France Protein Ingredients Market

France Protein Ingredients Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Plant Protein, Animal/Dairy Protein, Microbe-based Protein, Insect Protein, and Others), By Application (Food & Beverages, Infant Formulations, Clinical Nutrients, Animal Feed, and Others), and France Protein Ingredients Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

France Protein Ingredients Market Insights Forecasts to 2035

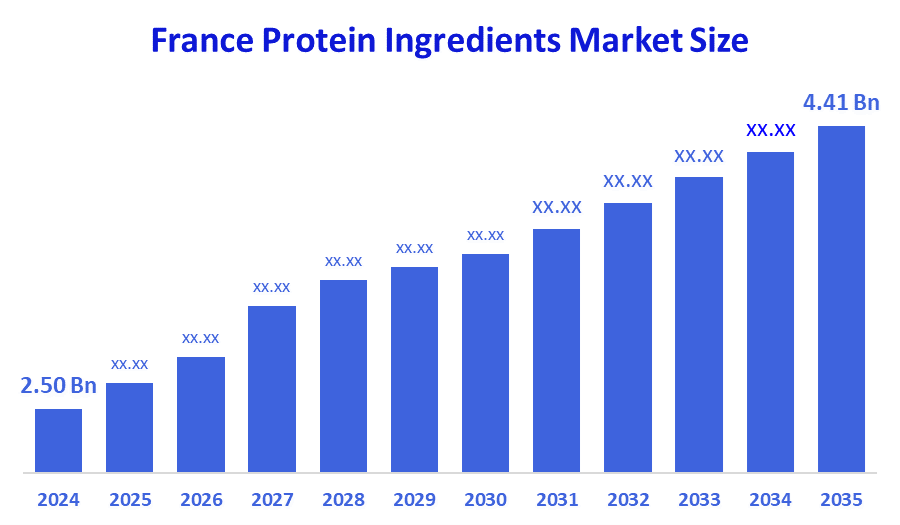

- The France Protein Ingredients Market Size Was Estimated at USD 2.50 Billion in 2024.

- The France Protein Ingredients Market Size is Expected to Grow at a CAGR of Around 5.3% from 2024 to 2035.

- The France Protein Ingredients Market Size is Expected to Reach USD 4.41 Billion By 2035.

According to a research report published by Decision Advisor & Consulting, the France Protein Ingredients Market size is projected to reach USD 4.41 billion by 2035, growing at a CAGR of 5.3% from 2025 to 2035. The France protein ingredients market is driven by a growing demand for health and wellness, sustainability, and functional products. Key factors include a shift towards plant-based proteins, increased consumer interest in clean-label and organic options, and the needs of an aging population for ingredients that support muscle maintenance and joint health.

Market Overview

The France protein ingredients market is the sector in France that manufactures, processes, and supplies protein-rich ingredients derived from both animal and plant sources for food, beverage, and nutritional applications. It is driven by consumer demand for healthier, functional, and sustainable products, including protein-fortified foods, sports nutrition, plant-based alternatives, and clinical nutrition for the elderly.

France demographic and health profile underscores a strong structural need for high-quality protein ingredients: the country has an aging population in which over 21% of its 67 million residents are 65 or older, a group highly vulnerable to sarcopenia, which affects up to 23.6% of elderly women and 12.5% of men. Malnutrition and inadequate protein intake are widespread among seniors, with 4–10% of older adults living at home, 15–38% in care homes, and 30–70% of hospitalized elderly experiencing undernutrition and routinely failing to meet recommended protein intake levels. At the same time, nearly half of France's adults are overweight or obese, and chronic diseases such as cardiovascular illnesses and cancer remain leading causes of mortality, increasing demand for protein-fortified and clinically oriented nutrition. These population-wide health pressures highlight the importance of developing accessible, functional, and diverse protein ingredients, animal, plant-based, and novel to support healthy aging, disease management, and more sustainable dietary patterns in France.

The France protein ingredients market is expanding steadily, driven by rising consumer demand for healthier, high-protein products. Growth comes from both traditional dairy proteins and rapidly emerging alternatives such as plant, insect, microbial, and algae proteins, supported by trends in sports nutrition, aging population needs, and eco-conscious eating. France’s push for protein sovereignty and sustainable agriculture is accelerating domestic production of pea and fava proteins, while major government initiatives, most notably the France 2030 plan and the USD 13.1 million AlinOVeg project (with USD 9.5 million in state funding), boost research and development, processing capacity, and innovation across the value chain. Overall, France’s scientific ecosystem, public-private partnerships, and sustainability goals make it well-positioned for continued growth in protein ingredients.

Report Coverage

This research report categorizes the market for the France protein ingredients market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France protein ingredients market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France protein ingredients market.

Driving Factors

The France protein ingredients market is driven by several strong forces, including an aging population with rising needs for high-quality protein to address sarcopenia and undernutrition, growing consumer focus on health, wellness, and sports nutrition, and increasing demand for sustainable and plant-based diets that favor pea, fava, microbial, and other alternative proteins. Government support through the France 2030 plan and major investments such as the USD 13.1 million AlinOVeg project are accelerating R&D, processing capabilities, and innovation across the protein value chain. At the same time, food manufacturers are expanding the use of protein ingredients in functional foods, dairy alternatives, snacks, and clinical nutrition, while consumers show a stronger preference for clean-label, locally sourced ingredients. Growth in the feed and pet-food sectors, including the adoption of insect and plant proteins, further reinforces the market expansion.

Restraining Factors

The France protein ingredients market faces several restraints, including strict labeling rules that limit plant-based products from using traditional meat terms. High production and processing costs make alternative proteins more expensive than conventional sources. Complex regulatory approvals slow down the introduction of novel proteins like insect or microbial ingredients. Consumer skepticism, especially toward unfamiliar protein sources, reduces adoption rates. Taste and texture limitations remain challenging in a country with strong culinary expectations. Finally, reliance on imported protein crops and supply-chain constraints hinder consistent, scalable production.

Market Segmentation

The France protein ingredients market share is categorized by product type and application.

- The animal/dairy protein segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France protein ingredients market is segmented by product type into plant protein, animal/dairy protein, microbe-based protein, insect protein, and others. Among these, the animal/dairy protein segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The animal/dairy protein segmental growth is due to its long-established use in food and beverage products, high nutritional value, widespread consumer acceptance, and strong demand in sports nutrition, clinical nutrition, and dairy-based functional foods. Additionally, well-developed domestic dairy production and established processing infrastructure make animal and dairy proteins more accessible and cost-effective compared with emerging alternative proteins.

- The food & beverages segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The France protein ingredients market is segmented by application into food & beverages, infant formulations, clinical nutrients, animal feed, and others. Among these, the food & beverages segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The food & beverages segmental growth is due to the growing consumer demand for high-protein and functional foods, rising health and wellness awareness, and the increasing popularity of protein-fortified products such as snacks, bakery items, dairy alternatives, and ready-to-drink beverages. The segment’s dominance is also supported by innovation in plant-based and alternative-protein products that cater to sustainability-conscious consumers and the expanding trend of protein enrichment in everyday diets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France protein ingredients market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Glanbia PLC

- Abbott

- PepsiCo

- Darling Ingredients

- Archer Daniels Midland

- Fonterra

- Ingredion

- Tate & Lyle

- AGT Food and Ingredients

- Kerry Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, Lactalis unveiled plans to expand its protein ingredient production facilities in France, aiming to strengthen its presence and market share in the functional food ingredient sector.

- In August 2023, Fonterra announced a strategic investment in a French dairy company to enhance its localized supply chain and boost innovation capabilities, positioning the company to better meet growing domestic and European demand for high-quality protein ingredients.

- In September 2025, Cargill launched a new line of plant-based protein products targeting the European market, strategically tapping into the growing consumer shift toward plant-based diets. This move is poised to expand Cargill’s market share in a fast-growing segment while enhancing its product portfolio.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the France Protein Ingredients Market based on the below-mentioned segments:

France Protein Ingredients Market, By Product Type

- Plant Protein

- Animal/Dairy Protein

- Microbe-based Protein

- Insect Protein

- Others

France Protein Ingredients Market, By Application

- Food & Beverages

- Infant Formulations

- Clinical Nutrients

- Animal Feed

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France protein ingredients market?

The France protein ingredients market size is expected to grow at a CAGR of around 5.3% from 2024 to 2035.

- What is the France protein ingredients market size in 2024?

The France protein ingredients market size was estimated at USD 2.50 billion in 2024.

- What is the projected market size of the France protein ingredients market by 2035?

The France protein ingredients market size is expected to reach USD 4.41 billion by 2035.

- What are the key growth drivers of the France protein ingredients market?

The aging population with rising needs for high-quality protein. increasing demand for sustainable and plant-based products, government support, stronger preference for clean-label, locally sourced ingredients.

- Which application segment dominated the market share in 2024?

The food & beverages segment dominated the market share in 2024.

- Which product type segment accounted for the largest market share in 2024?

The animal/dairy protein segment accounted for the largest market share in 2024

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 176 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |