France Pulse Oximeter Market

France Pulse Oximeter Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Portable Pulse Oximeter, Wearable Pulse Oximeter, Handheld Oximeter, Tabletop Oximeter, Fingertip Oximeter, And Other), By Technology (Smart and Conventional), By Age Group (Pediatrics and Adults), By End-User (Clinics, Hospitals, Home Healthcare, and Others), and France Pulse Oximeter Market Insights, Industry Trend, Forecasts To 2035

Report Overview

Table of Contents

France Pulse Oximeter Market Insights Forecasts to 2035

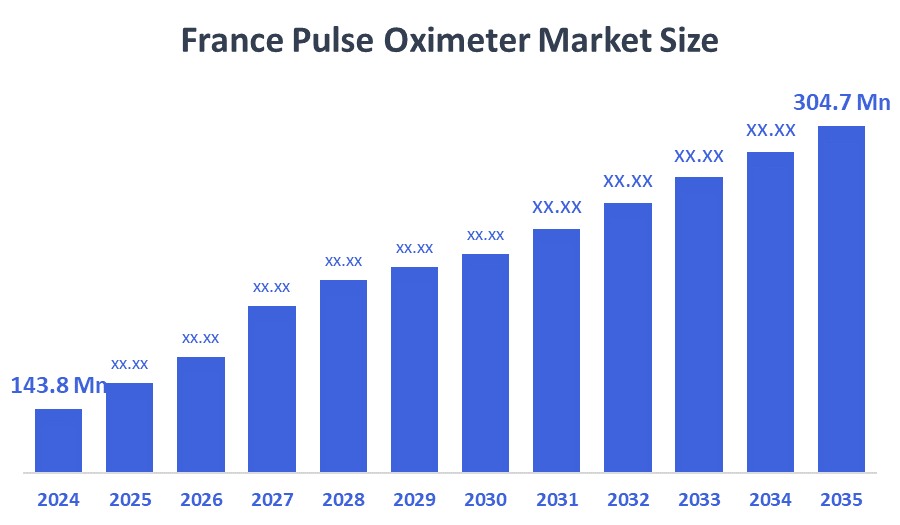

- The France Pulse Oximeter Market Size Was Estimated at USD 143.8 Million in 2024

- The France Pulse Oximeter Market Size is Expected to Grow at a CAGR of Around 7.06% from 2024 to 2035

- The France Pulse Oximeter Market Size is Expected to Reach USD 304.7 Million By 2035

According to a research report published by Spherical Insights & Consulting, The France Pulse Oximeter Market Size is projected to reach USD 304.7 million by 2035, growing at a CAGR of 7.06% from 2025 to 2035. The France pulse oximeter market is driven by increased prevalence of heart diseases, respiratory diseases, aging population, and technological developments in France, which increase the demand for effective blood oxygen level monitoring devices and also encourage healthcare institutions in France to develop new technology in this field.

Market Overview:

The France pulse oximeter market refers to the France medical device healthcare industry, which involves the production, distribution, manufacture, and sale of pulse oximeters, which are devices that measure blood oxygen saturation levels. The pulse oximeter covers the entire market of healthcare departments and is used in various areas, including hospitals, clinics, home healthcare, and is available in different device types like fingertip, handheld, tabletop, and wearable models. It is driven by factors such as the increasing respiratory diseases, the increasing elderly population, and the increasing importance of remote monitoring among the population.

The pulse oximeters are often used to diagnose hypoxia. And the recent development has been made in the pulse oximeters, which allow the assessment of other parameters like detection of above 100% oxygen level, detection of methemoglobin and carboxyhemoglobin level, which are the abnormal forms of hemoglobin that reduce the blood’s oxygen-carrying ability.

The pulse oximeter device works by measuring the amount of light that is passed through the skin, tissues, and blood, which allows it to detect the oxygen saturation of the blood. The normal identified range of peripheral oxygen saturation (SpO2) is 95 % to 100 % while less than 95 % is considered low or unstable. And the individual with the less than 90 % SpO2 is considered hypoxemic and requires an external oxygen supply.

Report Coverage

This research report categorizes the France pulse oximeter market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France pulse oximeter market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France pulse oximeter market.

Driving Factors:

Rising cases of respiratory diseases:

The growing prevalence of respiratory diseases such as asthma, COPD (Chronic Obstructive Pulmonary Disease), lung cancer, and pneumonia has become a leading factor in France pulse oximeter market. Adoption of unhealthy lifestyles, cigarette smoking, and exposure to irritating gases have become major reasons for the rise in COPD diseases, which in turn faster the demand for Pulse Oximeters. Further, the use of pulse oximeters in the management of COPD and other respiratory conditions has increased the demand and driven the market growth.

Aging population in France:

An increase in the number of elderly people in France leads to an increase in the rate of respiratory disease. The rising number of elderly people leads to a higher prevalence of chronic diseases in France, which makes a greater demand for health monitoring devices.

Restraining Factors:

The growth of the France pulse oximeter market has been reduced due to certain rules and concerns; people are buying these devices over the counter, without a doctor’s prescription, which can create confusion among users. These issues have affected trust in the product and have slowed down its demand in the market.

The rising number of alternative healthcare monitoring devices raises concern over the pulse oximeter's accuracy. Alternative devices, such as smartwatches and fitness tracking equipment with SpO2 sensors, pose a significant challenge for the pulse oximeter market.

Market Segmentation:

The France pulse oximeter market share is classified into product type, technology, age group, and end user.

- The handheld oximeters segment dominated the France pulse oximeter market in 2024 and is predicted to grow at a significant CAGR during the forecast period.

Based on the product type, the France pulse oximeter market is categorized into portable oximeter, wearable oximeter, handheld oximeter, tabletop oximeter, fingertip oximeter, and others. Among these, the handheld oximeters segment dominated the France pulse oximeter market in 2024 and is estimated to grow at a significant CAGR during the forecast period. The handheld segment growth is due to its portability,? affordability, ease of use in emergencies, and convenience for personal use. These factors are expected to boost the market growth over the forecast period.

- The conventional segment captured the largest share in 2024 and is expected to grow at a significant CAGR throughout the forecast period.

Based on the technology, the France pulse oximeters market is segmented into smart and conventional. Among these, the conventional segment captured the largest share in 2024 and is anticipated to grow at a significant CAGR throughout the forecast period. The conventional segment growth is driven by the increasing number of hospital admissions in France for chronic respiratory conditions. It is widely used in France for early identification of hypoxia, for user convenience, and it is easily accessible to user, also the conventional oximeter are generally more affordable and economical than other smart devices available in the market which making them widely used by clinics, hospitals, and by people for personal use particularly for the elderly population.

- The adult segment dominated the France pulse oximeter market in 2024 and is expected to grow at a CAGR during the forecast period.

Based on the age group, the France pulse oximeter market is segmented into adults and pediatrics. Among these, the adult segment dominated the share of market share in 2024 and is projected to grow at a significant CAGR during the forecast period. The segmental dominance is mainly driven by the higher prevalence of chronic respiratory and heart diseases in adults, the increasing geriatric population, and the rising awareness about continuous health monitoring among the people in France.

- The hospitals held the largest share in 2024 and are anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the France pulse oximeter market is classified into clinics, hospitals, home healthcare, and others. Among these, the hospitals segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the high need for continuous patient monitoring in clinics, hospitals, and critical care settings in France, increasing the demand for pulse oximeters.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France pulse oximeter market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Masimo

- Medtronic

- Nonin Medical

- Smiths Medical

- Nihon-Kohden

- Philips

- GE Healthcare

- Konica Minolta

- Mindray

- Heal Force

- Contec

- Jerry Medical

- Solaris

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In May 2024, Medable partnered with Masimo to integrate its MightySat Rx pulse oximeter technology into clinical trials. To collect medical-grade biometric data like oxygen saturation and respiration rate from a patient remotely.

In May 2023, Nonin Medical, Inc. introduced the WristOx2 model 3150. A Bluetooth-enabled, wrist-worn pulse oximeter. Launch to meet the growing demand for a wearable, long-term monitoring solution for both hospitals and home healthcare.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the France pulse oximeter market based on the below-mentioned segments:

France Pulse Oximeter Market, By Product Type

- Portable Pulse Oximeter

- Wearable Pulse Oximeter

- Handheld Oximeter

- Tabletop Oximeter

- Fingertip Oximeter

- Other

France Pulse Oximeter Market, By Technology

- Smart

- Conventional

France Pulse Oximeter Market, By Age Group

- Pediatrics

- Adults

France Pulse Oximeter Market, By End User

- Clinics

- Hospitals

- Home healthcare

- Others

Frequently Asked Questions (FAQ)

- What is the CAGR of the France pulse oximeter market?

The France Pulse Oximeter Market Size is Expected to Grow at a CAGR of Around 7.06% from 2024 to 2035

- What is the France pulse oximeter market size?

The France Pulse Oximeter Market Size Was Estimated at USD 143.8 Million in 2024 and is Expected to Reach USD 304.7 Million By 2035.

- Who are the top key players in the France pulse oximeter market?

The key players in the France pulse oximeter market are Masimo, Medtronic, Nonin Medical, Smiths Medical, Nihon-Kohden, Philips, GE Healthcare, Konica Minolta, Mindray, Heal Force, Contec, Jerry Medical, Solaris, and others.

- How is the France pulse oximeter market segmented By Product Type?

The France pulse oximeter market is segmented by product type into Tabletop Oximeter, Fingertip Oximeter, Handheld Oximeter, and Others.

- Who are the target audiences for this market report?

The Market target audiences are market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 167 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |