France Pain Management Devices Market

France Pain Management Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Radiofrequency Ablation, Electrical Stimulators, Analgesic Infusion Pump, Neurostimulation, and Others), By Application (Cancer, Neuropathic, Facial & Migraine, Musculoskeletal, Trauma, and Others), By End User (Hospitals & Clinics, Physiotherapy Centers, Rehabilitation Centers, and Others), and France Pain Management Devices Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Pain Management Devices Market Insights Forecasts to 2035

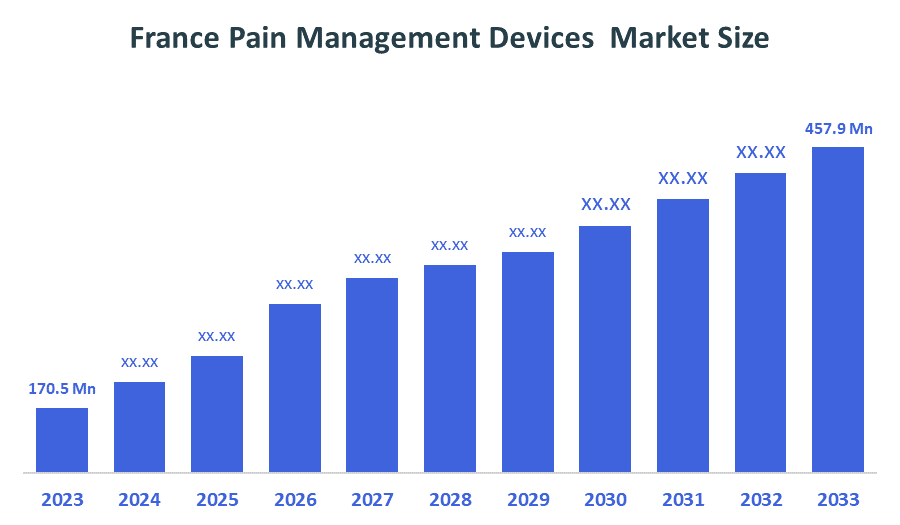

- The France Pain Management Devices Market Size Was Estimated at USD 170.5 Million in 2024.

- The France Pain Management Devices Market Size is Expected to Grow at a CAGR of Around 9.4% from 2024 to 2035.

- The France Pain Management Devices Market Size is Expected to Reach USD 457.9 Million By 2035.

According to a Research Report Published by Decision Advisiors & Consulting, the France Pain Management Devices Market size is projected to reach USD 457.9 million by 2035, growing at a CAGR of 9.4% from 2025 to 2035. The France pain management devices market is driven by the rising prevalence of chronic diseases and an aging population, increasing demand for non-opioid solutions like nerve and muscle stimulators. Other factors include advancements in digital health and user-friendly wearable devices, supportive government policies, and a growing preference for home-based care, which offers convenience and cost savings.

Market Overview

The France pain management devices market describes an industry that has medical devices that relieve or manage acute and chronic pain. The devices in the market include neurostimulators, infusion pumps, radiofrequency ablation devices, and TENS units, and are used to treat various types of pain in hospitals, clinics, and even within homes, providing patients with ways to reduce their pain without using drugs and improve their quality of life.

The France pain management devices market is poised for significant growth due to the high prevalence of chronic pain. It is reported that approximately 42% of the adult population in France, over 23 million people, suffer from some form of chronic pain for at least three months or longer. Examples of common chronic pain include musculoskeletal complaints (lower back pain and arthritis), neuropathic pain, migraines, and chronic pain syndromes, all of which have a similar impact on a person’s ability to function normally from day to day and are an indication that there is a high need for additional treatments and therapies. Since there are so many people in France who are experiencing chronic pain and are lacking appropriate or sufficient treatment options, the France Pain Management Devices Market will continue to provide additional opportunities for growth within the healthcare industry for medical device manufacturers and distributors.

Report Coverage

This research report categorizes the market for the France pain management devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France pain management devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France pain management devices market.

Driving Factors

The France pain management devices market is driven by the increase in the frequency of chronic pain and elderly illnesses. With an aging population comes increased utilization of long-term, device-based therapies. Among patients at increased risk of developing chronic pain, there is a growing understanding that prolonged use of medication carries with it the potential for serious health risks. Technological advancements in the areas of neurostimulators and radiofrequency ablation devices have increased the associated efficacy and user-friendliness of treatments. Additionally, the presence of strong supportive healthcare systems, reimbursement frameworks, and minimally invasive, patient-friendly treatment modalities will continue to foster the development of a growing marketplace.

Restraining Factors

The France pain management devices market faces several restraining factors. The high price of advanced medical equipment is a significant barrier to widespread adoption of these devices. Smaller clinics or patients without comprehensive insurance coverage are especially limited due to the expense. The lengthy approval process and tight regulations associated with newly developed technologies also contribute to the lengthening of the time it takes for new devices to reach the market. Available treatment options currently exist, such as medications and conventional methods, and therefore, device treatment may not be viewed as the primary choice. Certain types of invasive procedures can also present certain complications, which may deter both patients and providers from considering a device as the best option for treatment.

Market Segmentation

The France pain management devices market share is categorized by product, application, and end user.

- The neurostimulation segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The France pain management devices market is segmented by product into radiofrequency ablation, electrical stimulators, analgesic infusion pumps, neurostimulation, and others. Among these, the neurostimulation segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The Neurostimulation segment is dominated by a growth in technology along with the increase in Neuro disorders such as Parkinson's, Epilepsy, and Chronic Pain. The increased Elderly Population that is more vulnerable to chronic illnesses and the need for Advanced Non-Opioid Pain Management Solutions.

- The neuropathic segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France pain management devices market is segmented by application into cancer, neuropathic, facial & migraine, musculoskeletal, trauma, and others. Among these, the neuropathic segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The neuropathic segmental growth is due to the increasing prevalence of neuropathic pain conditions in France, driven by factors such as diabetes, post-herpetic neuralgia, and nerve injuries are driving the market for non-invasive devices for treating chronic pain. The increasing understanding of how well the various kinds of device-based therapies, like neurostimulation (e.g., TENS) and spinal cord stimulation, can treat chronic pain is driving demand for these types of products among both patients and health care providers. In addition, as the focus on reducing long-term opioid or pharmacological dependence through non-invasive methods continues to grow, so too will this segment of the chronic pain market.

- The hospitals & clinics held the largest share in 2024 and are anticipated to grow at a significant CAGR during the forecast period.

The France pain management devices market is segmented by end user into hospitals & clinics, physiotherapy centers, rehabilitation centers, and others. Among these, the hospitals & clinics held the largest market share in 2024 and are anticipated to grow at a significant CAGR during the forecast period. The hospitals & clinics’ segmental growth is due to the access to highly trained healthcare staff and resources. Typically, both hospitals and outpatient clinics experience very high volumes of both chronic and acute pain patients, with many of these patients needing special procedures such as neurostimulator implants and radiofrequency ablation (RFAs). Most healthcare providers do not want long hospital stays or extensive therapies, their goal is also to provide a high quality of care with minimal disruption to their patients' lives. Instead, most hospital administrators prefer to offer less invasive treatments using pain relief systems because they allow patients to remain as active as possible throughout treatment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France pain management devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medtronic PLC

- Abbott Laboratories

- Stryker Corp

- B. Braun

- AstraZeneca

- Boston Scientific Corp

- Baxter International Inc

- OMRON Corp

- Others

Key Target Audienc

Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2025, AstraZeneca exited neuroscie[ nce research, removing experimental drugs for Alzheimer’s, migraine, and from its pipeline. The company refocused on core areas, including cancer and cardiovascular diseases, which generated nearly USD 51 billion in sales. By 2030, it aims for USD 80 billion annual revenue and 20 new drug launches.

- In August 2025, Teva Pharmaceuticals announced that the U.S. FDA approved AJOVY (fremanezumab-vfrm) for preventing episodic migraine in children and adolescents aged 6-17 years weighing 45 kg or more. AJOVY became the first CGRP antagonist approved for both pediatric and adult migraine prevention.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the France Pain Management Devices Market based on the below-mentioned segments:

France Pain Management Devices Market, By Product

- Radiofrequency Ablation

- Electrical Stimulators

- Analgesic Infusion Pump

- Neurostimulation

- Others

France Pain Management Devices Market, By Application

- Cancer

- Neuropathic

- Facial & Migraine

- Musculoskeletal

- Trauma

- Others

France Pain Management Devices Market, By End User

Hospitals & Clinic

physiotherapy Centers

- Rehabilitation Centers

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France pain management devices market?

The France pain management devices market size is expected to grow at a CAGR of around 9.4% from 2024 to 2035.

- What is the France pain management devices market size in 2024?

The France pain management devices market size was estimated at USD 170.5 million in 2024.

- What is the projected market size of the France pain management devices market by 2035?

The France pain management devices market size is expected to reach USD 457.9 million by 2035.

- What are the key growth drivers of the France pain management devices market?

- The rising prevalence of chronic diseases and an aging population are increasing demand for non-opioid solutions like nerve and muscle stimulators. Advancements in digital health and user-friendly wearable devices, supportive government policies, and a growing preference for home-based care, which offers convenience and cost savings.

Which product segment dominated the market share in 2024?

- The neurostimulation dominated the market share in 2024.

- Which application segment accounted for the largest market share in 2024?

- The neuropathic segment accounted for the largest market share in 2024

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |