France Pediatric Imaging Market

France Pediatric Imaging Market Size, Share, By Product (Ultrasound, Magnetic Resonance Imaging (MRI), Computed Tomography, X-Ray, and Others), By Application (Oncology, Cardiology, Orthopedics, Gastroenterology, Neurology, and Others), By End User (Hospitals and Diagnostic Centers), and France Pediatric Imaging Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Pediatric Imaging Market Insights Forecasts to 2035

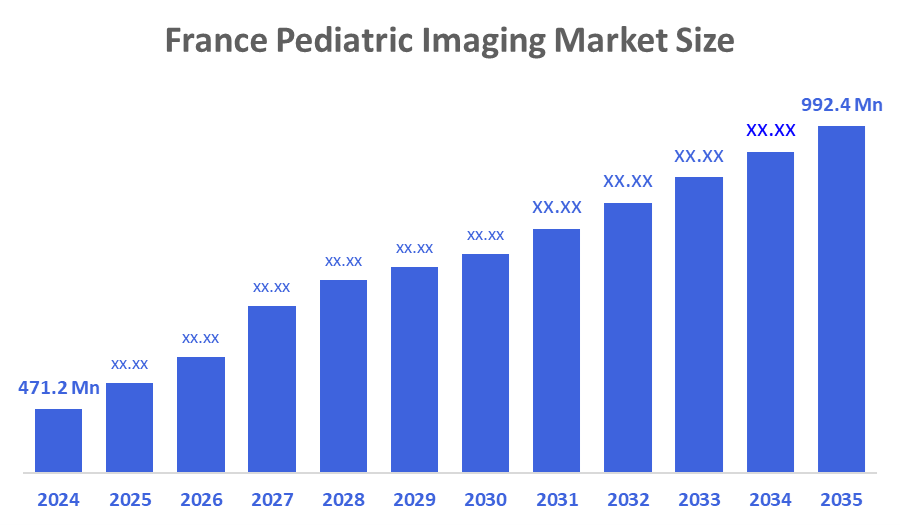

- France Pediatric Imaging Market Size 2024: USD 471.2 Mn

- France Pediatric Imaging Market Size 2035: USD 992.4 Mn

- France Pediatric Imaging Market Size CAGR 2024: 7.01%

- France Pediatric Imaging Market Size Segments: Product, Application, and End User.

The France Pediatric Imaging Market Size is the segment of the France healthcare and medical devices industry that offers diagnostic imaging technologies and services to children from infants to teenagers. It includes the manufacture, distribution, and application of such imaging techniques as ultrasound, MRI, CT, X-ray, and any other imaging systems that have been specifically designed for pediatric patients, so that safety, minimal radiation exposure, and a child-friendly approach are guaranteed. The market is made up of device sales, imaging procedures, and the provision of services by hospitals, pediatric clinics, and diagnostic centers across France and is shaped by the children's healthcare needs, technological progress, and the national healthcare system.

The France Pediatric Imaging is supported by significant government investment through the France 2030 program that is putting nearly €7.5 billion into health innovations, such as advanced medical imaging and digital health. Policy support derives from the French National Authority for Health (HAS) and the EU pediatric standards that encourage safety in radiation exposure and child-tailored imaging procedures. All these expenditures are consolidating the pediatric imaging supply, the use of cutting-edge technology, and diagnostic services in the hospitals and imaging centers throughout France.

The France Pediatric Imaging Market Size is turning to the use of AI-enabled imaging software, advanced MRI systems, low-dose CT, and digital radiology for the purposes of diagnostic accuracy, workflow efficiency, and patient safety. AI-based image analysis and automated processes are used by radiologists to improve the quality of the interpretation and, at the same time, to make the duration of the scans shorter for children. These technological improvements, along with the emphasis on radiation reduction and the use of age-appropriate protocols, are making the high-quality pediatric imaging services more widely available in France.

Market Dynamics of the France Pediatric Imaging Market:

The France Pediatric Imaging Market Size is driven by the increasing prevalence of pediatric disorders such as congenital abnormalities, neurological conditions, and cancers, which is leading to the growing need for accurate diagnostics. The government is also playing a facilitating role by launching programs such as France 2030, which aims at supporting the adoption of advanced imaging, upgrading the infrastructure, and integrating digital health.

The France pediatric imaging market faces several restraining factors, including the high price of advanced imaging devices, such as MRI, CT, and AI-assisted systems, for smaller hospitals and clinics, which may lead to decreased uptake. The availability of trained pediatric radiologists is also an impediment to efficient performance and interpretation of complex imaging exams. Limited understanding and availability of advanced pediatric imaging services in certain areas also limit utilization.

Advancements in France's pediatric imaging market will result from artificial intelligence utilization for AI-based diagnostic products, state-of-the-art MRI technology imaging and low-dose CT technology imaging, and digital health integration through the incorporation of cloud-based image management systems as well as images connected over wide area data networks for tele-radiology purposes, which would enhance access to the images and overall efficiency of workflow and increase patient safety while assisting with clinical decision support as well as supporting adherence to related regulatory standards.

Market Segmentation

The France Pediatric Imaging Market share is classified into product, application, and end user.

By Product:

The France pediatric imaging market is divided by product into ultrasound, magnetic resonance imaging (MRI), computed tomography, x-ray, and others. Among these, the ultrasound segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth of the ultrasound segment in the France pediatric imaging market is due to its radiation-free nature, making it safer for children, along with wide availability, lower cost, and ease of use in diagnosing a variety of pediatric conditions.

By Application:

The France pediatric imaging market is divided by application into oncology, cardiology, orthopedics, gastroenterology, neurology, and others. Among these, the cardiology segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The cardiology segment dominates because of the increasing prevalence of congenital heart diseases and other pediatric cardiovascular conditions, which require accurate and early diagnosis. Growing awareness among healthcare providers and parents about early cardiac screening is driving the adoption of pediatric cardiac imaging across hospitals and specialty centers.

By End User:

The France pediatric imaging market is divided by end user into hospitals and diagnostic centers. Among these, the hospitals segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The hospital segment dominance is due to the availability of advanced imaging infrastructure, specialized pediatric radiologists, and comprehensive care facilities. Hospitals offer a wide range of imaging modalities under one roof, enabling accurate diagnosis and treatment planning for complex pediatric conditions.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the France pediatric imaging market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in France Pediatric Imaging Market:

- GE HealthCare

- Siemens Healthineers

- Philips Healthcare

- Canon Medical Systems

- FUJIFILM

- Carestream Health

- Samsung Electronics

- AGFA HealthCare

- Hitachi Medical Systems

- Konica Minolta

- EOS Imaging

- Guerbet

- Others

Recent Developments in France Pediatric Imaging Market:

- In January 2024, Carestream Health launched a new and enhanced DRX-Excel Plus X-ray System that boosts the performance of the powerful, two-in-one solution to enable more productivity and efficiency, higher image quality, and an improved experience for users and patients.

- In October 2024, Siemens Healthineers and University Hospital Nantes signed a 12?year, €55 million Value Partnership to advance diagnostic and interventional medical imaging across 13 public hospitals in France, installing new CT and MRI systems and supporting research, education, and technology upgrades.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France Pediatric Imaging market based on the below-mentioned segments:

France Pediatric Imaging Market, By Product

- Ultrasound

- Magnetic Resonance Imaging (MRI)

- Computed Tomography

- X-Ray

- Others

France Pediatric Imaging Market, By Application

- Oncology

- Cardiology

- Orthopedics

- Gastroenterology

- Neurology

- Others

France Pediatric Imaging Market, By End User

- Hospitals

- Diagnostic Centers

FAQ

- What is the France pediatric imaging market size in 2024?

The France pediatric imaging market size was estimated at USD 471.2 million in 2024.

- What is the projected market size of the France pediatric imaging market by 2035?

The France pediatric imaging market size is expected to reach USD 992.4 million by 2035.

- What is the CAGR of the France pediatric imaging market?

The France pediatric imaging market size is expected to grow at a CAGR of around 7.01% from 2024 to 2035.

- What are the key growth drivers of the France pediatric imaging market?

The increasing prevalence of pediatric disorders. The government programs, such as France 2030, aim at supporting the adoption of advanced imaging, upgrading the infrastructure, and integrating digital health.

- Which product segment dominated the market in 2024?

The ultrasound segment dominated the market in 2024.

- What segments are covered in the France pediatric imaging market report?

The France pediatric imaging market is segmented on the basis of product, application, and end user.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |