France Pacemakers Market

France Pacemakers Market Size, Share, and COVID-19 Impact Analysis, By Product (External Pacemakers, Implantable Pacemakers, Single-Chamber, Biventricular Chamber, and Others), By Type (MRI Compatible Pacemakers and Conventional Pacemakers), By Application (Congestive Heart Failure, Arrhythmias, Atrial Fibrillation, Heart Block, Long QT Syndrome, and Others), By End User (Hospitals, Cardiac Centers, Ambulatory Surgical Centers, and Others), and France Pacemakers Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Pacemakers Market Insights Forecasts to 2035

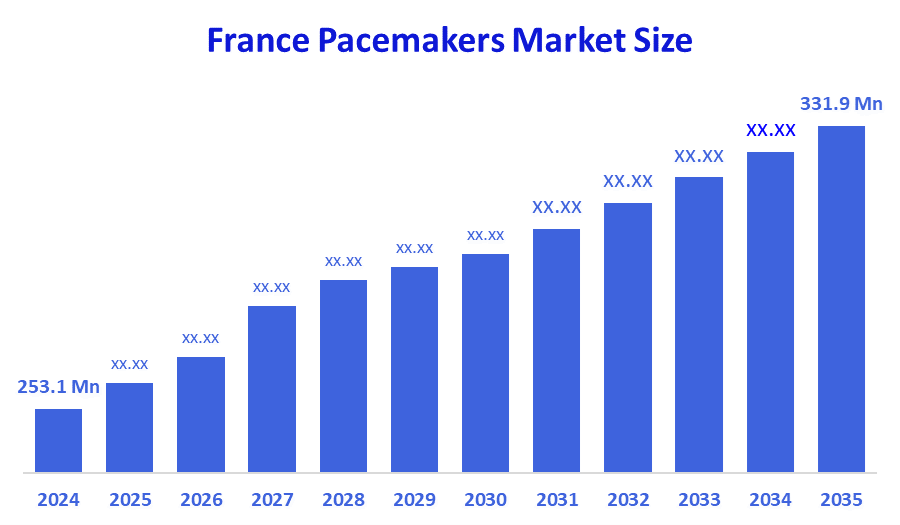

- The France Pacemakers Market Size Was Estimated at USD 253.1 Million in 2024.

- The France Pacemakers Market Size is Expected to Grow at a CAGR of Around 2.5% from 2024 to 2035.

- The France Pacemakers Market Size is Expected to Reach USD 331.9 Million By 2035.

According to a research report published by Decision Advisors & Consulting, The France Pacemakers Market size is projected to reach USD 331.9 Million by 2035, growing at a CAGR of 2.5% from 2025 to 2035. The France pacemaker market is driven by the rising prevalence of cardiovascular diseases, including arrhythmias and heart failure. An aging population increases demand for pacemakers. Technological advancements like leadless and MRI-compatible devices boost adoption. Strong healthcare infrastructure and government reimbursement support market growth. Growing awareness among physicians and patients further fuels demand.

Market Overview

The France pacemaker market consists of the creation, production, and selling of pacemakers. Pacemakers employ electricity to regulate abnormal heart rhythms. Pacemakers are primarily designed to support patients living with sudden, slow, or catastrophic heart disease, irregular heart rhythm disorder (arrhythmias), heart block (the delay or blockage of electrical impulses that control the heartbeat), and various disorders in the rhythm of the heart (arrhythmias). Examples include traditional transvenous pacemakers (TVPs), leadless pacemakers, and MRI-compatible (MIRP) pacemakers.

The vast majority of the France-based businesses that comprise the Pacemaker component of France are examples of how the Pacemaker segment of France works with hospitals, cardiology clinics, and cardiac rehabilitation centers in an effort to ensure better outcomes for patients and increased quality of life. Increased cardiovascular diseases, such as arrhythmia and heart failure, are expected to drive a significant amount of growth in the France pacemaker market. In addition, due to the increase in the aging population, the demand for pacemakers will continue to grow. The population of France is experiencing significant growth, and there are currently over 1 million people in France with heart disease, and nearly 10,000 new patients diagnosed with rhythm and conduction disorders per year. The European Society of Cardiology reported that, amongst the EU countries, France ranked as having the 3rd highest amount of pacemaker insertions, with over a thousand for every 1 million people. This is also supported by the Federation Française de Cardiology, which indicates that between 60000 and 75000 pacemakers are inserted each year in France alone. These statistics indicate a significant demand for and need for pacemakers within France.

Report Coverage

This research report categorizes the market for the France pacemakers market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France pacemakers market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France pacemakers market.

Driving Factors

The France pacemakers market is driven by several key factors. There is a great demand for heart rhythm control equipment to control the growing number of cardiovascular disorders like arrhythmia, bradycardia, and heart failure. The increasing population of senior citizens is much more likely to experience heart conduction problems as they get older. Improved device technology will improve patient safety and convenience for patients using leadless pacemakers, MRI-safe devices, and remote patient monitoring. Physicians and patients are becoming increasingly aware of the advantage of early heart disease diagnosis and treatment; this growing awareness is very helpful to the expansion of the heart rhythm management market in France.

Restraining Factors

The France pacemakers market faces several restraining factors. Cost factors associated with high patient expense and implant costs can prevent access to patients from price-conscious groups. Concerns over the potential risks of undergoing surgery and the potential complications that may arise from the implantation, such as infection or failure of the implanted heart monitor, may dissuade both patients and healthcare providers from utilizing implanted heart monitors. In some cases, patients may have a limited understanding of newer implanted heart monitor technologies, which can further limit the deployment of these devices. The presence of clinical alternatives to implant therapy, including drug therapy and surgical life support, will continue to be a barrier to market growth for general pacemaker devices.

Market Segmentation

The France wound care management devices market share is categorized by product, type, application, and end user.

- The implantable pacemakers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France pacemakers market is segmented by product into external pacemakers, implantable pacemakers, single-chamber, biventricular chamber, and others. Among these, the implantable pacemaker segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The implantable pacemaker’s segmental growth is due to its widespread use in treating conditions such as bradycardia, arrhythmia, and heart block. Implantable pacemakers serve continuous and long-term management of cardiac rhythm, improving patient life quality. Advancements in pacemaker device technology, such as leadless and MRI-compatible pacemakers, collectively make implantable pacemakers the dominant segment in France

- The conventional pacemaker segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The France pacemaker market is segmented by type into MRI-compatible pacemakers and conventional pacemakers. Among these, the conventional pacemakers segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The conventional pacemaker segment dominated the market due to its wide use, proven reliability, and easy availability across hospitals and critical care centers. A conventional pacemaker is generally more economical compared to the MR-compatible devices, which makes it the primary choice for a wide range of patients. Moreover, their safety and effectiveness also contribute to the continuous dominance of conventional pacemakers in France.

- The arrhythmias segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France pacemakers market is segmented by application into congestive heart failure, arrhythmias, atrial fibrillation, heart block, long QT syndrome, and others. Among these, the arrhythmias segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The arrhythmias' segmental growth is due to the high prevalence of cardiac rhythm disorders in the France population. Pacemakers are the primary treatment for bradyarrhythmias and other arrhythmic conditions, helping restore normal heart function and prevent complications. The growing aging population, rising awareness of early diagnosis and treatment, and strong adoption of advanced pacemaker technologies further contributed to the dominance of the arrhythmias segment in France.

- The hospitals held the largest share in 2024 and are anticipated to grow at a significant CAGR during the forecast period.

The France pacemakers market is segmented by end user into hospitals, cardiac centers, ambulatory surgical centers, and others. Among these, the hospitals segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The hospital’s segmental growth is due to its advanced infrastructure, experienced professionals, and ability to handle high-risk patients. Cardiac centers also commanded a significant share, and combined, hospitals and cardiac centers made up over 67% of the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France pacemakers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- OSYPKA MEDICAL

- Boston Scientific Corp

- ZOLL Medical Corporation

- Asahi Kasei Corp

- Medtronic PLC

- BIOTRONIK

- MicroPort Scientific Corp

- Medico International Inc

- Abbott Laboratories

- Integer Holdings Corp

- Lepu Medical

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2025, Abbott [AS1] launched its dual-chamber leadless pacemaker system, eliminating the need for wires or surgical pockets. This advancement offers enhanced comfort and safety for patients with bradycardia.

- In April 2022, Cairdac SAS [AS2] closed its first funding round, raising nearly USD 18.5 million to increase development of an autonomous, leadless pacemaker transcatheter system (ALPS) powered entirely using kinetic energy from the heart. Five France private equity funds and banks participated in this Series A round.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the France Pacemakers Market based on the below-mentioned segments:

France Pacemakers Market, By Product

- External Pacemakers

- Implantable Pacemakers

- Single-Chamber

- Biventricular Chamber

- Others

France Pacemakers Market, By Type

- MRI Compatible Pacemakers

- Conventional Pacemakers

France Pacemakers Market, By Application

- Congestive Heart Failure

- Arrhythmias

- Atrial Fibrillation

- Heart Block

- Long QT Syndrome

- Others

France Pacemakers Market, By End User

- Hospitals

- Cardiac Centers

- Ambulatory Surgical Centers

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France pacemakers market?

The France pacemakers market size is expected to grow at a CAGR of around 2.5% from 2024 to 2035.

- What is the France pacemakers market size in 2024?

The France pacemakers market size was estimated at USD 253.1 million in 2024.

- What is the projected market size of the France pacemakers market by 2035?

The France pacemakers market size is expected to reach USD 331.9 million by 2035.

- What are the key growth drivers of the France pacemakers market?

The increasing parental awareness of infant health and growing adoption of certified organic and clean-label personal-care products, combined with rising incidences of infant skin conditions. Supportive regulations in France.

- Which type of segment dominated the market share in 2024?

The conventional pacemakers segment dominated the market share in 2024.

- Which product segment accounted for the largest market share in 2024?

The implantable pacemaker segment accounted for the largest market share in 2024.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 167 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |