France Private Equity Market

France Private Equity Market Size, Share, and COVID-19 Impact Analysis, By Fund Type (Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others), and France Private Equity Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Private Equity Market Insights Forecasts to 2035

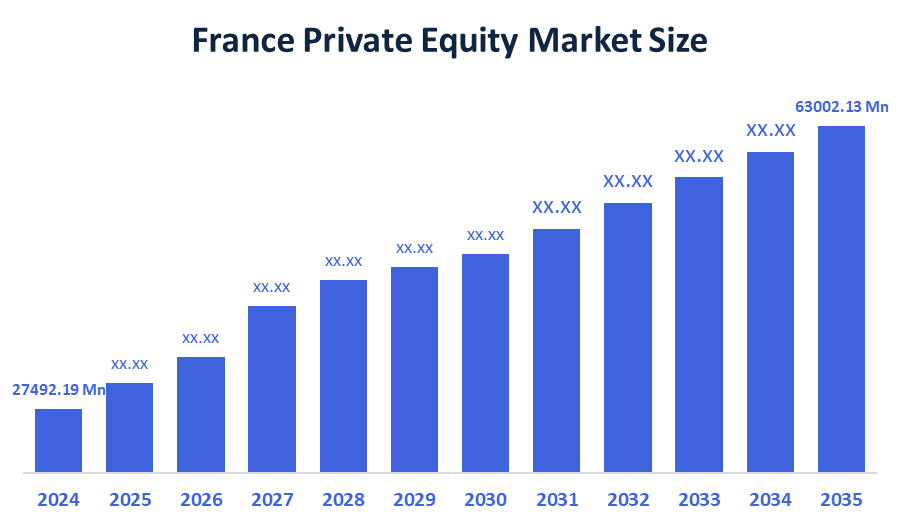

- The France Private Equity Market Size was estimated at USD 24792.19 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.85% from 2025 to 2035

- The France Private Equity Market Size is Expected to Reach USD 63002.13 Million by 2035

According to a research report published by Spherical Insights & Consulting, the France Private Equity Market is anticipated to reach USD 63002.13 million by 2035, growing at a CAGR of 8.85 % from 2025 to 2035. The market is driven by deal-making patterns, fundraising dynamics, and regulatory frameworks France is one of the major European centers for private equity activity.

Market Overview

The private equity market in France refers to the setting for investment activity in which investors and private equity firms acquire shares in private companies or delist publicly traded companies to reorganise, grow or sell on a secondary market. The private equity market in France includes buyouts, growth capital and venture investments. Generally, private equity investments focus on companies involved in innovation and strategic spaces. Additionally, private equity investments in the deep tech, enterprise SaaS, and AI sectors are on the rise in France. Innovation in cutting-edge technologies is fostered by the nation's established R&D ecosystem, which is bolstered by government programs like France 2030. By supporting high-growth initiatives in autonomous systems, machine learning platforms, and cybersecurity solutions, private equity firms are supporting these initiatives. France's inclusion in the European Digital Strategy, which offers more funding avenues, is another factor driving this upsurge. Scalable businesses with robust portfolios of intellectual property are of special interest to investors. By directing capital into the industries that are prepared for the future, this strategic orientation is greatly propelling the growth of the French private equity market as digital transformation intensifies across all industries.

Report Coverage

This research report categorizes the market for the France private equity market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France private equity market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France private equity market.

Driving Factors

A healthy pipeline of mid-market and innovation-led businesses, significant institutional investor participation, and advantageous regulatory reforms all contribute to the expansion of the French private equity market. Initiatives from the government, like more Bpifrance support and pro-investment laws, have improved deal flow and capital availability. Furthermore, both foreign and domestic investors have been drawn to France by its strategic focus on industries like technology, healthcare, and energy transition.

Restraining Factors

A difficult exit environment, increased economic uncertainty, and political impasse are some of the factors that are limiting the growth of the French private equity market. Due to waning investor confidence, deal activity substantially slowed in early 2025; Q1 saw the lowest deal value since late 2023. The sentiment toward cross-border investment has been further tempered by external factors like U.S.-imposed tariffs on European exports, which primarily affect important industries like the automobile industry.

Market Segmentation

The France private equity market share is classified into fund type.

- The buyout segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France private equity market is segmented by fund type into buyout, venture capital (VCs), real estate, infrastructure, and others. Among these, the buyout segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to increased sponsor-to-sponsor transactions that improve liquidity, robust mid-market activity, and succession planning among family-owned enterprises. Investor confidence has increased as a result of favorable regulatory changes and government-supported programs, and sectoral opportunities in technology, services, and industry continue to draw strategic buyout interest.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France private equity market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ardian

- Eurazeo

- PAI Partners

- Astorg

- Siparex Group

- Capza

- Andera Partners

- Others

Recent Developments:

- In July 2025, AMG announced a minority equity investment in Montefiore Investment, a leading European private equity firm that managed €5 billion focused on small- and mid-cap service sector companies. Montefiore’s management retained majority control and continued to lead independently. The partnership diversified AMG’s business and expanded its global private market presence. Montefiore utilized AMG’s capital to enhance capabilities and support team growth while preserving its entrepreneurial culture. The deal, expected to close in late 2025, reflected AMG’s strategy of supporting independent firms through long-term partnerships.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Private Equity Market based on the below-mentioned segments:

FAQ’s

Q: What is the France private equity market size?

A: The France Private Equity Market is expected to grow from USD 24792.19 million in 2024 to USD 63002.13 million by 2035, growing at a CAGR of 8.85% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Government-backed programs, sectoral innovation, mid-market succession opportunities, institutional investor participation, regulatory reforms, ESG integration, and growing demand for impact-driven investments and strategic buyouts across France's changing economy are some of the major growth drivers.

Q: What factors restrain the France private equity market?

A: Restraining factors that contribute to cautious investor sentiment and decreased deal-making momentum include political instability, economic uncertainty, valuation mismatches, regulatory complexity, limited exit opportunities, cross-border investment barriers, and sector-specific risks.

Q: Who are the key players in the France private equity market?

A: Ardian, Eurazeo, PAI Partners, Astorg, Siparex Group, Capza, Andera Partners, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |