France Patient Monitoring Market

France Patient Monitoring Market Size, Share, and COVID-19 Impact Analysis, By Device Type (Hemodynamic Monitoring Devices, Neuromonitoring Devices, Cardiac Monitoring Devices, Respiratory Monitoring Devices, and Others), By Application (Cardiology, Neurology, Respiratory, Fetal & Neonatal, Weight Management, Fitness Monitoring, and Others), By End User (Home Healthcare and Hospitals), and France Patient Monitoring Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Patient Monitoring Market Insights Forecasts to 2035

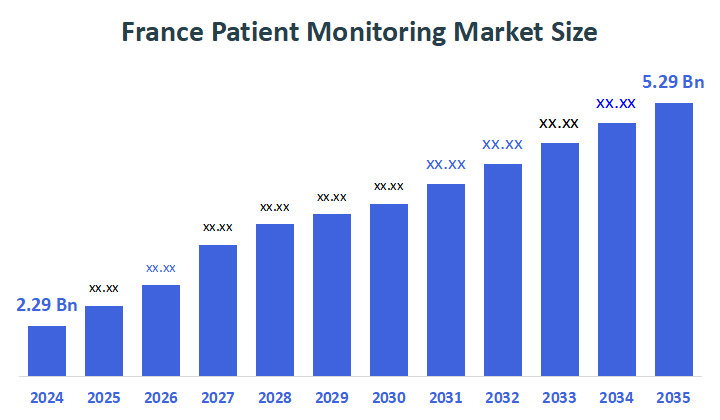

- The France Patient Monitoring Market Size Was Estimated at USD 2.29 Billion in 2024.

- The France Patient Monitoring Market Size is Expected to Grow at a CAGR of Around 7.9% from 2025 to 2035.

- The France Patient Monitoring Market Size is Expected to Reach USD 5.29 Billion by 2035.

According to a research report published by Decisions Advisors, the France Patient Monitoring Market size is anticipated to reach USD 5.29 billion by 2035, growing at a CAGR of 7.9% from 2025 to 2035. The France patient monitoring market is driven by several factors, including increasing incidence of chronic disease, an increasing population over age 65, advances in technology related to remote and wearable monitoring devices, and the France government's commitment to promoting digital health and telemedicine.

Market Overview

The France patient monitoring market refers to the industry involved in the manufacturing, distribution, and sale of medical devices and systems that continuously or intermittently track patients’ vital signs and physiological parameters. This includes devices for monitoring heart rate, blood pressure, oxygen saturation (SpO?), respiratory rate, temperature, and other critical health indicators. The market serves hospitals, clinics, ambulatory care centers, and home care settings, and is driven by the need for real-time patient data, improved clinical decision-making, early detection of health deterioration, and enhanced patient safety in both critical care and general care environments.

The France patient monitoring market is rapidly growing, as a result of the increasing burden of chronic diseases and the advancement of technology used in the medical industry. Examples of chronic conditions that are driving demand for continuous patient monitoring are cancer, cardiovascular disease, and other chronic diseases. As reported by the International Agency for Research on Cancer, France had over 484,000 newly diagnosed cancer cases in 2022, and that number will exceed 500,000 by 2025, which shows the continued need for more patient monitoring equipment. In addition, as the World Population Dashboard indicates, by 2024 people over the age of 65 years will comprise 22% of the population of France (approximately 14 million people) and many of these will be at increased risk of developing chronic illness (e.g. diabetes, hypertension, respiratory disorders, neurodegenerative diseases) so they will require regular monitoring of their condition in order to maintain their health status.

The continued growth of the market is expected to be supported by partnerships among market participants and continued technological advancement. Currently, many companies are developing and supplying innovative monitoring solutions through partnerships, such as BIOSENCY and RestMed, which are expanding the availability of the Bora-Care telemonitoring system to home care patients with respiratory failure who require close monitoring. Thus, the combination of an increasing burden of chronic disease, an ageing population, and continued technological advancement positions the France patient monitoring market for continued steady growth during the forecast analysis period.

Report Coverage

This research report categorizes the market for the France patient monitoring market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France patient monitoring market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France patient monitoring market.

Driving Factors

As the population ages and the number of chronic illnesses such as cardiovascular diseases, diabetes, respiratory problems, and or neurological diseases continues to increase, the monitoring of vital signs has become more essential. The popularity of home care, outpatient service, and telemedicine continues to grow, resulting in more use of remote patient monitoring and timely interventions. Also, technological advances such as wearable devices, AI-based analytics, and connected monitoring systems allow for increased accuracy, efficiency, and usability in hospitals and at home.

Restraining Factors

The France patient monitoring market faces restraints from high device and infrastructure costs, strict data privacy regulations like GDPR, and challenges in integrating new systems with existing hospital IT. Limited digital infrastructure in some regions and low digital literacy among patients and healthcare staff further slow adoption, particularly outside major hospitals.

Market Segmentation

The France patient monitoring market share is categorized by device type, application, and end-user.

- The cardiac monitoring devices segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France patient monitoring market is segmented by device type into hemodynamic monitoring devices, neuromonitoring devices, cardiac monitoring devices, respiratory monitoring devices, and others. Among these, the cardiac monitoring devices segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The cardiac monitoring devices segmental growth is due to the high prevalence of cardiovascular diseases in France, including hypertension, arrhythmia, and heart failure, which necessitate continuous and accurate monitoring. Increasing hospitalizations for cardiac conditions, rising adoption of advanced technologies like wearable and remote cardiac monitors, and growing awareness of early detection and preventive care further drive demand.

- The cardiology segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France patient monitoring market is segmented by application into cardiology, neurology, respiratory, fetal & neonatal, weight management, fitness monitoring, and others. Among these, the cardiology segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The cardiology segmental growth is due to the high prevalence of cardiovascular diseases in France, including heart failure, arrhythmia, and coronary artery disease, which drive the demand for continuous cardiac monitoring. Increasing hospital admissions for cardiac conditions, rising awareness of early diagnosis and preventive care, and the adoption of advanced monitoring technologies such as wearable and remote cardiac devices further support market growth.

- The hospitals segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France patient monitoring market is segmented by end-user into home healthcare and hospitals. Among these, the hospitals segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The hospital's segmental growth is due to the high patient inflow and the need for continuous monitoring of critical and chronic conditions in inpatient and emergency care settings. Hospitals require advanced patient monitoring systems, including cardiac, respiratory, and hemodynamic devices, to ensure accurate real-time data for timely clinical decisions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France patient monitoring market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Draegerwerk AG

- General Electric Company

- Koninklijke Philips NV

- Kalstein France

- Medtronic Plc

- Kaptalia

- Baxter International

- Siemens Healthineers

- Beckton, Dickinson and Company

- Braintale

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, OMRON Healthcare Co., Ltd launched the AliveCor KardiaMobile portable ECG to the France market through a distributorship agreement with AliveCor Inc.

- In March 2023, OMRON Healthcare, a prominent player in manufacturing home health monitoring medical equipment, signed a strategic partnership with Servier Laboratories, a France non-profit foundation. The collaboration's primary goal is to drive innovations enhancing the identification, management, and sustained control of hypertension and other cardiovascular ailments.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Patient Monitoring Market based on the below-mentioned segments:

France Patient Monitoring Market, By Device Type

- Hemodynamic Monitoring Devices

- Neuromonitoring Devices

- Cardiac Monitoring Devices

- Respiratory Monitoring Devices

- Others

France Patient Monitoring Market, By Application

- Cardiology

- Neurology

- Respiratory

- Fetal & Neonatal

- Weight Management

- Fitness Monitoring

- Others

France Patient Monitoring Market, By End User

- Home Healthcare

- Hospitals

Frequently Asked Questions (FAQ)

- What is the CAGR of the France patient monitoring market?

The France patient monitoring market size is expected to grow at a CAGR of around 7.9% from 2024 to 2035.

- What is the France patient monitoring market size in 2024?

The France patient monitoring market size was estimated at USD 2.29 billion in 2024.

- What is the projected market size of the France patient monitoring market by 2035?

The France patient monitoring market size is expected to reach USD 5.29 billion by 2035.

- What are the key growth drivers of the France patient monitoring market?

Increasing incidence of chronic disease, an increasing population over age 65, and advances in technology related to remote and wearable monitoring devices.

- Which application segment dominated the market in 2024?

The cardiology segment held the largest market share in 2024.

- Which device type segment accounted for the largest market share in 2024?

The cardiac monitoring devices segment accounted for the largest market share.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 160 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |