France Photonic Integrated Circuit Market

France Photonic Integrated Circuit Market Size, Share, and COVID-19 Impact Analysis, By Raw Material (Indium Phosphide (InP), Gallium Arsenide (GaAs), Lithium Niobate (LiNbO3), Silicon, and Silica-on-Silicon), By Integration (Monolithic Integration, Hybrid Integration, and Module Integration), and France Photonic Integrated Circuit Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

France Photonic Integrated Circuit Market Insights Forecasts to 2035

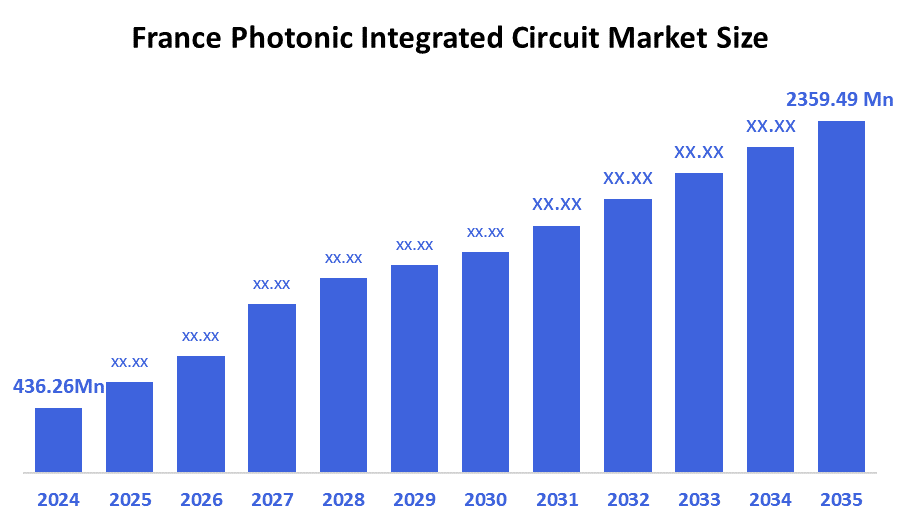

- The France Photonic Integrated Circuit Market Size was estimated at USD 436.26 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 16.59% from 2025 to 2035

- The France Photonic Integrated Circuit Market Size is Expected to Reach USD 2359.49 Million by 2035

According to a research report published by Spherical Insights & Consulting, the France Photonic Integrated Circuit Market is anticipated to reach USD 2359.49 million by 2035, growing at a CAGR of 16.59% from 2025 to 2035. Growing demand for high-speed data transfer, increased use of optical communication networks, and developments in smaller electronic devices are the main factors propelling the market. The market share of France's photonic integrated circuits is further supported by increased R&D spending as well as applications in the fields of healthcare and defense.

Market Overview

The France photonic integrated circuit market includes the design, manufacture, and use of integrated photonic technologies for modifying light for different purposes such as data communication, sensing and computing. Additionally, to encourage the expansion of the photonics sector, the French government has made investments in R&D projects, including financing for cooperative projects and alliances with industry players. Rules are also in place to guarantee the safety and quality of photonic integrated circuits and to encourage environmental preservation and sustainability in production processes. The overall goal of French government policies is to create an environment that is favorable to the development and commercialization of photonic integrated circuits, with an emphasis on economic growth, technological advancement, and global competitiveness.

Report Coverage

This research report categorizes the market for the France photonic integrated circuit market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France photonic integrated circuit market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France photonic integrated circuit market.

Driving Factors

The growing need for advanced sensing applications, data centers, and high-speed communication networks is propelling the market for photonic integrated circuits (PICs) in France. The market is growing because PICs are being used in the automotive, healthcare, and telecommunications industries. Developments in silicon photonics technology, the integration of several functions on a single chip, and the creation of small and energy-efficient PICs are important trends. Market opportunities include the rise in R&D spending, collaborations between industry and academic institutions, and the introduction of cutting-edge applications like augmented reality, LiDAR, and quantum computing. Businesses that prioritize cost-effective manufacturing techniques, innovative product development, and strategic partnerships are well-positioned to benefit from the growing PIC market in France.

Restraining Factors

The need for skilled labor in the field of photonics, the lack of standardized design tools and processes, and the high initial investment costs for PIC development and fabrication is some of the challenges facing the French photonic integrated circuit (PIC) market. Furthermore, well-known semiconductor technologies like electronic integrated circuits compete with the market. The French PIC market's small size in comparison to international players makes it difficult to attract investment and take advantage of economies of scale.

Market Segmentation

The France photonic integrated circuit market share is classified into raw material and integration

- The silicon segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France photonic integrated circuit market is segmented by raw material into indium phosphide (InP), gallium arsenide (GaAs), lithium niobate (LiNbO3), silicon, and silica-on-silicon. Among these, the silicon segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to its ability to integrate seamlessly with current semiconductor infrastructure and enable cost-effective mass production through compatibility with CMOS manufacturing. Applications in telecom, data centers, and quantum computing benefit greatly from silicon photonics' ability to support high-speed data transmission and energy-efficient operation. Its market growth is further supported by government-backed R&D projects and growing demand for scalable, reasonably priced photonic solutions.

- The monolithic integration segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France photonic integrated circuit market is segmented by integration into monolithic integration, hybrid integration, and module integration. Among these, the monolithic integration segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This growth due to its capacity to combine several photonic functions onto one substrate, producing devices that are small, powerful, and reasonably priced. This method is perfect for telecom, quantum computing, and data center applications because it improves scalability and reliability while simplifying packaging. Mass production is also supported by its compatibility with CMOS processes, and its adoption is further accelerated by government-sponsored R&D projects and the growing need for miniaturized photonic systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France photonic integrated circuit market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Teem Photonics

- Cailabs

- Keopsys

- Almae Technologies

- Photonics Bretagne

- Others

Recent Developments:

- In June 2025, French quantum computing company Pasqal acquired Canadian photonic integrated circuit (PIC) firm Aeponyx for an undisclosed sum. Aeponyx’s PICs enhanced light control for atom-based quantum systems, improving stability, scalability, and precision. Pasqal stated that the deal strengthened its hardware roadmap toward fault-tolerant quantum computing.

Key Target Audience

Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Photonic Integrated Circuit Market based on the below-mentioned segments:

FAQ’s

Q: What is the France photonic integrated circuit market size?

A: The France Photonic Integrated Circuit Market is expected to grow from USD 436.26 million in 2024 to USD 2359.49 million by 2035, growing at a CAGR of 16.59% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Growing demand for high-speed data transmission, growing optical communication networks, electronic device miniaturization, and developments in integrated photonics technologies are the main factors propelling the photonic integrated circuit market in France.

Q: What factors restrain the France photonic integrated circuit market?

A: The French market for photonic integrated circuits is hampered by high fabrication costs, a lack of standardization, integration complexity, a lack of skilled labor, and the sluggish commercialization of new photonic technologies in spite of robust research momentum.

Q: Who are the key players in the France photonic integrated circuit market?

A: Teem Photonics, Cailabs, Keopsys, Almae Technologies, Photonics Bretagne, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 173 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |