion Technologies has reintroduced the Allurion Balloon in France following the French regulatory authority ANSM's clearance. The swallowable, procedureless gastric balloon, is aimed at nonsurgical weight loss and facilitates combination research with GLP1 therapies. The re, launch of the device widens the repertoire of obesity interventions through the device route and thus, elevates the therapeutic possibilities for doctors and patients.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France obesity treatment market based on the below-mentioned segments:

France Obesity Treatment Market, By Drug Class

- GLP-1 Receptor Agonists

- Lipase Inhibitors

- Appetite Suppressants

- Other Drug Class

France Obesity Treatment Market, By Route of Administration

- Parenteral

- Oral

France Obesity Treatment Market, By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Other Distribution Channel

FAQ

Q: What is the France obesity treatment market size?

A: France Obesity Treatment Market is expected to grow from USD 175.4 million in 2024 to USD 1232.8 million by 2035, growing at a CAGR of 19.4% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the rising prevalence of obesity and related chronic diseases, increasing awareness of weight management, innovations in GLP-1 receptor agonists and other pharmacological therapies, and government programs promoting healthier lifestyles and obesity management.

Q: What factors restrain the France obesity treatment market?

A: Constraints include high drug costs, potential side effects of medications, strict regulatory approvals, and low long-term patient adherence to obesity therapies, which collectively slow market expansion.

Q: How is the market segmented by drug class, route, and distribution channel?

A: The market is segmented by Drug Class (GLP-1 Receptor Agonists, Lipase Inhibitors, Appetite Suppressants, Other Drug Class), Route of Administration (Parenteral, Oral), and Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Other Distribution Channel).

Q: Who are the key players in the France obesity treatment market?

A: Key companies include Novo Nordisk, Eli Lilly and Company, Sanofi, Pfizer, Hoffmann?La Roche, EktaH, and Laboratoires Servier.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |