France Oral Anti-Diabetic Drug Market

France Oral Anti-Diabetic Drug Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Biguanides, Sulfonylureas, DPP-4 Inhibitors, SGLT2 Inhibitors, GLP-1 Receptor Agonists, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Others), and France Oral Anti-Diabetic Drug Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Oral Anti-Diabetic Drug Market Size Insights Forecasts to 2035

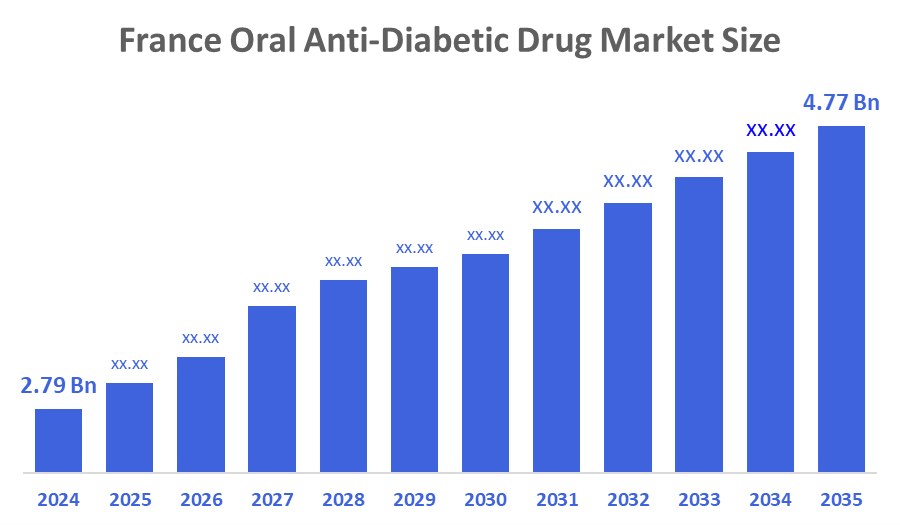

- The France Oral Anti-Diabetic Drug Market Size Was Estimated at USD 2.79 Billion in 2024.

- The France Oral Anti-Diabetic Drug Market Size is Expected to Grow at a CAGR of Around 5.01% from 2025 to 2035.

- The France Oral Anti-Diabetic Drug Market Size is Expected to Reach USD 4.77 Billion by 2035.

According to a research report published by Decisions Advisors & Consulting, the France Oral Anti-Diabetic Drug Market size is Anticipated to reach USD 4.77 Billion by 2035, Growing at a CAGR of 5.01% from 2025 to 2035. The France Oral Anti-Diabetic drug Market Size is driven by the Rising prevalence of type 2 diabetes, Growing Awareness and Adoption of Convenient Oral Therapies, Advances in drug formulations and combination treatments, Supportive government initiatives, and an aging population with changing lifestyles.

Market Overview

The France oral antidiabetic drug market refers to the sector focused on the production, distribution, and use of oral medications such as metformin, sulfonylureas, DPP-4 inhibitors, and SGLT2 inhibitors used to manage blood glucose levels in patients with type 2 diabetes. These drugs are widely prescribed in hospitals, clinics, and home settings due to their convenience, effectiveness, and strong patient compliance. France has a significant and growing diabetes burden, with over 3.9 million adults living with diabetes, a prevalence rate of around 8.6% of the adult population, driving sustained demand for oral treatments and regular diagnostic monitoring. The high prevalence of diabetes, coupled with lifestyle factors like rising obesity and sedentary habits, highlights the critical need for effective oral therapies that support long-term glycemic control and help prevent complications associated with chronic diabetes.

Government support and initiatives play a key role in market growth, with France’s national healthcare system providing reimbursement for oral anti-diabetic drugs, making them accessible and affordable. Public health programs and government-funded research promote innovation in drug formulations and combination therapies, while ongoing pharmaceutical advancements improve efficacy, safety, and patient convenience. The market is further supported by the focus on personalized diabetes care and integration with digital health monitoring. With increasing disease prevalence, supportive policies, and continuous therapeutic innovations, the France oral anti-diabetic drug market is expected to grow steadily in the coming years.

Report Coverage

This research report categorizes the market for the France oral anti-diabetic drug market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France oral anti-diabetic drug market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France oral anti-diabetic drug market.

Driving Factors

The France oral anti-diabetic drug market is primarily driven by the rising prevalence of type?2 diabetes, fueled by aging populations, obesity, and sedentary lifestyles. Increasing awareness of diabetes management and early diagnosis programs encourages the adoption of oral therapies. The convenience and cost-effectiveness of oral medications compared to insulin injections further support demand. Technological advancements in drug formulations and combination therapies improve efficacy, safety, and patient adherence, and a growing focus on preventive healthcare reinforces widespread adoption and market growth in France.

Restraining Factors

The market faces challenges such as side effects and contraindications of some oral anti-diabetic drugs, which may limit patient use. High treatment costs for newer drug classes and combination therapies can restrict adoption, despite reimbursement support. Patient non-adherence to long-term medication regimens and competition from injectable therapies like insulin also pose challenges that can slow market growth.

Market Segmentation

The France oral anti-diabetic drug market share is categorized by drug class and distribution channel.

- The biguanides segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France oral anti-diabetic drug market is segmented by drug class into biguanides, sulfonylureas, DPP-4 inhibitors, SGLT2 inhibitors, GLP-1 receptor agonists, and others. Among these, the biguanides segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The biguanides segment's growth is driven by the widespread use of metformin, the most prescribed first-line therapy for type 2 diabetes in France. Its effectiveness in lowering blood glucose, favorable safety profile, cost-effectiveness, and strong clinical guidelines recommending its use support high adoption. Additionally, growing awareness among healthcare providers and patients about its long-term benefits, along with combination therapies that include metformin, further boost the segment’s growth.

- The hospital pharmacies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France oral anti-diabetic drug market is segmented by distribution channel into hospital pharmacies, retail pharmacies, online pharmacies, and others. Among these, the hospital pharmacies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The hospital pharmacies’ segmental growth is driven by the high volume of prescriptions from healthcare providers, centralized distribution of medications in clinical settings, and strong preference for hospital-based dispensing for chronic disease management. The role of hospitals in diabetes education and monitoring contributes to the continued dominance of hospital pharmacies in the France oral anti-diabetic drug market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France oral anti-diabetic drug market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sanofi S.A.

- Novartis AG

- Merck & Co., Inc.

- AstraZeneca plc

- Boehringer Ingelheim

- Eli Lilly and Company

- Novo Nordisk A/S

- Servier Laboratories

- Les Laboratoires Servier

- Pierre Fabre Medicament

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, Sanofi agreed to acquire U.S. biotech Provention Bio for $2.9?billion, adding TZIELD, a first-in-class therapy that delays progression of type?1 diabetes, to its portfolio, reinforcing Sanofi’s diabetes focus with potential implications for its broader diabetes drug offerings, including oral anti?diabetic treatments.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Oral Anti-Diabetic Drug Market based on the below-mentioned segments:

France Oral Anti-Diabetic Drug Market, By Drug Class

- Biguanides

- Sulfonylureas

- DPP-4 Inhibitors

- SGLT2 Inhibitors

- GLP-1 Receptor Agonists

- Others

France Oral Anti-Diabetic Drug Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

Frequently Asked Questions (FAQ)

- What is the France oral anti-diabetic drug market size in 2024?

The France oral anti-diabetic drug market size was estimated at USD 2.79 billion in 2024.

- What is the projected market size of the France oral anti-diabetic drug market by 2035?

The France oral anti-diabetic drug market size is expected to reach USD 4.77 billion by 2035.

- What is the CAGR of the France oral anti-diabetic drug market?

The France oral anti-diabetic drug market size is expected to grow at a CAGR of around 5.01% from 2024 to 2035.

- What are the key growth drivers of the France oral anti-diabetic drug market?

Rising prevalence of type 2 diabetes, growing awareness and adoption of convenient oral therapies, advances in drug formulations and combination treatments, and an aging population with changing lifestyles.

- Which distribution channel segment dominated the market in 2024?

The hospital pharmacies segment dominated the market in 2024.

- Which drug class segment accounted for the largest market share in 2024?

The biguanides segment accounted for the largest market share in 2024.

- What segments are covered in the France Oral Anti-Diabetic Drug market report?

The France Oral Anti-Diabetic Drug market is segmented on the basis of drug class and distribution channel.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |